Experian and Moody’s Analytics have just released the Q2 2019 Main Street Report. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary on what certain trends mean for lenders and small businesses.

Q2 Highlights

In spite of business confidence in the second quarter, shaken by talk of trade war escalation, small businesses got a helping hand from seasonal factors that combined to push delinquency rates down.

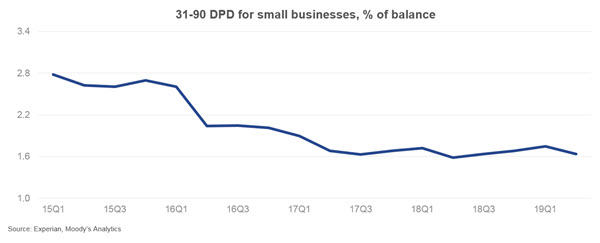

Delinquency rates for businesses with fewer than 100 employees fell in the second quarter, decreasing the 31–90 days past due rate from 1.74 percent to 1.64 percent for the quarter. But agriculture’s problems continued as weather and trade conditions continued to weigh on small farms.

These factors won’t be as helpful in the third quarter, so fundamentals or confidence will need to improve to propel performance and growth forward.

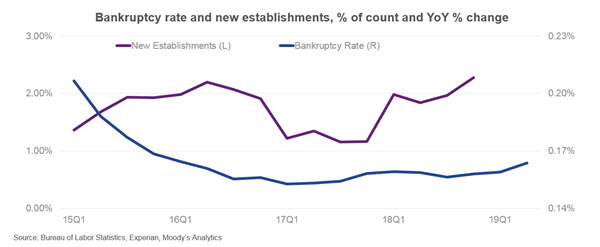

Bankruptcies ticked up ever so slightly again in the second quarter coming in at over 16 basis points. The most recent data available, from Q4 2018, indicates an establishment growth rate of 2.3%. Enough of these new businesses will seek credit to ensure that, combined with existing borrowers, balances look set to grow for some time.

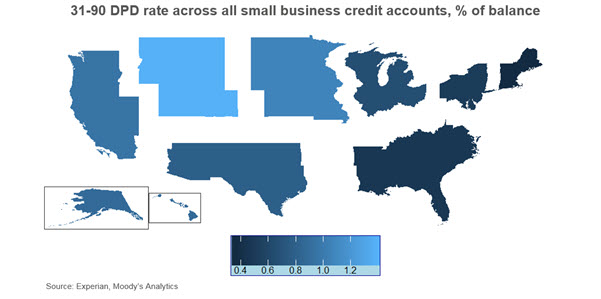

Overall, small businesses continue to display little to no signs of broad-based weakness. What weakness exists is fairly well confined at either the regional or industry level, and the solid performance that has been the norm for the last several quarters looks set to continue.

Watch Webinar Recording

Experian and Moody’s Analytics go in-depth on the Q2 2019 Main Street Report in the below webinar.