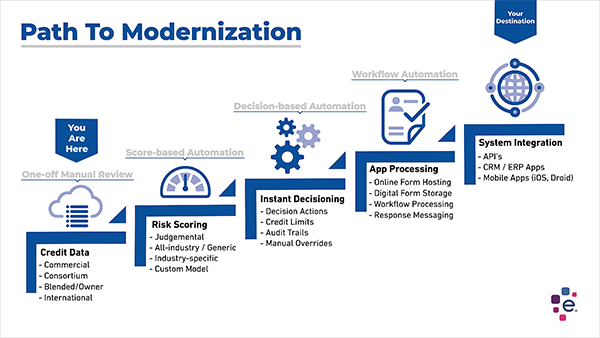

Over the next several weeks, we will be sharing a series of videos featuring Sr. Product Manager, Erikk Kropp talking about the Path To Modernization framework. Path To Modernization is centered around common needs we help clients to address when modernizing their credit process. This includes managing risk in customer acquisition and retention, especially important as market conditions evolve.

Credit Departments Adapting to Change

The COVID-19 pandemic led to significant shifts, such as employee furloughs and changing demand, forcing businesses to reconsider their operations. Credit departments, despite facing staff reductions, had to continue managing risk amidst these challenges, pointing to a need for long-term strategic adjustments rather than short-term fixes.

Long-Term Strategy Shifts

In the new normal, businesses are modifying their models to accommodate these changes sustainably, focusing on automation and remote work to manage risks more effectively with fewer resources.

In our next post we will focus in on the various forms of data available to credit departments in addition to traditional business credit reports and scores so be sure to subscribe to this blog to be notified when we post.

Pivotal Growth: A Guide to Modernization

If you are looking to modernize your credit processes, Experian’s guide, Pivotal Growth, offers a structured framework to navigate these changes. We encourage downloading the guide and consulting with an Experian representative for further discussion.