In this post, I would like to share some thoughts on the emerging business threat from the Delta Variant as it pertains to small business credit performance.

Small Businesses are emerging

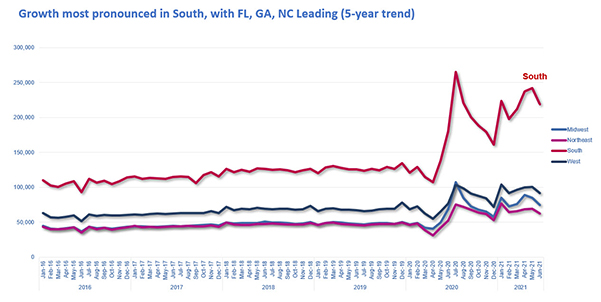

New business applications are up 53% in the past 12 months, consistently coming in around 450k applications a month. We see these businesses become visible to commercial credit markets 3-4 months following the application. Industries including retail, transportation & warehousing, and accommodations & food services top the list as some of the fastest-growing sectors, particularly in the southern United States.

Growth most pronounced in South, with FL, GA, NC Leading (5-year trend)

Lenders and creditors are working hard to meet the need of their current customers and rapidly expanding inclusion programs to engage the underbanked in communities and provide access to new businesses. These emerging businesses and micro-businesses will not have the traditional credit history to access private commercial funding without the inclusion of non-traditional data.

As stimulus support and moratoriums wind down, the concern is the resilience of small businesses as COVID spread and regional public policy decisions apply pressure to commercial growth and consumer spending.

COVID-19 Delta variant emerges as a likely business spoiler

The more contagious COVID19 variant is spreading quickly across the U.S., increasing to 21 times the average daily new case count in the last 30 days.

Public policy limitation to commerce

From a foot traffic perspective, the Delta variant surge has not greatly impacted small businesses as policymakers struggle to hold off on resuming state and local COVID commerce restricting policies. As case numbers rise, legal challenges to this restraint will waiver. We are seeing the return of mask mandates and capacity limitations amid indecision about whether or not schools can or will open in the fall or if remote classrooms will continue. These policy reversals and additional restrictions will be focused on social distancing versus lockdown strategies. This means stores will stay open to foot traffic, but consumers will become warier of utilizing this in-person experience.

Delta hotspots highlight the small business threat

A slow-down in foot traffic will place pressure on small business growth. Consumer confidence and re-emerging health concerns will play a role in how consumer spending impacts Main Street in the lead-up to the holidays. Regional COVID spread hot spots will impact supply chain for specific industries. As the variant picks up pace the travel industry and supporting industries (Hotels, Restaurants, etc..) will see customers warier to utilize the service, putting a damper on growth in this sector.

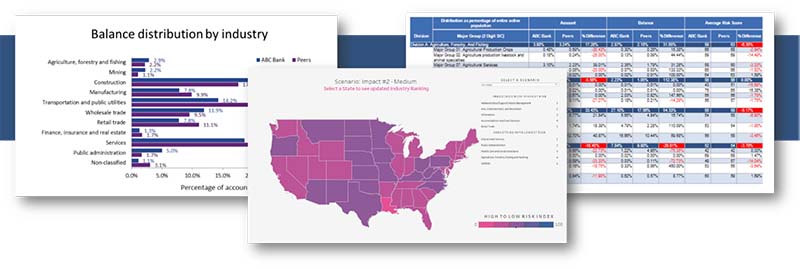

COVID-19 has impacted all regions of the U.S. We needed a reset to understand how the newest variant is impacting areas outside of previous surges. Experian created a Delta Variant index to understand how small businesses will be affected differently now vs prior surges.

We see a divergence of regional growth trends impacted by variant spread, macro-economic pressures, labor re-engagement, and consumer spend. Global trade pressures will continue to impact supply chain success. Creditors are formulating new risk management strategies for onboarding, term flexibility, balance management, and treatment that include traditional and non-traditional data.

This COVID variant RESET, how we evaluate small business impact due to spread, is important in identifying areas of resilience and accelerated growth opportunity and uncovering industry and local risk.

View COVID Risk Dashboard

The COVID-19 U.S. Business Risk Index was developed by Experian Business Information Services to help businesses better understand the impact COVID-19 may have on their commercial operations.

Related posts