Women led businesses lag behind on venture capital funding, and are turning to commercial loans and lines to bridge the gap

While it is very encouraging to see the progress of women in business advancing, the pace of progress is slow and more could be done to achieve parity. Women’s salaries are slowly catching up, but they are still only about 80% of men’s wages.

There are continued barriers to mothers participating in the labor force due to the limited capacity of childcare facilities, the high costs to families for childcare, and the low wages for childcare workers making lower skilled work sometimes more attractive in a tight labor market.

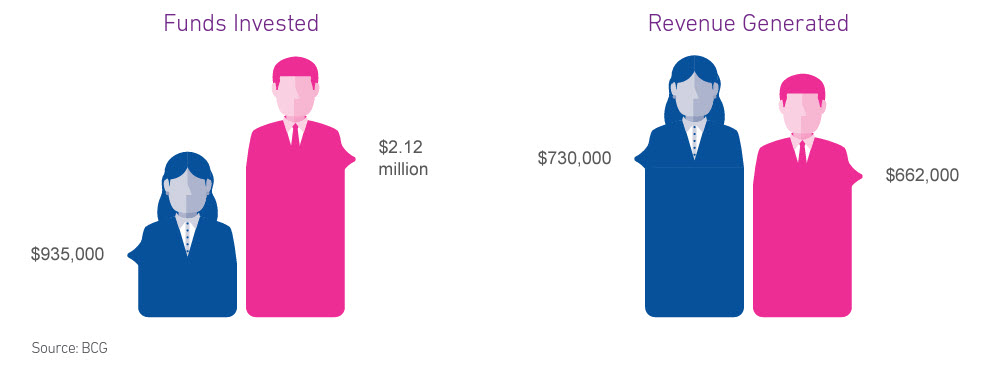

These forces disproportionately affect women whether they work for wages or work for themselves as a small business owner. In addition to the issues facing women as workers, there are unique challenges they face as start-up founders as well. There is a known disparity in the funding provided to start-up businesses pitched by a woman versus a man and that is leaving women without the full funding they need to launch new businesses successfully.

Added diversity within venture capital and angel investor groups could help change this dynamic so women can access that capital and expertise when launching their businesses at the same rate as their male counterparts. Without this, they are left to rely on self-funding and loans from banks — if they can get approved. The good news is that many women are making it work and the number of successful women-owned businesses continues to climb.

What I am watching:

The debt-ceiling standoff continues to cause uncertainty in the financial system with no compromise in place and a looming June 1 deadline, according to Secretary Janet Yellen. This situation is going to dwarf all others until there is a resolution, so all eyes are going to be on Congress and the President.

Other signs in the economy suggest that inflation may finally be responding to the aggressive interest rate hikes enacted by the Fed. The Fed will have a more difficult decision on whether to raise interest rates one more time in June or hold them steady and wait to see if inflation continues to improve.

Download your copy of Experian’s Commercial Pulse Report today. Better yet, subscribe so you’ll always know when the latest Pulse Report comes out.