In this article:

Personal loans can provide fast access to money you may need to cover an emergency expense, consolidate high-interest debts or for almost any purpose. However, you'll have to meet specific requirements to qualify.

Personal loan requirements vary from lender to lender, but most are looking for similar indications that you'll repay your loan as agreed. Understanding of the following requirements for a personal loan can help you prepare for the application process and may improve your odds of approval.

Find a personal loan matched for you

1. Good Credit Score

Your credit score is one of the most important factors lenders consider, as it provides a snapshot of your creditworthiness. While many lenders work with borrowers with below-average credit scores, having a FICO® Score☉ that falls in the good range (670-730) or higher can help you qualify with more lenders and more favorable interest rates.

If your credit score is below average, you might consider enlisting a cosigner to improve your approval odds. Pausing your loan efforts and instead focusing on improving your credit score is another option.

2. Payment History

When you apply for a personal loan, the lender will also pull your credit score to look at your history of managing credit. Lenders look to your payment history for reassurance you're a responsible borrower who makes consistent on-time payments.

Your payment history is the most important factor of your FICO® Score, making up 35% of your score. Even one late payment can severely harm your score and remain on your credit report for seven years.

3. Income

When lenders evaluate your loan application, they want to see that you can afford to repay the loan. But the income you'll need for a personal loan varies depending on the lender. Some lenders don't have a minimum requirement but still want to verify your income to ensure you'll have enough money to cover the loan payments.

Of course, lenders tend to reserve their best interest rates for those with higher incomes, among other factors.

4. Low Debt-to-Income Ratio

Lenders use what's called a debt-to-income ratio (DTI) to help them measure your ability to make good on a loan. Your DTI compares how much you owe in debt payments every month with your gross monthly income. Many banks use their own metrics to determine an acceptable DTI, but typically the lower your DTI, the better.

You can determine your DTI percentage by adding up all of your monthly debts and dividing that number by your monthly gross income. For example, if your monthly debt obligation is $2,000 and your gross monthly income is $6,000, your DTI is about 33% (2,000/6,000=0.333). Generally speaking, lenders prefer DTIs below 36%, but many lenders approve loans with higher ratios.

5. Sufficient Collateral

Do personal loans require collateral? Not usually, since most personal loans are unsecured. However, you do need to provide collateral for a secured loan, typically in the form of cash savings, a car, a home or another asset holding monetary value.

Since secured loans are backed with collateral, they pose less risk to the lender. As such, it may be easier to not only qualify for a secured loan but also to receive a lower interest rate. Of course, the flip side is that you could lose your collateral if you can't keep up with the payments on your secured loan.

6. Potential Origination Fee

Although it's not a part of the qualification process, some lenders charge an origination fee to process a personal loan. Origination fees, which typically range from 1% to 8% of the borrowed amount, cover the lender's administrative expenses like running your credit report and verifying documents.

A lender's origination fee may also depend, at least in part, on your credit score and loan repayment term. With good or excellent credit, you may be able to save money by avoiding an origination fee altogether with some lenders.

How to Get a Personal Loan

Taking out a personal loan is usually a straightforward process involving the following steps:

- Review your credit score and credit report. Check to see if your lender requires a minimum credit score. You can get a free credit report and credit score through Experian to see where you stand. If you discover any discrepancies or inaccuracies in your credit report, dispute the incorrect information with the credit bureaus.

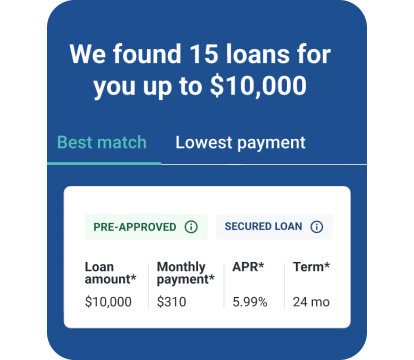

- Compare multiple lenders. Investigate multiple lenders to find the loan offer with the best interest rate, repayment terms and lender fees. Try to use a lender's prequalification process to check your potential loan rate and terms without impacting your credit score.

- Choose the best loan. After reviewing your loan offers, choose the one that best suits your needs.

- Complete a full application. Once you complete this step, the lender will likely perform a hard pull of your credit, which may cause a slight temporary dip in your credit score. Be prepared to submit any supporting documentation the lender requests, such as pay stubs or tax returns.

- Receive your funds. Upon approval, you'll need to sign for the loan. At that point, the lender will disburse your loan as one lump-sum payment. If you take out a loan through a bank or credit union, your funding time may range from one to five days. Online lenders are usually very fast, with many lenders providing loan funding the same day or the next business day.

Consider the Requirements for a Personal Loan Before Applying

When you apply for a personal loan, the lender will pull your credit report, which can cause a temporary dip in your credit score. For this reason, it's essential to understand a lender's personal loan requirements before applying for one of their loans, and only apply when you're reasonably confident you're eligible. Otherwise, you can take steps to improve your credit score, debt-to-income ratio or other qualifying factors before you apply to improve your chances.

When you're ready to shop for a personal loan, consider using Experian to help you compare lenders. Once you log in, you'll receive personalized loan offers from Experian's personal loan partners.