As the recovery gets underway, it will take months to assess the full economic impact of the unprecedented devastation brought to South Texas by Hurricane Harvey. Thousands of residents have been displaced, and as food and shelter are delivered and residential rebuilding plans begin, many of these people are also employees and business owners whose places of work may also need weeks or months to rebuild, if they will be rebuilt at all.

How quickly the area’s economy recovers has obvious implications for the people and businesses in the region, but it also has farther-reaching implications for businesses that depend on the region as a source of revenue as well. Experian looked to its wealth of business credit data to gauge the overall magnitude of the disaster and the impact to regional businesses.

Nearly 1.5 million businesses in Texas are in FEMA declared Hurricane Harvey impacted counties. This represents one of three businesses in all of Texas. The businesses impacted have $10 billion in outstanding payables and represent 31% of all commercial payable balances in Texas. The businesses in the impacted regions, on average, have very similar credit profiles to the rest of the businesses in Texas, with the typical business being 10 years old, paying 7 days late, and having an Intelliscore Plus commercial credit score of 41 out of 100.

Statistics for areas impacted

| Texas | Impacted | Impact % TX | |

| Number of businesses | 4,823,364 | 1,411,583 | 29.27% |

| Total balances | $ 32,334,156,000 | $ 10,014,029,400 | 30.97% |

|

Bal 1-30

|

$ 1,630,010,705 | $ 515,641,208 | 31.63% |

| Average utilization | 26.22 | 27.34 |

|

| Average IPV2 Score | 40.93 | 40.54 |

|

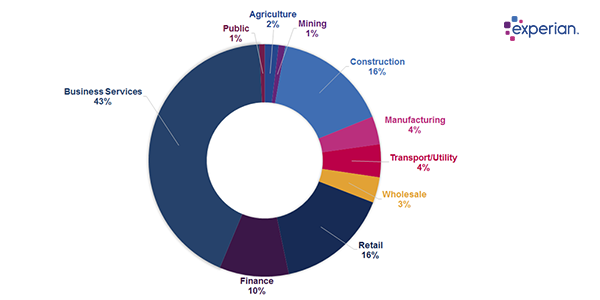

From an industry sector point of view, professional and business services were hardest hit, with these businesses accounting for over 40% of all businesses impacted. Professional and business services owe $2 billion in payables. Other industry sectors significantly affected include construction and retail trade, each accounting for 16% of businesses in the impacted region, and having $7.6 billion and $9.6 billion in total payables, respectively.

Impacted Businesses by Industry

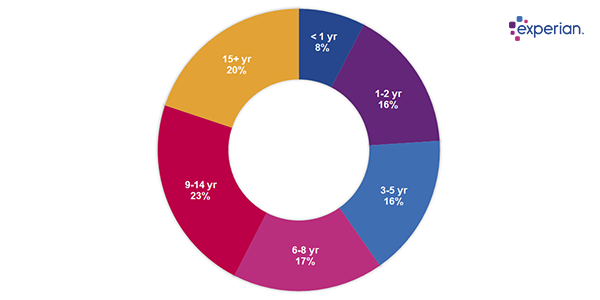

Smaller and younger businesses in general face lower odds of continued prosperity, and these businesses are the most susceptible to the devastation of Hurricane Harvey. The impacted areas are dominated by smaller businesses, with nearly 90% of businesses having four or less employees, and almost 100% having less than 50 employees. Even though they are small, these businesses account for $8.7 billion, or 86% of payables impacted. Many of these small businesses are young, and there are two in five businesses in the impacted counties that have been credit active for less than six years. These young businesses owe a total of $2.7 billion, or 27% of outstanding payables.

Impacted Businesses by Company Age

Over the next several months, Experian will show the level of progression of recovery by location and type of business. To be informed when we post about this topic, subscribe to our blog.