Michael Myers, Experian’s Vice President of Products, assembled an impromptu roundtable discussion in March 2020 to discuss some of the key findings in a Forrester Study titled “Build Credit Risk Confidence Through Advanced Assessments.” Mike is joined by Ann Skibicki, Sr. Director of Product Management and Brodie Oldham, Director of Analytics Consulting. What follows is a lightly edited transcription of their discussion.

Build Credit Risk Confidence Through Advanced Assessments

[Mike]: Hi everyone. I’m Michael Myers. I am the Vice President of Products here at Experian Business Information Services and looking forward to talking to you today. We’re going to share a number of findings from our most recent Forrester Research project entitled “Build Credit Risk Confidence Through Advanced Assessments”, and I’m joined today by Ann Skibicki, a Senior Director on our Product Management team. We’re also joined by Mr. Brodie Oldham all the way from Texas. He is a Director of Analytics Consulting here at Experian.

[Mike]: All right guys, let’s jump into it. We recently commissioned Forrester and ended up with our most recent study and what we want to do is share some of the key findings. Really the goal of the overall project was to get a sense of risk-based decisioning and what some of the firms in the industry’s plans are around the future of their credit risk assessment practices. I’ll start at a high level discussing some of the key findings and then with Ann and Brodie’s help, we’re going to dig into each one.

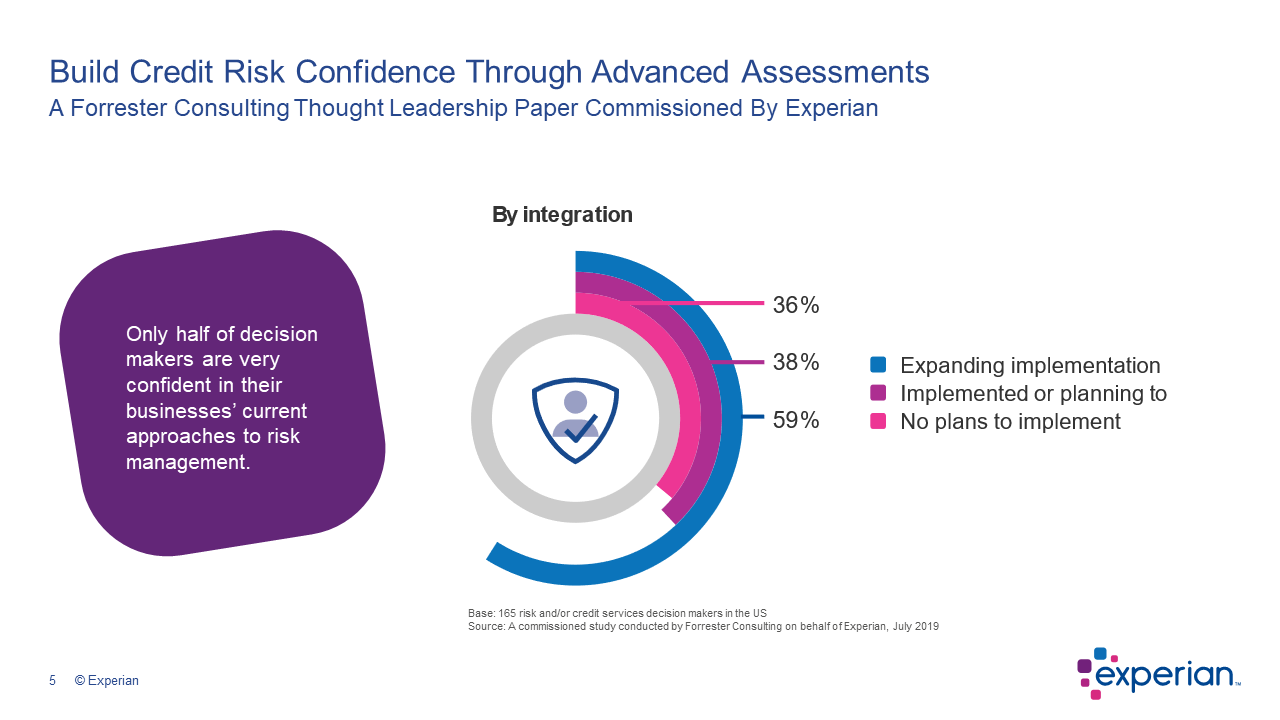

[Mike]: So, finding number one, only half of decision-makers are very confident in their businesses, current approaches to risk management. The second finding, businesses struggle to deploy advanced analytics or automate account reviews, and last but not least, our third finding we’re going to discuss today is most businesses are looking to a credit risk evaluation partner to evolve their risk solutions.

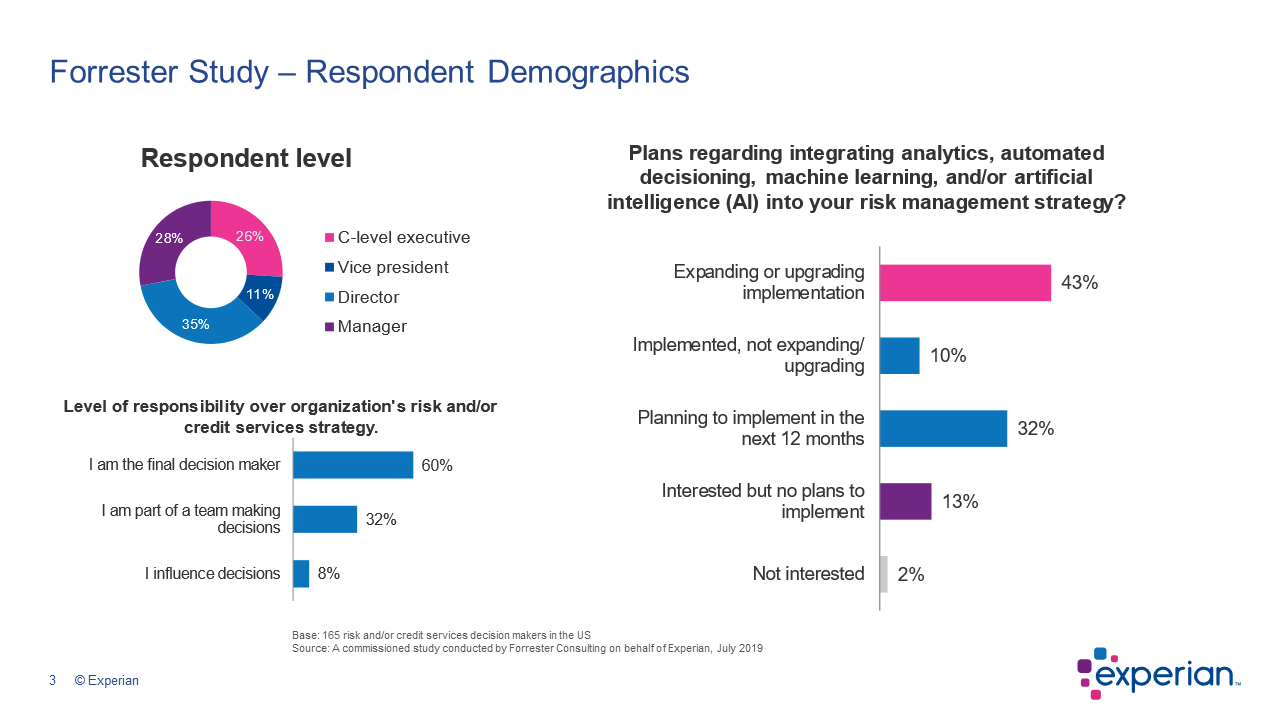

[Mike]: Okay so, before we jump into those, let me just give you a little bit of background about who we talked to and their background firmographics. We certainly wanted to talk to decision-makers, so we went after those at the C level down through Vice President, Director Management. We certainly want to make sure they were part of this conversation and had an active role in it. So, we talked to everyone that was just considering starting this journey, those that were mid-flight of the journey, and those that had actually implemented some more automated analytic approaches.

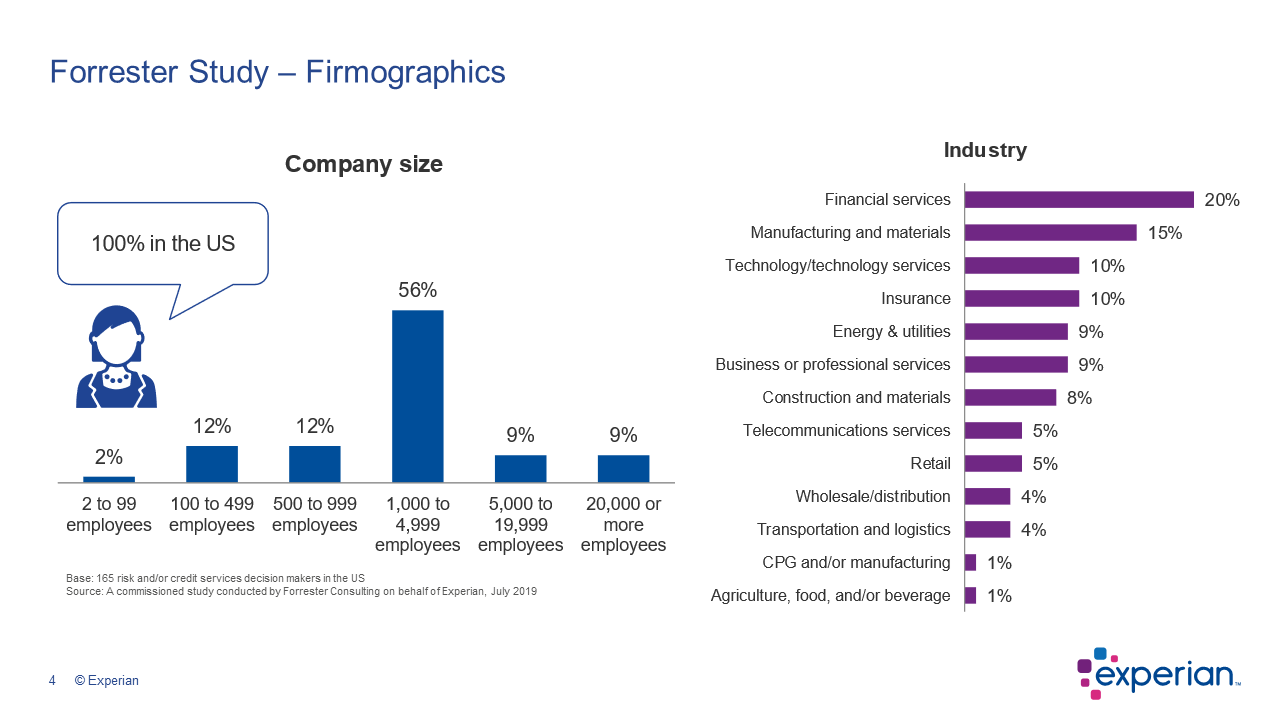

[Mike]: One more slide on the background. We needed to make sure we had a wide variety across the spectrum of company sizes. You’ll see on this graph on the left, you know, really the sweet spot in that mid to large size company. But we also covered the small business micro-business even as well as some of the larger firms out there. And with that comes really a wide array of industry verticalization. Everything from what you see here on the top right, financial services down to the agricultural food and beverage industry.

[Mike]: Okay. So let’s jump into it guys. Finding number one only of decision-makers are very confident in their business’s current approaches to risk management. Ann let’s start with you. Give us your, take some of your thoughts.

[Ann]: Uh, sure. Mike. Yeah, I think that that is interesting. But I think you do have to dig in a little bit further by the client’s evolution as to where they’re at in the adoption of advanced analytics and decisioning to really make meaning of that stat. You’ll find that the folks that are actually adopting advanced analytics and decisioning are already on their path, are much more confident, almost twice as confident as the folks that have not implemented or have no plans at this point to implement.

[Ann]: So I think there is something interesting to be said there about the level of competence that folks are having with their processes and advanced analytics, particularly with the folks that are already adopting. Brodie anything to add?

[Brodie]: Well, sure Ann. As I’ve looked at this and we’ve talked to clients and part of the engagements that we’ve had, we find that a lot of times that confidence that they have has pulled back a little bit because they lack some of the automation there. We look behind the curtain, and we see it. What they end up with are inconsistent decisions. And so, what we’re trying to do is give them a pathway or a framework to work with, and Forrester really showed us that they needed that. Some of the things that they need are a strong benchmark to start, you know, where they’re really going to start their path. Those advanced analytics that you talked about are important, we have new methodologies that we can deploy and then a place to deploy them. Really that decisioning platform is super important for their confidence.

[Brodie]: So when they come out for that progression and for the performance to be there, they really need to have that confidence to progress their sales cycle, and we see that those that don’t have that plan to implement. Only 12% of those folks really, they’re not planning to grow. 12% of those that are planning to grow in the near future really aren’t going to grow. So we found that in the Forrester study, it’s very exciting to see.

[Brodie]: But when we look at those that are really having some success. I know Mike in the Forrester study some of the things, there were some key points that we found that were helping some of those that are really pushing forward and pushing that limit to overcome. What are some of the challenges that they might be facing?

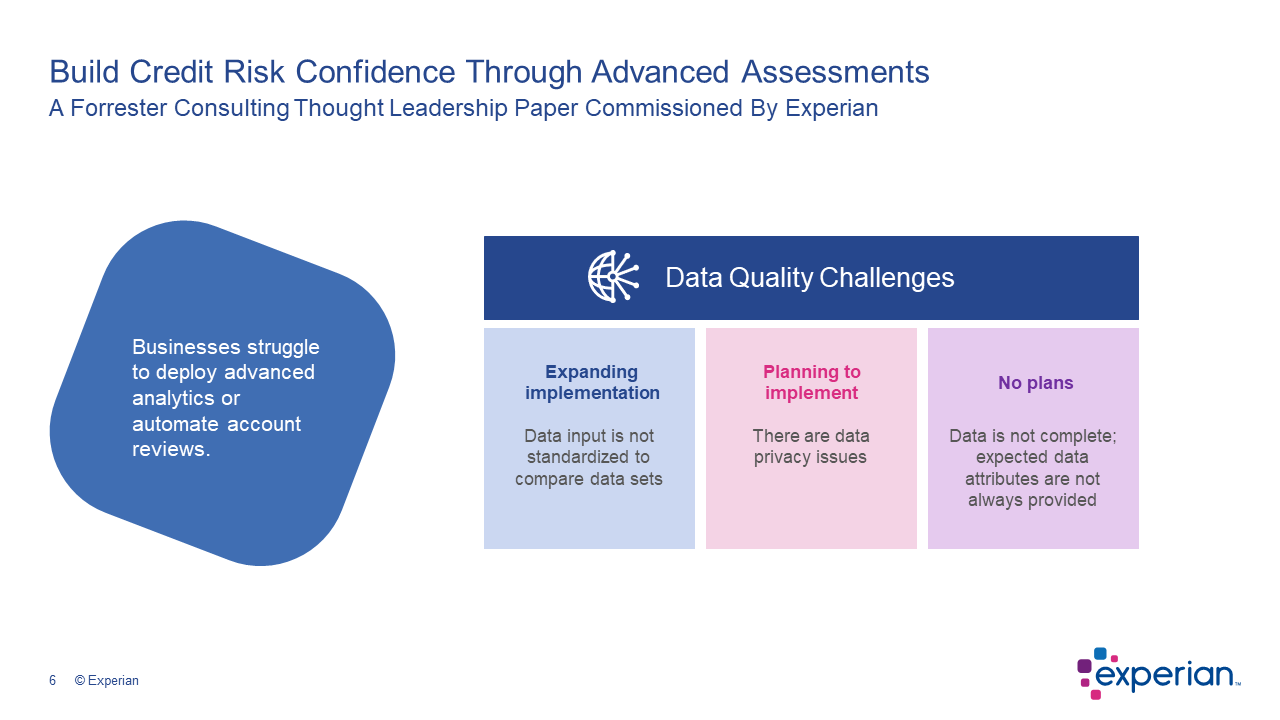

[Mike]: Yeah, got it. Couldn’t agree more Brodie and thank you both. Great insights on that first finding. Tell you what, let’s jump into the second one. Finding number two, businesses struggle to deploy advanced analytics or automate account reviews. Let’s start with you Brodie, but I’ll add a little bit of my insight on this one too.

[Mike]: In my experience with our prospects, and with our clients, you know, account reviews are often overlooked, especially when the economy is doing as well as it is. You know, everyone’s focused on origination, opening accounts, but they tend to forget the need to really focus on account reviews and really managing those accounts. So, Brodie give me some of your thoughts.

[Brodie]: When we’re looking at the Forrester study it really highlights what we’ve been seeing with our clients. We know that some of the strategies that we’ve been taking are implementing some of these more mature methodologies, more advanced cutting-edge methodologies for Machine Learning, and in our processes for an account review, even originations, but account review especially. We’ve seen lift over those tried and true logistic regression type models with our new Machine Learning models — 12% 15%,17% plus percent. So really some great value that’s being added in these Machine Learning type models.

[Brodie]: The hardest thing that we see with our clients is being able to install what we have here in this new methodology into the process, so into their account review process. With some of the new microservices that we have in place, we can deploy those. We have sub-second turnaround times with the new methodologies that we have. Which is really industry-leading, and it takes us into a place where our clients can deploy either models that we’ve built for them or models that they’ve built themselves and deploy it here at a significantly lower cost and they can really do it themselves. I know Ann, some of these, when we talk about implementing a key to that is data. Do you have some points that you want to make on that?

[Ann]: Yeah, I was going to kind of bring it back to the fundamentals because when I read the study and looked at the results for me, a couple of things stood out. Not only were our clients and their survey respondents struggling with IT budget and system constraints, which I think we would all agree is a challenge across the board. What I thought was interesting was that they’re having data quality challenges and that was across the board. Whether they were just starting to implement or if they were on the path of implementation. Everybody seemed to have really the same challenge with standardizing the data, finding good fill rates of the information of where the data’s not complete or even the data privacy issues. I’ll say in working with some clients recently, I would definitely agree with this. You know, data standardization, data quality, especially with data and multiple systems becomes pretty challenging. And then you really want to leverage that information, right? Unlock the power of the data to be used in the advanced analytics portion, whether it’s for portfolio management or new account acquisition. It can be a definite challenge for sure.

[Mike]: Great job guys. You know, I just want to add to that too. I think you both hit on some key points. ML, Machine Learning, A.I. buzzwords, right? Really hot in this space right now. It’s really important not to forget what problem are you trying to solve, what are you trying to accomplish, and then how can you go about doing that? I think Brodie, you outlined some really good points of hey double-digit lift. That’s no joke. How can we at Experian possibly help you implement that? And we do have a number of ways and a number of analysts that are really experienced in just that.

[Mike]: So, bringing it back to your point too, Ann, it’s easy to forget some of the basics, tie that together and you really have a compelling proposition. All right guys let’s go to the third and final finding from our Forrester study. Most businesses are looking to a credit risk evaluation partner to evolve their risk solutions. Ann why don’t we start with you. Talk to me about this finding.

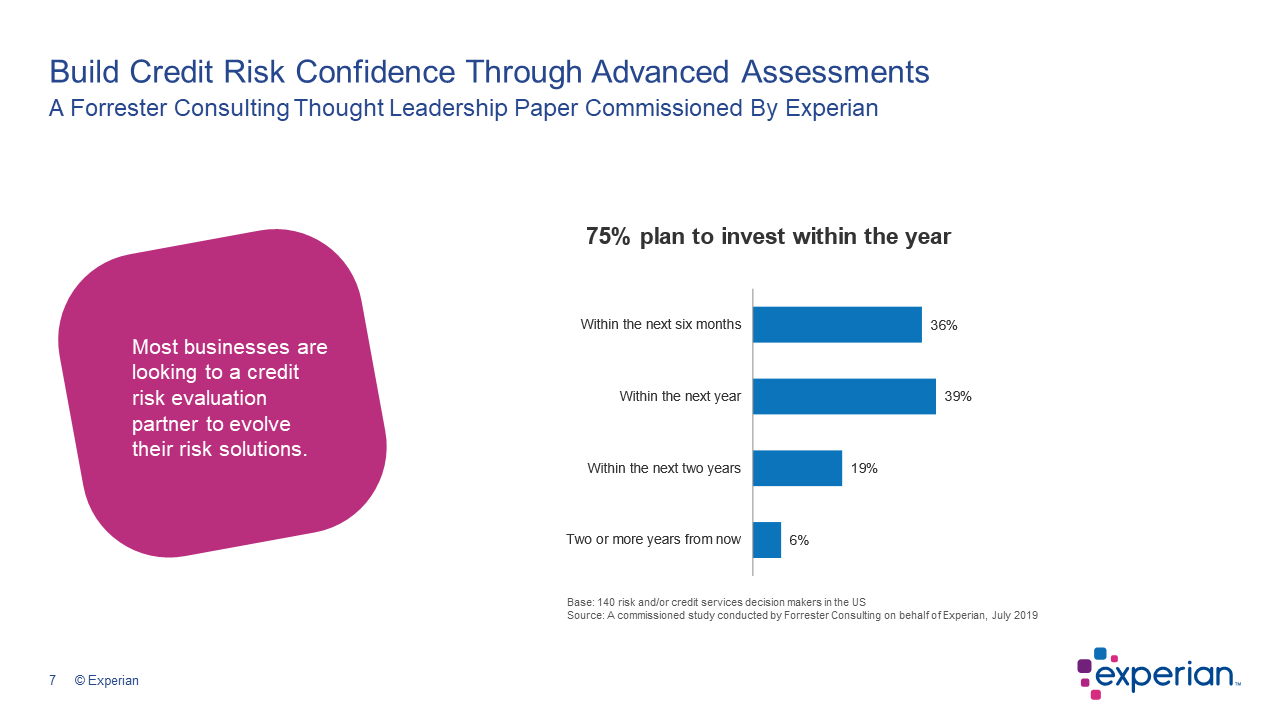

[Ann]: Yeah, I thought this was interesting as well. A very strong call to action for me. I saw that with our clients and respondents, this is not necessarily an emerging need. About 75% of the respondents are taking immediate action within the next 12 months. So, I’m happy to see that folks are definitely starting to adopt these new methodologies, are really looking at ways to transform their business. And that is happening right now at the present time. I’m sure Brodie, you’re probably hearing a lot from clients working in the analytics space of folks that are looking to us maybe want to share some of your insight.

[Brodie]: Well, they certainly are Ann, the way that we’re really drawing this in to show the value they’re there, they get the feeling that they’re on the cutting edge and we really want them to see that, and as our clients move forward with us in partnership, to build out their account management and even their origination systems, as they’re including some of these Machine Learning and advanced techniques into their processes. It’s not just the performance that they’re getting here, as far as their numbers and the dollars that they’re earning, but their sales teams are getting that lift as well. And I like to call it the swagger factor. So, you mentioned a little bit earlier, you know, in this Forrester study what you’re going to see is that swagger factor, which is up about a 200% increase in that confidence level that our clients are really feeling here.

[Brodie]: When we look at those in this study that didn’t feel like they had a good onboarding process, about 28% didn’t in the group that wasn’t going to implement in the next two years. So there are groups that are waiting to implement or looking out in the future to take these next steps into Machine Learning. The ones that are doing it more quickly in the next six months or so, 85% of them feel like they’re really on the cutting edge. They’re moving forward, they’re going to have great sales and growth in the next six to 12 months. That’s where the swagger factor comes in. This really reinforces the good value that we’re seeing in a partnership with Experian. And Mike, can you tell us a little bit about how to get some of this information?

[Mike]: Yeah, you got it. Brodie, thank you so much. We can help you. Let us help you increase your swagger factor, but first I just want to say thank you, Brodie, thank you Ann for joining us today. Really what we have available is a copy for download of this Forrester research study. It’s available over on experian.com so please join us there and we’d love to talk to you further. We do have quite a bit of experience as you heard from Ann, Brodie, and myself today, and we’d love to help you on this journey. Thanks so much for joining us today.

If you would like to download a copy of the full report visit our credit risk assessment page.