In this article:

If a surprise bill comes up because your car breaks down or you face another financial emergency, you may need extra cash quickly to make ends meet. A same-day loan is a type of loan that can get you cash right away, but usually at a high cost. In this guide, we'll explain how same-day loans work, what they cost and how to find good alternatives.

What Is a Same-Day Loan?

A same-day loan (sometimes called an emergency loan) is any loan that's disbursed the same day you're approved for it. These short-term loans tend to be more expensive than other methods of borrowing.

For example, a same-day payday loan could carry an annual percentage rate (APR) of a whopping 400% when the fee is calculated into a percentage. In comparison, the average APR for a 24-month personal loan is 9.58%, and the average APR on credit cards that are assessed interest is 16.3%, according to Federal Reserve data from May 2021.

If you have the flexibility, shopping around and waiting a week or two to get approved for a personal loan or credit card with a more competitive interest rate could be a cheaper option when you need to borrow money.

Find a personal loan matched for you

How Do Same-Day Loans Work?

Same-day loans tend to be for small amounts and have loan terms that last a few weeks or months. Here's an overview of different types of same-day loans.

Payday Loans

Payday loans are loans you can get online or at storefronts that are meant to help you cover expenses until your next paycheck. You borrow a small sum (usually $500 or less), and the lender may ask for a blank check or bank account details at application. The loan amount plus fees are due a short time later. In some cases, the amount may be taken directly out of your bank account.

Payday loans let you get money fast without a credit check, but this flexibility comes at a high price. Although these may be an option for getting loans with bad credit, the interest rates on pay day, same day, and emergency loans can be very high. Lenders may charge a flat-rate or percentage fee for each $100 you borrow. A typical fee is $15 per $100 for a two-week loan, which is equivalent to an annual percentage rate (APR) close to 400%. Borrowers also tend to re-borrow payday loans several times, accumulating high fees as they go and getting stuck in a cycle of debt. For these reasons, it's best to avoid payday loans whenever possible.

Title Loans

Title loans use your vehicle as collateral. The lender holds on to your car title and lets you borrow a sum. You can still drive your car around as you pay the loan back, but the lender may be able to take your car if you default on the loan.

Like payday loans, a credit check may not be required for a title loan, and money can be rapidly disbursed. But lenders may charge various processing fees and a typical financing fee might be 25% per month, which could work out to an APR of 300%. Not only that, losing your car in the event you fail to repay the loan can cause numerous other problems—including job loss.

Pawnshop Loans

Pawnshop loans are a type of loan where you offer something of value—like heirlooms, jewelry or electronics—as collateral for a loan. You get some of the item's value in cash, and the pawnshop holds on to the item until you repay the debt.

Fees on pawnshop loans can also vary. According to the National Pawnbrokers Association, an example of a fee could be 20% on $80, which would cost you $16 over 30 days—an APR of roughly 240%.

Credit Card Cash Advance

If you need cash or can't pay a bill with your credit card, taking a cash advance from your credit card is another way to get money fast. You may be able to draw cash at a bank or credit union. You could even get cash at an ATM if you have a card PIN.

The drawback of cash advances is that there's typically an upfront fee; often, it's 5% with a $10 minimum. Interest rates on cash advances also tend to be higher than the standard purchase interest rate. For example, the purchase APR could be as low as 14.99%, while the cash advance rate could be as high as 24.99%. Unlike credit card balance on purchases, however, cash advances don't benefit from a grace period and start accruing interest immediately.

Do Banks Give Same-Day Loans?

Banks may approve you for a loan and give you the money within the same day, but the entire process of applying and getting funding could take several business days.

Some credit unions offer same-day (or very fast) options. Alliant Credit Union, for example, may offer funding the same day you apply online. Navy Federal Credit Union has a quick application, and once your application is processed, you may be able to get the loan deposited into your checking account within 24 hours.

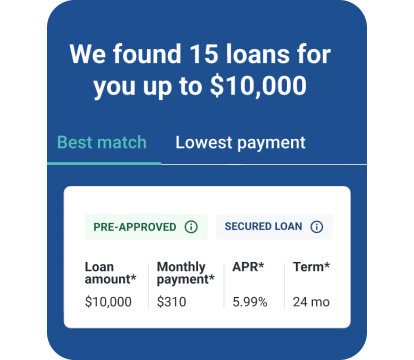

Online lenders or lending platforms, may also be able to get you funds within a few business days once you're approved and documents are signed.

Explore Your Options Before Borrowing

A same-day loan with a high interest rate could be difficult to pay back, and falling behind on debt payments could worsen an already bad situation. If you get a surprise bill or have trouble making ends meet, certain creditors or service providers may be willing to set up a payment arrangement or bill extension.

Consider contacting customer service to see what options are available. A bit of payment leeway could give you an opportunity to shop around and secure a more affordable loan. With Experian's loan comparison tool, you can compare personalized loan offers from many different lenders in one place.