Consumer spending is by far, the largest component of the U.S. economy. At the height of the COVID-19 pandemic lockdowns, consumers were not

spending and instead saved huge amounts of money. Since re-openings occurred, consumers went on spending sprees to make up for the time in lockdown.

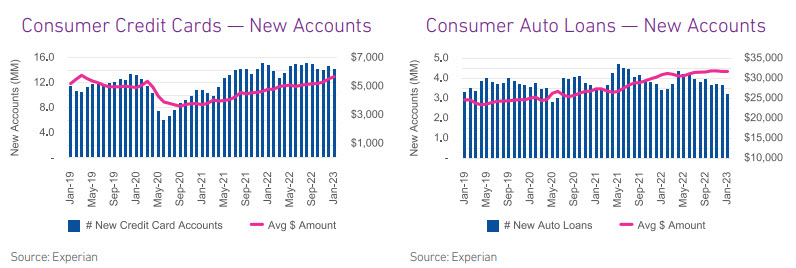

The higher demand along with supply chain issues are partly driving the high inflation. Consumers dug into their savings to continue to spend and cover higher prices. With savings dwindling, the FDIC reporting that Q2 & Q3 2022 were the two largest recorded declines in bank deposits in the U.S., consumers have increased borrowing so that they can continue to spend.

As the Federal Reserve increases interest rates, a large portion of the increase in debt burden is becoming much more expensive than a year ago. These highly leveraged consumers are likely to begin driving up delinquencies, causing banks to react and tighten lending policies. With bank account deposits dwindling and borrowing becoming less available and more expensive, consumers will have no option but to cut back on spending.

When consumers reduce spending, the first sectors to be impacted are discretionary areas such as travel, accommodation, restaurants, arts and entertainment, and certain retail. Businesses in those sectors have been seeking higher amounts of commercial funding over the past year compared to pre-pandemic levels. In addition, their delinquencies are increasing, indicating that these sectors are tight on cash. If sales decline at a high pace going forward, these sectors may feel the brunt of the impact of an economic slowdown.

What I am watching:

The Federal Reserve has taken an aggressive approach to slow the economy and cool inflation to return to the target 2% inflation rate. However, since the Fed’s most recent rate hike on Feb. 1, the January jobs and retail sales reports both came in stronger than expected, including a 3.4% unemployment rate which was the lowest in 53 years. While CPI is showing inflation slowly reducing, the latest PCE numbers show consumer prices continuing to increase. These factors are a good reason to believe that the Federal Reserve is likely to not only continue to increase interest rates at their March meeting and beyond but will also revert to larger increases of more than a quarter of a point.