In this article:

An unsecured personal loan is a type of loan that doesn't require you to promise the lender any collateral. These loans often offer flexibility, as you can use the money in various ways and choose your repayment terms. However, there are pros and cons to consider before applying.

How Unsecured Loans Work

You can apply for an unsecured personal loan from a bank, credit union or online lender. If approved, you may be able to choose from several loan offers with varying loan amounts, interest rates and repayment terms.

Once you accept an offer, the lender sends you the money, which you can use for almost anything. People often take out unsecured personal loans for major expenses, such as a wedding or medical emergency, or for consolidating higher-interest debts.

When you apply, the lender will review your application and likely check your credit reports and scores. Because you aren't offering any collateral, your creditworthiness may be especially important when you want an unsecured personal loan.

After taking out the loan, you'll repay it following the loan's terms, which often require fixed monthly payments. Although you don't risk losing collateral, missing payments could lead to additional fees and hurt your credit.

Find a personal loan matched for you

Unsecured vs. Secured Loans

The collateral you offer (or don't) makes a loan secured or unsecured. Most personal loans are unsecured—they're offered to you solely based on your credit and your promise to repay the debt. Secured loans may be easier to qualify for or offer lower interest rates because the lender can take the collateral if you stop repaying the loan, making them less risky for lenders.

Many people use secured loans for major purchases, such as an auto loan or mortgage, which uses the car or home as collateral. Your loan amount and terms can depend on your creditworthiness and the value of the home or vehicle you're buying with the loan.

Title loans and pawn shop loans are also secured loans that can give borrowers cash for other expenses. But they typically have onerous terms, such as high interest rates, and borrowers usually turn to them as a last resort.

You can also sometimes secure a loan with cash rather than property. For example, a credit-builder loan is a secured installment loan that uses money set aside in a savings account or certificate of deposit (CD) as collateral while you pay off the loan. It could be a good option if you're looking to build credit for the first time and are having trouble qualifying for a traditional loan.

Pros and Cons of Unsecured Loans

Unsecured personal loans can offer you quick and easy access to money that you can use for almost anything, but they aren't always the best option. Consider some of the main pros and cons before deciding how you want to borrow money.

Pros

- Fixed repayment terms: You may be able to choose from several repayment terms, such as 12 or 24 months, and will know exactly when you'll pay off the debt. The choice can also impact your interest rate and monthly payment.

- Large loan amounts: Some lenders offer large potential loan amounts—sometimes up to $100,000—which is enough to cover most major expenses. However, your loan offers can depend on your creditworthiness.

- Potentially low and fixed interest rates: Personal loans may also have low interest rates, especially when compared to credit cards. The interest rates are also often fixed, which means the rate won't change over the lifetime of your loan.

- Flexible funding: Although there may be some limits (for example, you agree not to use the funds for illegal activity), you can use a personal loan for almost anything. You can also take out a single loan for multiple purposes, such as paying off high-interest debt and funding a wedding.

Cons

- May require good credit: Because you're not offering any collateral, you may need to have good to excellent credit and a high income if you want to borrow a lot of money with favorable terms.

- Upfront fees: Lenders may charge an administration or origination fee, which is often a percentage of the amount you borrow and deducted from the amount you receive.

- Potentially high interest rates: Applicants who have poor credit might only be able to get a personal loan with a high interest rate—sometimes even higher than the average credit card. Even applicants who have good credit might find the rates are higher than what they can qualify for with a secured loan.

- Interest accrues immediately: Interest will also start to accrue as soon as you take out the loan. In contrast, you may be able to use a credit card and avoid accruing interest if you pay off your balance in full each month.

How to Qualify for an Unsecured Loan

Lenders may have their own eligibility and credit requirements, which you'll need to meet if you want to take out an unsecured personal loan. Here are five steps you can follow to see if you'll likely qualify, find the best offers and get a loan.

- Check your credit score. Your credit score can be important when you're applying for an unsecured personal loan, and you can check your Experian credit report for free and get your FICO® Score☉ to see where you stand. You may be able to qualify if your credit score is at least in the high 500s. However, a higher credit score can help you get more favorable terms. Your credit report can explain what's impacting your credit score the most so you can take steps to improve your score.

- Pay off debts. Your debt-to-income ratio (DTI) shows how your monthly income compares to your monthly bills and can help lenders make sure you can afford a new loan. Paying off existing debts can improve your DTI, making it easier to qualify for a personal loan.

- Add up all your income. Review what types of income you can use on your application, such as income from investments, gig work, ongoing insurance payments, alimony or child support. These can increase the income you report and give you a better DTI.

- Review lenders' requirements. You might not qualify for a loan from some lenders based on their eligibility requirements. For example, lenders might not offer loans to borrowers in every state.

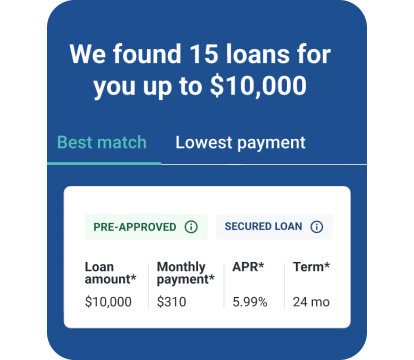

- Gather loan offers. Once you're ready to apply, try to get loan offers from several lenders to see which is best. Sometimes you can get a preapproval, which gives you a sense of whether you'll get approved and your potential loan terms with a soft credit inquiry—the type that doesn't hurt your credit scores.

You'll need to submit a complete application and generally agree to a hard inquiry when you're ready to apply. Hard inquiries might hurt your credit score a little, which is why it's best to try to get preapproved with soft inquiries first.

Once you complete the application and it's approved, you may be able to get the loan proceeds within a few days—and sometimes even sooner.

Get Matched With Personal Loan Offers

Experian can help borrowers easily compare multiple personal loan offers. If you sign in and use tools from Experian, you can get loan offers based on your unique credit profile and a soft credit inquiry.