In this article:

A payday loan is a short-term loan that can help you cover immediate cash needs until you get your next paycheck. But while they may appear to be a financial lifeline, payday loans often make matters worse for their borrowers.

Before you apply for a payday loan, it's important to know what you'll get and what's expected from you in return.

What Is a Payday Loan?

A payday loan is a small-dollar, high-cost loan that may be available online or at a physical branch of a payday lender. These loans typically charge high fees, equivalent to triple-digit annual percentage rates (APRs), and payments are typically due within two weeks—or close to your next payday.

Different states have different laws surrounding payday loans, limiting how much you can borrow or how much the lender can charge in interest and fees. Some states prohibit payday loans altogether.

How Do Payday Loans Work?

If you're approved for a payday loan, you may receive cash or a check or have the money deposited into your bank account.

In exchange, the lender may have you write a check for the loan amount plus the finance charge, which is based on your loan amount. The lender will then cash the check on the repayment date—usually within 14 days. Alternatively, you may allow the lender to pull the lump-sum payment from your bank account.

If you can't afford to repay a payday loan, you can renew it or roll it over into a new payday loan, which compounds your finance charges and could create a cycle of debt that may be difficult to manage.

How Much Do Payday Loans Cost?

Payday loan costs are set by state laws, with fees ranging from $10 to $30 for every $100 borrowed. A two-week payday loan usually costs $15 per $100 borrowed. Due to their short repayment terms, however, payday loan APRs are usually 400% or more, according to the Consumer Federation of America.

As an example, let's say you borrow $100 for a two-week payday loan and your lender charges you a $15 fee for every $100 borrowed. That is a simple interest rate of 15%. But since you have to repay the loan in two weeks, that 15% finance charge equates to an APR of almost 400% because the loan length is only 14 days.

By comparison, APRs on credit cards typically go as high as 30%, and personal loans typically max out at 36%.

How Much Can I Borrow With a Payday Loan?

State laws dictate how much you can borrow with a payday loan, with $500 being the most common limit.

In addition to a flat cap, Idaho, Illinois, Nevada, Washington and Wisconsin set limits based on the borrower's income. Other states, including Utah and Wyoming, have no set limit.

Note: 29 states have specific statutes that allow for payday lending with few limitations. Eighteen states and the District of Columbia don't necessarily prohibit payday loans, but they protect consumers by setting interest rate caps of 36% or lower. In some states, payday lenders have circumvented consumer protections, such as interest rate caps and extended repayment terms, by structuring their loans differently.

Why Are Payday Loans Bad?

A payday loan can solve an urgent need for money in an emergency situation. But in most cases, they can do more harm than good for the borrower. Here's why it's generally best to avoid payday loans:

- They're expensive. With an average APR of 400% or more, payday loans are arguably the most expensive type of loan you can get. If you roll over or renew your loan, you'll face compounding costs.

- They're difficult to repay. Although payday loans are typically small, payment is often due within just a couple of weeks, giving you little time to fix your financial problems. In fact, most payday loan borrowers roll over or renew their payday loans within 14 days, according to the Consumer Financial Protection Bureau (CFPB).

- They don't help your credit. Payday lenders may not require a credit check when you apply, but they also don't report your payment to the credit bureaus. If you fail to repay a loan, the lender could send it to collections, which could damage your credit.

Learn more >> What Happens if You Don't Pay Back a Payday Loan?

What Do You Need for a Payday Loan?

Payday lenders have few requirements for approval. Most don't run a credit check or even require that the borrower has the means to repay the loan. Typically, all you need is the following:

- A photo ID

- A bank account in relatively good standing

- A steady paycheck

Do Payday Lenders Check Credit?

You typically don't need to undergo a credit check when applying for a payday loan, making it appear to be less risky than alternative financing options.

Overall, however, payday loans are among the riskier financial choices you can make, especially when you're already experiencing financial hardship.

Do Payday Loans Affect Your Credit?

Generally, no, payday loans do not affect credit. There's no hard inquiry when you apply, and payday lenders typically don't report on-time payments to the credit reporting agencies.

However, if you can't repay a payday loan, and the lender has given up trying to collect the amount you owe, it may sell your debt to a collection agency. Once this happens, the agency will typically report the unpaid debt to the credit bureaus, which can cause significant damage to your credit scores.

Alternatives to Payday Loans

One of the reasons payday loans are so popular may be a lack of knowledge about or fear of alternatives. While you may not have access to all of these options, it's important to research the alternatives to try to minimize your costs. Here are some to consider.

Bad-Credit Personal Loans

Some personal lenders specialize in working with people with poor credit. Whether you need to cover some basic expenses, pay for an emergency or consolidate debt, you can usually get the cash you need.

Some credit unions even offer payday alternative loans (PALs) that offer more reasonable interest rates and repayment terms, though your eligibility will depend on the type of PAL you choose and the credit union's membership requirements.

While a bad-credit personal loan will charge a higher interest rate than other personal loans, the rate will still be much lower than what you'll get with a payday loan.

Family or Friends

Asking a loved one for financial assistance is never a fun conversation. But if the alternative is being driven deeper into debt, it may be worth it. Just be sure to create an official agreement and stick to it to avoid damaging your relationship.

Bad-Credit Credit Cards

Most credit cards designed for people with bad credit require a security deposit, which won't help your cash shortage. But some credit card issuers offer unsecured credit cards with low credit requirements.

Retail credit cards, for instance, are often in reach for people with bad credit. And while they typically come with low credit limits, many of them can be used outside the store.

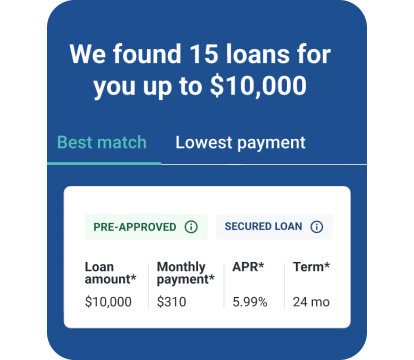

Find a personal loan matched for you

How to Get a Payday Loan

To get a payday loan, you'll need to first check if they're legal in your state. If payday lenders operate in your state, then you can apply for a payday loan by searching for lenders that offer loans in your area.

Options may include online lenders and physical stores that might also offer check cashing, money transfer and other services.

That said, it's crucial that you consider a payday loan only as a last resort. Carefully research and compare all of your alternatives first to avoid worsening your financial situation.

Know Your Options

Payday loans can provide borrowers with short-term cash when they need it, but they're not the only option available. If you need access to money right now, look for other ways to get emergency cash.

If you're worried about your credit, you can check your FICO® Score☉ and Experian credit report for free to get an idea of where you stand. While it may not fix your current situation, try to take meaningful steps to improve your credit so that you'll have better and more affordable borrowing options in the future.