Modern credit approvals make the customer onboarding process efficient, and it begins with credit data

In today’s rapidly evolving financial landscape, the shift towards modern credit approvals is not just a trend but a necessary step for businesses aiming to streamline their customer onboarding process. This transformation is powered by advanced data analytics and digital technologies, making credit decisions faster, more accurate, and incredibly efficient. Modern credit approvals stand at the forefront of this change, revolutionizing how companies assess creditworthiness and manage risk in real-time.

This post marks the second installment in our series on the “Path to Modernization,” where we unravel the intricate steps and strategies businesses can adopt to embrace modern credit approvals. Spearheaded by Sr. Product Manager, Erikk Kropp, our series offers a deep dive into optimizing credit processes for the digital age. Today’s focus is on the vital role of diverse data sources—a cornerstone in enhancing risk assessment and driving efficiency within credit departments through modern credit approvals.

As we navigate through the complexities of digitizing and automating credit approval processes, it becomes evident that modern credit approvals are not just about adopting new tools but about rethinking our approach to credit risk management. By leveraging a blend of traditional and innovative data insights, businesses can unlock unparalleled efficiency and accuracy in their credit operations, setting a new standard for customer onboarding and financial assessment.

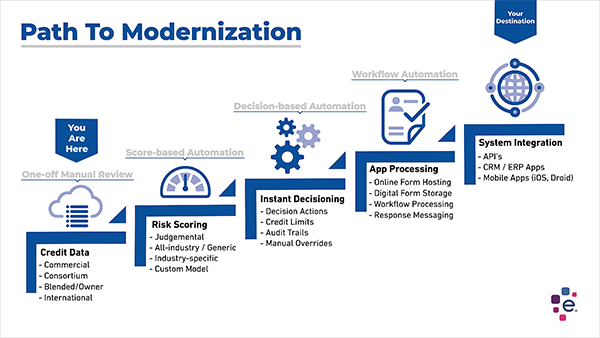

The Path To Modernization Framework

About the Framework

The “Path to Modernization” framework is intended to highlight five key areas where Experian can potentially assist clients when introducing digitization and automation to help drive change across their risk management process. The framework is based on observed best practices and common tools frequently used today in the industry. Higher levels of modernization and performance can be achieved with each subsequent step of the process.

Understanding Your Data Landscape

The journey to modernizing risk assessment begins with recognizing the importance of diverse data sources. This is crucial for comprehensively understanding the risks associated with your clients. Often, clients are unaware of the wealth of options available to them for risk analysis. Providing a structured framework helps clients identify where they stand and offers guidelines and tools for a new perspective on risk assessment.

Exploring Data Sources Beyond the Basics

Credit reporting agencies like Experian are commonly known for their role in assessing risk through commercial credit data, payment history, public records, demographics, and firmographics. However, the landscape is much broader, especially for small businesses where personal and business finances often overlap. Blended credit reports that combine a business’s commercial health with the owner’s personal credit history offer a deeper insight into potential risks. This approach not only helps in evaluating small business delinquency but also enriches the existing data, making it more actionable in the risk management process.

Leveraging Consortium Data and International Insights

The concept of consortium data, such as the Small Business Financial Exchange, introduces a reciprocal data-sharing model. This “give to get” strategy enables access to unique credit insights, enhancing the risk assessment process with additional financial information. Furthermore, with the global economy continually expanding, considering international data sources becomes essential for businesses looking to operate or expand overseas. Tools like Experian’s Global Data Network can provide valuable financial and credit risk insights across different regions, thus broadening your risk assessment capabilities.

The Role of Data in Modern Credit Approvals

The trend towards incorporating alternative data sources into risk assessment is growing. These sources offer a new dimension of insights that, when combined with existing data, can significantly enhance the understanding of a business’s risk profile. This approach not only diversifies the data pool but also offers a more nuanced view of potential risks.

Modernizing risk assessment requires a multifaceted approach, embracing a variety of data sources beyond traditional credit data. From leveraging blended credit reports and consortium data to exploring international insights and alternative data sources, businesses can gain a comprehensive understanding of risk. This journey towards modernization is not only about enhancing data accessibility but also about enriching the quality of risk assessment, ensuring businesses are well-equipped to navigate the complexities of today’s financial landscape.