Modernizing commercial credit approvals for efficient workflow and improved customer experiences

In our fourth installment of our Path to Modernization series, Erikk Kropp, Sr. Product Manager at Experian, talks about driving efficient rules-based credit decisions based on scores and other attributes.

Introduction to Batch Decisioning

In the realm of business automation, batch decisioning emerges as a powerful tool that extends beyond mere batch scoring. This method integrates credit data and scoring into a portfolio to enhance decision-making processes. Unlike traditional methods that rely on manual interpretation, batch decisioning leverages automation to act on data without human intervention to render instant decisions. Batch decisioning not only streamlines operational processes but also provides strategic advantages. By automating routine decisions, companies can gather and analyze outcomes over time, leading to better-informed business strategies and adjustments based on empirical data. This strategic use of data can drive innovation and maintain competitive advantage in the market.

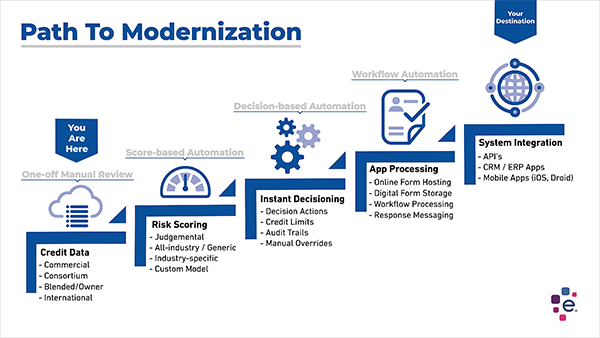

The Path To Modernization Framework

About the framework

The “Path to Modernization” framework is intended to highlight five key areas where Experian can potentially assist clients when introducing digitization and automation to help drive change across their risk management process. The framework is based on observed best practices and common tools frequently used today in the industry. Higher levels of modernization and performance can be achieved with each subsequent step of the process.

The Mechanism Behind Batch Decisioning

Batch decisioning functions by applying predefined logic or automated decision policies. These policies analyze individual data points derived from the scoring process, enabling businesses to take calculated actions based on this analysis. For instance, consider a scenario where a business is evaluated with specific financial scores. An automated decision policy might be set to trigger actions if the business meets certain criteria, such as having a high commercial IntelliScore and Financial Stability Score.

Practical Applications and Examples of Batch Decisioning

A practical application of batch decisioning can be demonstrated through an “if-then” statement. For example, if a business scores above a certain threshold in both commercial intelligence and financial stability, an automated policy might suggest actions related to acquisition, portfolio management, or collections. This level of automation significantly enhances efficiency by reducing the need for manual data interpretation.

Enhancing Efficiency and Sophistication

The introduction of batch decisioning into business processes represents a significant step in the path to modernization. It not only saves time but also increases the sophistication of data handling and decision-making processes. With the ability to handle more complex information and simplify operations, batch decisioning stands as a testament to the evolving landscape of business technology.

As businesses strive to manage resources more effectively and process increasing amounts of data, tools like Experian’s DecisionIQ play a crucial role. They offer a higher level of automation and decision-making sophistication, which is becoming increasingly prevalent in modern credit management organizations.