We get a lot of questions from our customers about blended credit scores vs consumer scores so, for our latest Fast FUNdamentals session, I thought it would be helpful to share what makes blended scores so powerful, and something you should consider when granting credit to small businesses. Watch our video or read the post, and remember to share it with your friends and colleagues.

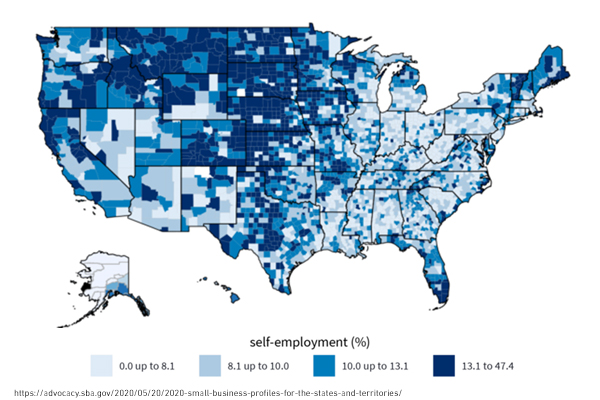

Small business growth fuels the U.S. economy through job creation and innovation! Small businesses support regional and local economies throughout the country, with higher proportions in middle America, and for every Walmart, Amazon, and Google, there are thousands of small business manufacturers, distributors, resellers, and app developers supporting their growth as well.

In order to grow, small businesses need good ideas, a good business plan, hard work, and access to capital. Good credit is required to access capital, and many creditors look at the business owner’s consumer credit information from bureaus like Experian, to determine creditworthiness and credit risk. They tend to see small businesses and small-business owners as one and the same. However, this strategy is not always successful.

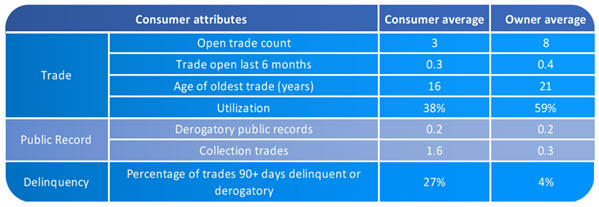

The average consumer profile is quite different from the average business owner. Let’s look at how the profiles compare on some general consumer attributes associated with credit risk.

The average owner has more trade experiences and has a longer credit history, which indicate lower risk. However, the owner also has higher credit utilization, which commonly indicate higher risk. Does this mean that the average owner is a higher credit risk than the average consumer? Not necessarily. Many small business owners rely to an extent on their personal credit to help finance their business.

For public records, such as tax liens, judgments, and bankruptcies, the average is low for both the average consumer and owner. For collections, the average consumer has 5 times the amount to that of the owner. That’s indicative of higher risk. Another major indicator of credit risk is severe payment delinquency, and again, the average consumer is much more likely to be more severely delinquent than the average owner.

Given that the average business owner looks and behaves differently from the average consumer, is there a better way to assess small business credit risk?

A better way to assess small business risk

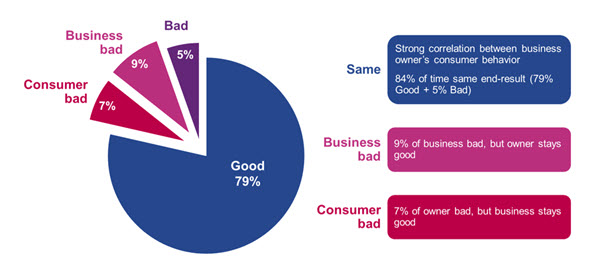

Experian conducted a study to look at the relationship between the business and the owner’s credit behaviors over 3.5 years, to determine the strength of that relationship. We tracked the percentage of those businesses and owners that continued to remain credit active and healthy, and those that became high credit risks, becoming 91+ days delinquent on over 35% of all trade obligations. Over 3.5 years, 79% of the time, both the business and owner’s credit remained healthy.

We tracked the percentage of those businesses and owners that continued to remain credit active and healthy, and those that became high credit risks, becoming 91+ days delinquent on over 35% of all trade obligations.

Over 3.5 years, 79% of the time, both the business and owner’s credit remained healthy, and 5% of the time, both the business and owner became severely delinquent on the business obligations and on the personal credit obligations. That means that 84% of the time, the end result of business and consumer credit is the same!

That’s a very strong correlation, so the owner’s consumer credit behavior is very indicative of business credit behavior. But, that also means that 16% of the time, the outcome of the business and consumer are diametrically opposed. 9% of the time, the business goes bad, but the owner stays good. If a creditor were to approve a business for credit based on the owner’s credit profile, the creditor would have made a bad decision. Furthermore, 7% of the time, the consumer goes bad but the business stays good.

Blended risk scores provide better commercial risk assessment

Blended risk scores predict business risk by utilizing the owners’ consumer credit attributes with the business credit attributes together – to calculate a more comprehensive risk score for the business

With the blended risk score, creditors can more confidently approve those with a great score and know that they will have a profitable customer. And they may have to decline those with a high-risk score to mitigate against future loss.

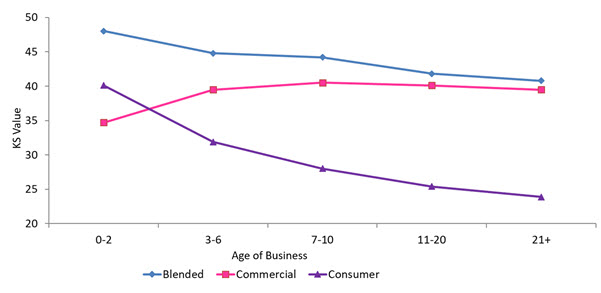

Let’s compare the predictive power of three risk models as the business ages, from infancy to full maturity

In the below illustration, the horizontal axis going across measures the business as it ages, from 0 to 2 years on left, to 21+ years old on the right. The risk models compared are the Blended model, Commercial only model and Consumer model. Again, the Blended model uses both the business and consumer credit information to calculate the business risk. The Commercial only model uses just the business credit data to predict business risk and the Consumer model uses consumer credit data to assess the risk of the consumer, which is the business owner. The vertical axis measures KS, which is a metric representing the predictive power of each model in accurately identifying future good vs bad business credit outcomes. The KS is scaled from 0 to 100, with 0 indicating no predictive power and 100 Indicating perfect prediction. So, higher values indicate stronger model performance.

For businesses in infancy up to 2 years, the Consumer risk score is more predictive of business risk than the Commercial risk score.

That may seem counter-intuitive, but the underlying reason is that new and young businesses do not have a lot of credit activity on their profile. Many young businesses are actually funded by the owner’s personal credit, so there is less business credit information to calculate the business score. And in general, the less information available, the less predictive a model score will be.

As the business matures, it establishes and expands its credit profile, opening more tradelines in the name of the business. As the business profile becomes richer in information, the commercial risk becomes more predictive than the consumer score. The business becomes a separate entity, and the consumer score becomes less and less indicative of business risk. Behaviors can differ dramatically from the business owner, as we have seen in previous examples. As expected, across all the ages of the business, the blended score provides superior performance.

The blended score takes the age of the business into consideration as one of the factors for calculating risk, at every stage of the business lifecycle, the blended score provides a more holistic risk of the business by integrating the dynamic relationship between the business and owner credit profiles.

Small business owners represent a unique market. They have an evolved sense of purpose, discipline, and responsibility that allows them to accept the risks and hardships required to build an enterprise from the ground up. To properly evaluate an entrepreneur’s credit risk, creditors must look at the right score. Utilizing a blended score is a proven, better way for creditors to evaluate risk and extend worthy businesses the capital they need to grow and prosper.

And, as small businesses succeed, we all benefit.