We know that small business is the heart of the U.S. economy, driving the majority of private-sector employment. But just how successful in managing credit is the average small business owner compared with the average consumer? In a new data study titled The Face of Small Business, Experian examines key credit and demographic attributes of both groups and uncovered distinct differences.

Experian presented the full research from our data study in a webinar recently.

Watch Webinar

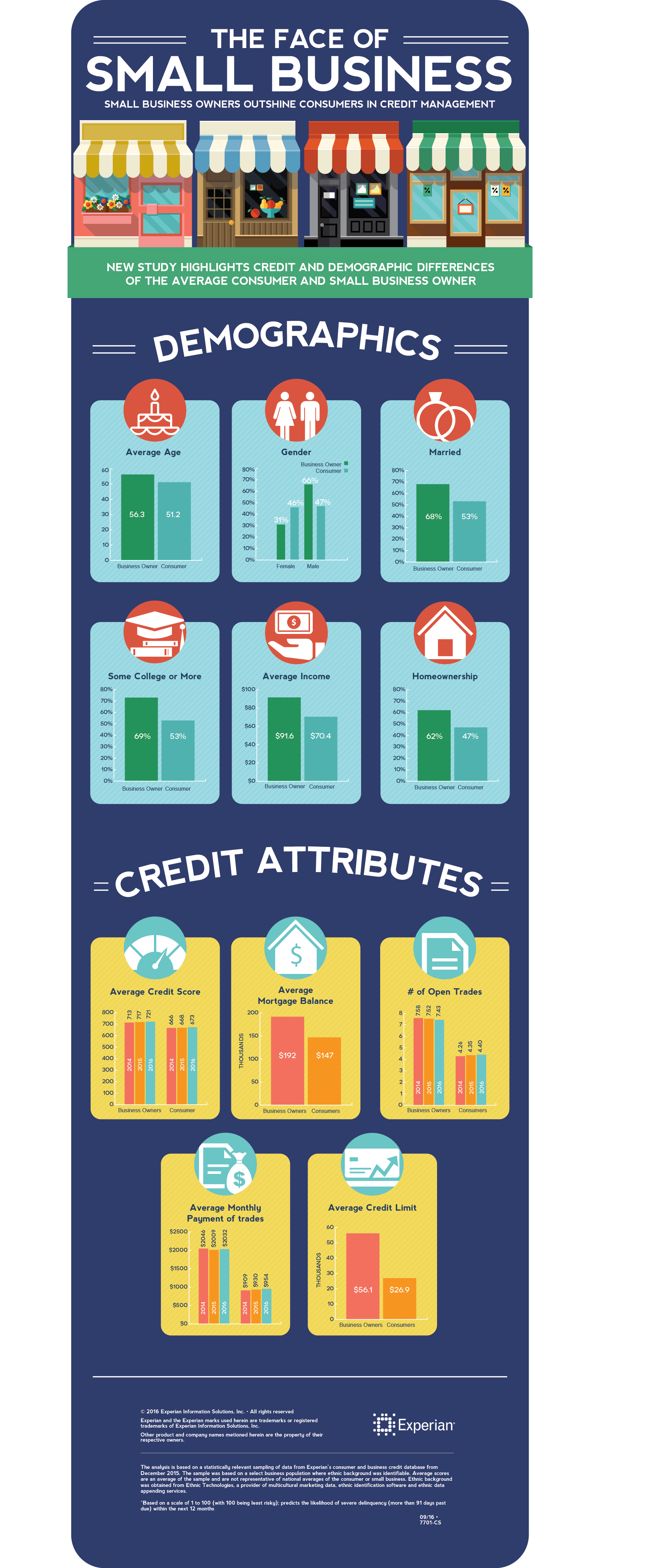

Experian took a random sample of 2.5 million small businesses and 1 million consumers to base the research. Findings show that small-business owners outpace consumers when it comes to credit management. For example, the average personal credit score for a small-business owner is 721 — 48 points higher than the average consumer score of 673. Small-business owners also have a higher amount of available credit, with an average credit limit of $56,100; while consumers have an average credit limit of $26,900.

Debt load, however, is also higher for small-business owners, with the average total balance of all trades being $195,000 versus $96,000 for consumers. Small business owners have higher monthly payment obligations with an average payment of $2,032 compared to $954 for consumers. Despite these differences, only a relatively small percentage of small-business owners (5.9 percent) have one or more revolving bankcard trades that are 90-plus days beyond terms in the past 24 months compared with 7 percent of consumers.

Download our Infographic

“Since the health of small business tells the tale of how the overall economy is performing, it is encouraging to see that while small-business owners have an exceptional amount of credit available to them and carry a higher debt load, they have done a great job managing their payment obligations and keeping utilization low. In order to explore possibilities and pursue opportunities, consumers and small-business owners alike need to master the credit management skills that will allow them to achieve their dreams — whether that dream is to start or expand a business or to finance a new home or vehicle.”

“Since the health of small business tells the tale of how the overall economy is performing, it is encouraging to see that while small-business owners have an exceptional amount of credit available to them and carry a higher debt load, they have done a great job managing their payment obligations and keeping utilization low. In order to explore possibilities and pursue opportunities, consumers and small-business owners alike need to master the credit management skills that will allow them to achieve their dreams — whether that dream is to start or expand a business or to finance a new home or vehicle.”

Pete Bolin

Director of Consulting and Analytics

Experian

Demographic differences

In terms of demographic characteristics, small-business owners are more likely to own a home and have a higher income than the average consumer. For example, the average income for small-business owners is $91,600 versus $70,400 for consumers. Also, 62 percent of small business owners own a home compared with only 47 percent of consumers. Small-business owners tend to be a bit older and are more likely to have pursued higher education than the average consumer. The average age of a small-business owner is 56, and the average age of a consumer is 51. From an education perspective, 68.6 percent of small business owners have attended some college and beyond, while only 53.5 percent of consumers have done so.

Other highlights from the report:

- The average mortgage balance for small-business owners is $192,000 versus $147,000 for consumers.

- The average number of open trades for small-business owners is 7.4 versus 4.4 for consumers.

- The balance-to-limit ratio for small-business owners is 29.5 percent compared with 30.1 percent for consumers.

- A higher percentage of small-business owners are married, with 68.3 percent having tied the knot versus 53.4 percent of consumers.

- The average gender breakdown for small-business owners is 65.6 percent male and 31.2 percent female. For consumers the mix is more equal, with 46.4 percent female and 47

percent male.