The U.S. economy continues to be stronger than expected, even as a looming downturn is still expected.

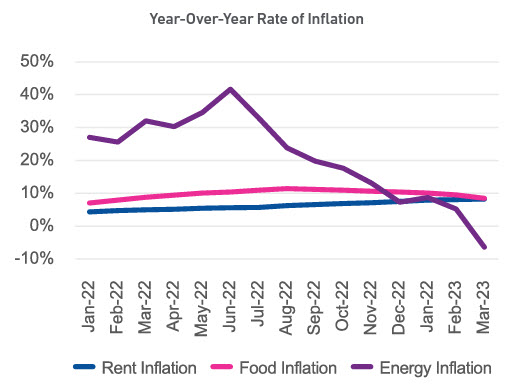

Inflation remains persistent with March prices 5% higher than a year ago, but slowing from 6% inflation in February.

One of the biggest drivers of inflation over the past year was energy, but in March energy was 6.4% lower than a year ago, the first decline since January 2021.

The labor market continues to be tight with low unemployment still driving wages higher, but inflation makes real wages stagnant.

With these mixed signals, it will be interesting to see if the Federal Reserve continues to increase interest rates, or if they pause rate hikes at their May 3rd meeting. New businesses are opening at a high pace, with the 2022 monthly average 44% higher than the pre-pandemic 2019 monthly average. Those newer and smaller businesses are seeking a greater portion of commercial credit and have accounted for a larger portion of new commercial accounts opened.

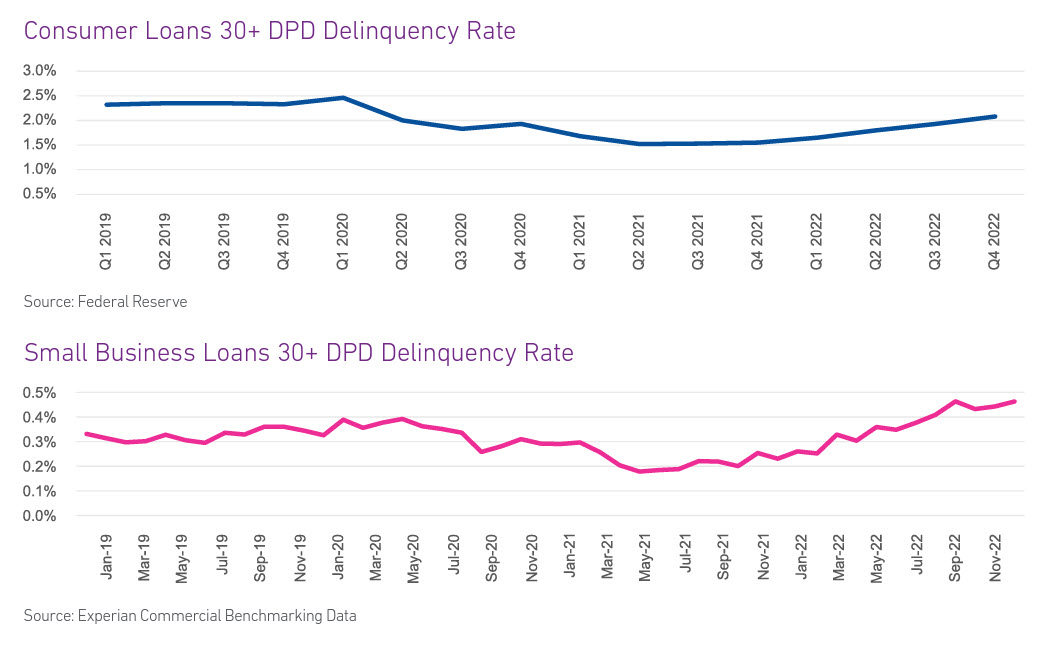

Delinquencies are rising in the newer and smaller business segments and may be the first to feel the brunt of tightening credit criteria.

What I am watching

As delinquency begins to rise, lenders are tightening underwriting policies. Businesses will find it harder to obtain capital and may turn to alternative funding sources besides traditional banks. Alternative lenders generally charge higher interest rates, and in a rising interest rate environment, they are getting even higher, so businesses will be hard-pressed to find affordable funding sources.

Commercial bankruptcies, which were at historical lows the past year, started to increase in Q4 2022 and are likely to continue to increase, especially if businesses in need of capital struggle to obtain it.

Download your copy of Experian’s Commercial Pulse Report today. Better yet, subscribe so you’ll always know when the latest Pulse Report comes out.