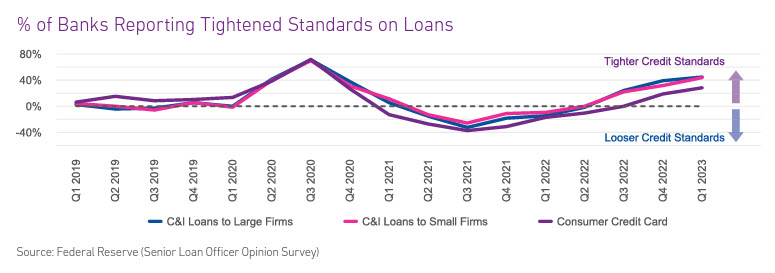

Lenders are experiencing an increase in delinquencies and are therefore tightening credit criteria. According to a survey of loan officers, underwriting standards are becoming particularly more stringent on commercial loans.

Moreover, the recent news of the SVB collapse has also highlighted the vulnerability of small banks and served us as a reminder of their crucial role in serving local communities. During the days immediately after the SVB failure, we saw a sizable shift in deposits from small banks to larger institutions.

A liquidity crunch affecting small banks puts their lending capacity at risk and could develop into a credit crunch in the communities served by them.

Furthermore, as mobile banking becomes more prevalent and friction on fund transfers is minimized, financial institutions must work harder to retain their deposit customers.

In all, the financial sector has shown remarkable resilience weathering the recent challenges, and small and medium-sized banks seem to have successfully covered their liquidity gap through borrowing from the Fed.

Moving forward, it is essential for small and mid-sized financial institutions to reassure their customer of their stability and to prepare for additional interest rate hikes. Large institutions should focus on streamlining their acquisition processes to capitalize on a potential influx of new customers, and to implement fraud detection systems to identify bad actors while minimizing disruption to legitimate applicants.

What I’m Watching

Interest Rates: The Fed has been sending mixed signals lately, stating that it remains committed to fighting inflation (which implies additional rate hikes) yet signaling a willingness to slow down or even pause the rate increases in light of recent events and the pressure that rate increases put on banks’ deposits.

Small and Medium-Sized Banks’ Financial Health: Smaller institutions seem to have successfully managed recent challenges. Keep an eye out for further signs of stabilization, and the impact of additional rate increase on unrealized losses and liquidity.

Regulatory Environment: In reaction to the SVB and Signature Bank failures, it will be interesting to see if regulators issue new requirements for banks.