Originally designed as a cloud-based alternative to expensive software that was not flexible, Salesforce.com has become the platform of choice for many companies.

To take full advantage of the many capabilities Salesforce provides and to avoid re-creating department silos that exist with most CRM/ERP platforms, more operational business groups are moving to Salesforce to take advantage of built-in features such as 360-degree prospect and account views, workflow, approval queues and tasks.

Until now though, credit departments have typically operated in their own silo, accessing customer credit information through proprietary credit and risk management systems. At Experian, we are seeing an increasing need by finance and credit departments to be able to request, review and store our commercial data within Salesforce and quickly respond to credit requests from prospects as well as perform periodic account reviews of existing customers.

To solve this disconnect, we have created Experian FusionIQ™, a new Salesforce.com Lightning-compatible app that enables B2B organizations to easily integrate Experian business and commercial credit information into their Salesforce.com CRM instance. With Experian FusionIQ™, we enable credit departments to make better credit decisions while increasing efficiency through easy access to our data.

Salesforce.com no longer just for the sales department

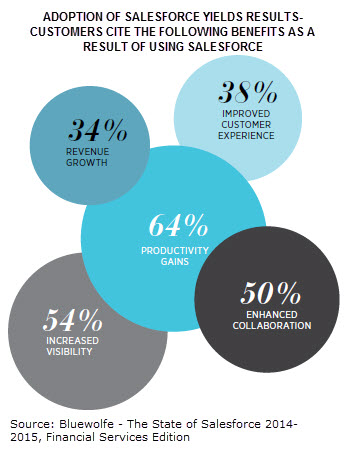

According to a recent study of financial services companies looking to deploy Salesforce.com, sixty four percent of respondents anticipated productivity gains; fifty percent expected a boost to enhanced cross-functional collaboration; fifty four percent anticipated increased visibility to customer information and thirty eight percent expected improved customer experience. Financial services companies are transitioning from utilizing Salesforce solely as a sales application to leveraging it as a platform for delivering customer engagement.

Here are some of the things you can do with Experian FusionIQ™:

Get a 360-degree view of all your customer accounts

Payment history, public records and credit ratings are key factors when determining whether to pursue new customers or grow existing accounts. The Experian FusionIQ™ app allows you to centralize this critical information within the Salesforce.com environment, giving full transparency to key stakeholders within your organization. Your sales, finance, credit and other internal departments now can work together to optimize resources and prioritize accounts.

When the Sales Department can’t easily share information with the Credit and Finance departments, the approval process slows down, opportunities are lost, and customers aren’t retained.

The Experian® FusionIQ™ app seamlessly adds the business risk data all your key internal stakeholders need within your Salesforce.com environment. Reports, Scoring, Alerts and Decisioning features are available to everyone on your platform, allowing them to make key review decisions in real-time.

Create more proactive account-management workflows

What is your process for monitoring significant changes in your accounts? The Experian FusionIQ™ app provides instant notification of late payments, defaults, bankruptcies and other changes in your customer and prospect accounts right within your Salesforce.com environment.

Migrate your existing BusinessIQ℠ services into Salesforce.com

Are you already using Experian’s BusinessIQ℠ to track your accounts’ credit statuses? The Experian FusionIQ™ app allows you to migrate the BusinessIQ services you’re already using into Salesforce.com easily to eliminate bottlenecks and accelerate decision making.

Virtually no IT resources required

The Experian FusionIQ™ app is designed to integrate automatically with your existing Salesforce.com platform with virtually no additional coding required. Out-of-the-box features give you access to reports, alerts and decisioning. Configure existing Salesforce.com features such as workflow, notifications and reporting to streamline your credit process.