All posts by Brodie Oldham

I have been on the road meeting with clients at advisory events, forums, and industry thought leadership conferences, and what I continue to hear is a concern about the upcoming recession. The drivers of the next recession are up for debate but the consensus is that it is inevitable. The U.S. Economy is complex and the signals are mixed as to where the greatest impact will be felt. Protecting your business, whether consumer or commercial focused, is dependent on the stability and strength of your lending criteria and customer engagement practices. You want to protect your customers as well as your business in the case of a market stumble. You are laser-focused on making the best possible decision when reviewing credit applications and setting loan terms, however, financial situations change over time for both individuals and companies. This is especially true when a recession hits and unemployment begins to rise, consumers stop spending, and commercial delinquencies begin to rise. When these macroeconomic changes occur, the credit you have extended to your portfolio might be at under market stresses and at a stronger risk of nonpayment, and this can affect your business’s health and sustainability. By stress testing your portfolio, you can determine what may happen, when stresses are exerted, by a receding economy, on your portfolio. You can use credit information, macroeconomic data, and alternative data to build models that forecast what is likely to happen in the future and how stresses, will affect the ability for people or businesses to pay their bills. While larger regulated companies may be required to perform forecasting and stress testing, lenders of all size can benefit from the process. Gathering the Right Data for Accurate Stress Testing The accuracy of your stress test depends on the type and quality of data used for forecasting. Recessions are cyclical and likely to re-occur every few years, it is recommended that companies use historical data from the 2008 recession for analysis and to make accurate predictions. Young businesses may not have complete historical data going back to the 2008 recessionary time period. A partner like Experian can create look-alike business samples, from the vast holistic data, to simulate the likely impact of macroeconomic scenarios. For example, a financial services firm has been providing small business loans between $50,000 and $100,000 for the past three years and wants to predict future losses. To gather the data for loss forecasting, you need to create a business and product profile identifying loans or businesses with similar characteristics, to stress and forecast performance. These profiles are used to build a look-alike sample of businesses and loan products that look and perform like your current portfolio and will add the sample size and retro time periods needed to create a statistically viable analysis sample. Selecting a Forecasting Strategy Once you have the historic credit, macroeconomic, and alternative data on your portfolio or look-alike retro sample for modeling, you need to stress test the data. Most stress test analyses start with a vintage based analysis. This type of analysis looks at the performance of a portfolio across different time periods (Example: March 2007, March 2008, March 2009, etc..) to evaluate the change in performance and the level of impact environmental stresses have on the portfolio's performance. Once you have this high-level performance, you can extrapolate into the future performance of the portfolio and set capitalization strategies and lending policies. Identifying Loss Forecasting Outcomes Regulators and investors want to know the business is solvent and healthy. Loss forecasting demonstrates that your company is thoughtful in its business processes and planning for future stresses. For regional lenders that are not regulated as closely as large national or global lenders, forecasting shows investors that they are following the same rules as larger regulated lenders, which strengthens investor confidence. It also demonstrates effective management of capital adequacy and puts you on a level playing field with larger lenders. Companies with limited data can start with credit data for look-alike sample development and add historical data and alternative type data as they grow for a holistic portfolio view. Setting up Governance Business policies and macroeconomic stresses change over time, it’s essential to set up a governance schedule to review forecasting processes and documentation. Your stress testing and forecasting will not be accurate if you design it once and do not update it. Most companies use an annual schedule, but others review more frequency because of specific circumstances. Effectively Documenting Loss Forecasting The key element of loss forecasting is effectively documenting both sample and strategy taken in the evaluation of your portfolio. A scenario you might face is when a regulator looks at the analysis performed and you have selected sample data at the business level instead of the loan level, documentation should capture the explanation of why you made the decision and the understood impacts of that decision. While the goal is to have complete data, many companies do not have access to high-quality data. Instead of foregoing loss forecasting, the use of documentation to note the gaps and build a road-map for the data can be of great value. Here are additional key points to include in the documentation: • Data sources • Product names • Credit policies • Analysis strategy • Result summary • Road-map and governance schedule By creating a stress-test analysis strategy for forecasting loss, your company can make sure its portfolio and financial status remain as healthy tomorrow as they are today while maintaining transparency and investor confidence. The next recession is out there, this is a great time to strengthen processes for future successes.

Are the credit models you are using to make lending decisions more than 2 or 3 years old? If so, you are likely making less than optimal credit decisions. You may be turning down a customer who is a good risk — while taking on customers who are more apt to default on their obligations. Every year a model isn’t updated, its accuracy decreases. The economy changes. The consumer’s or business’s financial situation changes. Updating your models, using the most current data and attributes available, you can have confidence that you are making good credit decisions. To make the most accurate credit decisions possible, many businesses are now turning to data-driven decisioning models that are powered by artificial intelligence (AI) within machine learning engines. While the standard regression model works well in some industries, the lift in predictive value from using AI data models can be very important in other industries, such as retail, fraud and marketing. These models use sophisticated algorithms to predict the customer’s future ability to repay their obligation, which means a much more accurate decision than traditional models. Starting with High Quality Data While data has always been at the core of credit decisions, models using machine learning are even more dependent on data. These models can be very accurate, but their accuracy depends on having the necessary data to understand what happened in the past and present behavior to make a prediction for what will happen in the future. The more data provided, the higher the accuracy of the decision. Here are three things to consider when building your data-driven decisioning model: Clean Data – As innovation spurs business and technology to run faster and more efficient, the quality of the data underneath all of that innovation becomes even more important. Machine learning becomes smarter the more data it consumes. This means the accuracy of the credit decisions made by the model is largely dependent on the quality of the data provided. Data from third-party sources often contains mistakes, missing fields, and duplicate information, which results in less accurate credit decisions. Correct Data Points – The accuracy of the results depends on considering the right criteria in the form of data points in the model. When you use machine learning and AI algorithms, they can predict which specific data points will help increase the performance of the model for the specific customer and the specific type of credit decision. Often, data points that you may not consider are the ones that can make a big impact on the accuracy of the decision. Real-Time Data – In the past, there was often significant lag time between collecting and being able to use the data. By using real-time data with machine learning models, you can get a clear picture of the most current view possible and see changes in the different data points as they occur. This lets you make a much more accurate prediction of what will happen, with the consumer or business, than was previously possible with a traditional credit decisioning process. Using Alternative Data to Get the Full Picture Often, additional data — typically referred to as alternative data — that is not readily available from traditional data providers is used to enhance the accuracy and predictive ability of a model. While the model can seem complete without this information, the model may provide suboptimal results without it. Machine learning models can predict the situations and exact type of alternative data a model needs to produce an accurate decision. Experian offers a wide variety of alternative data that clients can use to improve decision models. For example, a business owner may be taking out short-term loans to increase her cash flow, which makes her a much higher credit risk than she appears to be without this data. Weather information is also a common type of alternative data; a business located in Tornado Alley may need higher cash reserves to be a good credit risk. On the other hand, businesses located in an area impacted by a recent weather event, such as a hurricane, may be a good credit risk even with a lower score because both their business and local economy is recovering. Regularly Evaluating Your Data Model You must build in governance and make sure you are evaluating how the model is working on a regular basis, like having an annual checkup with your healthcare providers. Once you begin using a data model, you can’t simply set it and forget it. Ask the following questions to periodically evaluate your models: Are there changes in the outcome of the models? You need to verify that your attributes are still predicting the same outcomes as intended, as well as capturing the same data. For example, say you have an attribute in your model that counts the number of credit lines open for a small business. If the attribute changes and those types of credit lines are no longer reported by the data provider, that number can go from three or four to zero, without there being a change in the number of credit lines open by the business. Because the data that goes into your model has changed, your model is not accurate unless you update the attribute. Is your model stable? You need to make sure that degradation hasn’t reached a point where the predictive value is no longer accurate. For example, scores before the 2008 recession have a different meaning than afterward, due to the changes in the financial system. The future of your business depends on making accurate credit decisions. Instead of using outdated models, use the latest technology and methods available by using machine learning data-driven models. It’s simple. It’s quick. And most importantly, data-driven models are accurate. Related articles: How To Modernize Decisioning with Automation and Real Time Respones Integrating Credit Decisions with the Back Office Improving Customer Experience Through Decisioning as a Service (DaaS)

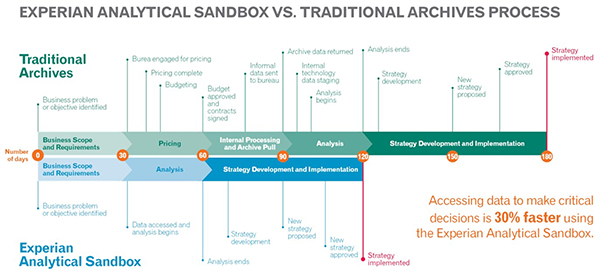

The appetite for businesses incorporating big data is growing significantly as the data universe continues to expand at an astronomical rate. In fact, according to a recent Accenture study, 79% of enterprise executives agree that companies that do not embrace big data will lose their competitive position and could face extinction. Especially for financial institutions that capture and consume an incredible amount of data, the challenge becomes how to make sense of it. How can banks, credit unions, and other lenders use data to innovate? To gain a competitive advantage? This is where analytics sandboxes come in. A sandbox is an innovation playground and every data-consuming organizations’ dream come true. More specifically, it’s a platform where you can easily access and manipulate data, and build predictive models for all kinds of micro and macro-level scenarios. This sounds great, right? Unfortunately, even with the amount of data that surrounds financial services organizations, a surprising number of them aren’t playing in the sandbox today, but they need to be. Here’s why: Infinite actionable insights at your fingertips One of the main reasons lenders need a sandbox environment is because it allows you to analyze and model many decisioning scenarios simultaneously. Analysts can build multiple predictive models that address different aspects of business operations and conduct research and development projects to find answers that drive informed decisions for each case. It’s not uncommon to see a financial services organization use the sandbox to simultaneously: Analyze borrowing trends by type of business to develop prospecting strategies Perform wallet-share and competitive insight analyses to benchmark their position against the market Validate business credit scores to improve risk mitigation strategies Evaluate the propensity to repay and recover when designing collection strategies A sandbox eliminates the need to wait on internal prioritization and funding to dictate which projects to focus on and when. It also enables businesses to stay nimble and run ad-hoc analyses on the fly to support immediate decisions. Speed to decision Data and the rapid pace of innovation make it possible for nimble companies to make fast, accurate decisions. For organizations that struggle with slow decision-making and speed to market, an analytics sandbox can be a game-changer. With all your data sources integrated and accessible via a single point, you won’t need to spend hours trying to break down the data silos for every project. In fact, when compared to the traditional archive data pull, a sandbox can help you get from business problem identification to strategy implementation up to 30% faster, as seen with Experian’s Analytical Sandbox: Cost-effective analytics Building your own internal data archive with effective business intelligence tools can be expensive, time-consuming, and resource-intensive. This leaves many smaller financial services at a disadvantage, but sandboxes are not just for big companies with big budgets. An alternative solution that many are starting to explore is remotely hosted sandboxes. Without having to invest in internal infrastructure, this means fast, data-driven decisions with little to no disruption to normal business, fast onboarding, and no overhead to maintain. For financial institutions capturing and consuming large amounts of data, having an analytical sandbox is a necessity. Not only can you build what you want, when you want to address all types of analyses, you’ll have the insights to support business decisions faster and cheaper too. They prove that effective and efficient problem solving IS possible! Ready to learn more about Experian's Analytical Sandbox and how it can help you optimize your business? Contact Commercial Data Science

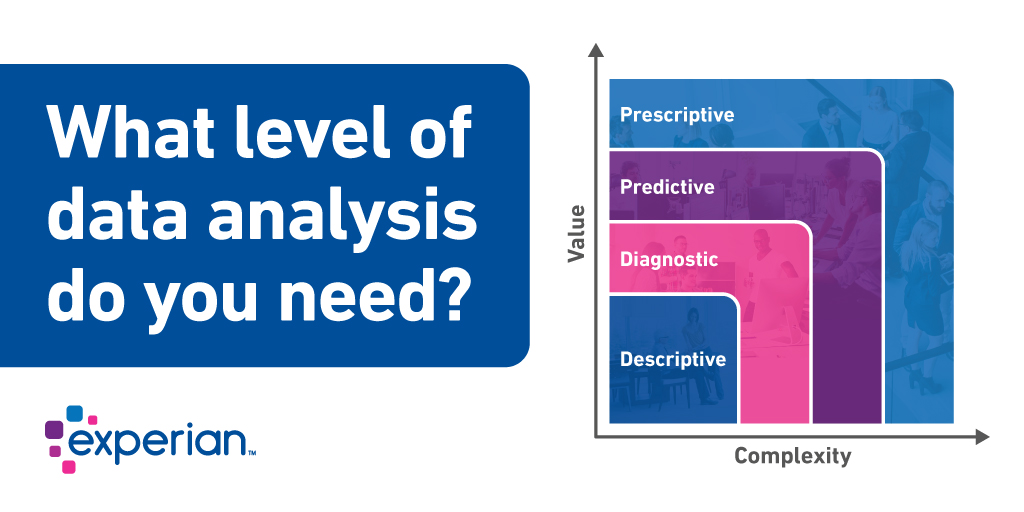

Data analysis surrounding lending practices for commercial lenders falls into 4 distinct buckets that define scope, usability, and purpose. In this post we will discuss how they differ in terms of value and complexity. Descriptive Analytics Descriptive analytics provide the current state of a commercial lender’s acquisitions, portfolio, or other parts of the lending lifecycle. This is “Reporting” in its simplest form. Defining and creating metrics can be as simple as a snapshot of the firmographic and performance elements of a portfolio to complex retro trends that define the effectiveness and success of a lender. Full coverage of the target market and accurate data play a big part in the success of this type of analysis. Selecting the wrong element, when creating a view, can lead the lender to a sub-optimal understanding of the state of their business. Looking at a competitor’s metrics can inform market share and pricing decisions. Experian commercial clients use Portfolio Benchmarking reports as an empirical view into the health of their business compared to their market peers. Adding data visualization on top of the descriptive-analytic reporting quickly closes the gap to a diagnosis. In the map below Texas, California, and Florida have higher rates of account opening and would be attractive target regions for acquisition. Diagnostic Analytics A Diagnostic view of lending performance will look at the portfolio health of a lender and its peers and determine what are the key success and opportunity drivers within comparable products. Larger financial institutions have been performing this type of analysis for years. Several years ago, fintech lending hit its stride challenging the large commercial lenders by providing targeted products in niche lending spaces with little or no traditional commercial credit data. Large commercial lenders used benchmarking and market analysis to understand where the fintechs were being successful. Large lenders use of alternative data sources and market intelligence helped them to recognize the gaps in identifying and evaluating the risk of those underserved businesses. Fintech use diagnostic analysis, to their advantage, to make fast decisions and pivot to market demand. In the chart above, you can see that ABC bank is able to identify where they are offering higher credit limits than their competitors. This client had similar bad rates to its peers causing the lender to have higher losses due to improperly assigned credit limits. Predictive Analytics Predictive analytics can help to scope the effectiveness of a strategic decision and plan for the long-term impacts of credit decisions. Financial institution use this type of analysis to forecast loan performance and plan for impacts to cash flow as economic and market conditions change. Machine learning is used in predictive analysis to be nimbler in the evaluation of vast amounts of data to provide more accurate prediction of future outcomes. Large financial institutions will use Machine Learning in predicting response to an offer through the lifecycle to the collection of outstanding debt. Prescriptive Analytics Predicting potential outcomes within a commercial lender’s strategies only gets them half way to a successful outcome. Providing insight on top of the analytic content is what drives the decisions to stay the course or pivot to an alternate course of action. Prescriptive analytics provides that direction. Machine learning can be used as a tool in prescriptive analytic engagements to develop models that can learn and pivot with changes to the market and behaviors of businesses within that market. Having the capability to adjust actions associated with outcomes allows the model to stay relevant and predictive over a longer period. As customer experience drives lending practices, commercial lenders look to use varying levels of analysis as stepping stones to better serve their small business clients. Got a question about analytics? We would be delighted to answer your questions. Commercial Data Science

Loan stacking is a small but serious problem for Online Marketplace Lenders (OMLs). Often invisible to the issuers of commercial capital, businesses that engage in this insidious practice are significantly more likely to become delinquent on their payments and even default entirely on their obligations. If you manage a company that issues commercial credit, you need to be diligent in weeding out these bad players to protect not only yourself but your industry as a whole. What is Loan Stacking? Simply put, loan stacking is the opening of multiple credit lines within a short period of time. (Sometimes as little as 24 or 48 hours.) Because there is a natural lag in credit reporting, the lenders involved usually are unaware that other companies are transacting with the same customer. On the personal credit side, loan stacking is a potential problem for borrowers who run their multiple credit lines near – or up to – their maximums and then find they can no longer meet all of their monthly obligations. However, it’s not uncommon for individuals to carry multiple credit cards, and most credit card companies already have reliable systems in place to ensure borrowers don’t get more credit than their incomes justify. Things are different on the commercial side. Today, a lot of short-term borrowing occurs online through Merchant Cash Advances (MCAs). Repayment takes the form of weekly or even daily debits against the businesses’ cash receipts pulled directly from the borrower's checking account. For example, a restaurant may take out a $10,000 cash advance, the lender then taking five percent of that restaurant’s daily receipts until the advance is repaid – with interest. MCAs are not technically considered “loans,” and thus are not subject to the same regulations and oversight as traditional commercial lending. Such advances usually cover a period of four to eight months. Some can go as long as 12 months, but rarely do they go longer. MCAs are most popular among retail stores and have helped many small businesses get funding when needed. However, problems arise when a business takes out several cash advances at the same time. Instead of paying, say, 5 percent of daily receipts to a single lender, the restaurant loses perhaps 20 percent to four lenders simultaneously. At this rate, the business becomes unsustainable and defaults. Not only is commercial loan stacking a risky practice, it can be legally problematic. Many MCA providers are now placing anti-stacking language in their contracts that require borrowers to pledge not to promise their receipts to any other companies. Stacking loans violates this provision and thus may be tantamount to fraud. How common is commercial loan stacking? Based on our research and analysis, we believe that between five and six percent of all merchant cash advances are stacked. In 2013, the MCA market accounted for about $3 billion in transactions. By December 2016, that number had probably doubled. That means that between $150 million and $360 million in commercial loans are stacked. Granted, that's a drop in the bucket for the $1.9 trillion commercial lending industry, but for a small company just getting in the business of making such credit advances, it could be a serious threat to their portfolio's health. Why loan stacking occurs Why do MCA lenders allow themselves to be pitted against each other in this fashion? Blame the internet. The same internet that gives us the benefits of virtually instantaneous credit applications, reviews and approvals also makes it possible for businesses to easily make multiple applications within a 24- or 48-hour period. Many commercial credit reporting companies may provide updates as quick as 24 hours in some cases, a commercial MCA lender receiving a cash advance application may experience a slight delay in knowing if other lenders are working with the same customer. As for borrowers, most don't stack because they are not intending to commit fraud or otherwise game the system. They're doing so because, at the time, they believe they have no choice. Running a small business is difficult. Businesses often operate on thin margins and owners may, at times, struggle to make payroll. If there's a sudden setback or cash flow suddenly stalls, an owner may need a sizeable cash infusion just to keep the doors open. Being an optimistic lot, most owners who get multiple MCA loans do so in the belief they can quickly get over the hump, recover their losses, rapidly pay back what they owe and no one will be any the wiser. Sometimes, this strategy works. But too often, it does not. And that's when things get nasty. How to avoid loan stacking customers If you are an MCA lender and wish to avoid loan stacking customers, you have three tools at your disposal: Before making a cash advance, ask to see a full year of checking account activity. If you see a pattern of weekly or daily debits in a similar dollar range, this could be a sign that the business already has an MCA in place. If the business is relatively new, check their credit report for a high number of UCC (Uniform Commercial Code) filings. A large number of hard credit inquiries often indicates the owner is doing a lot of loan shopping, and this can indicate loan stacking. Sign up for Experian's custom short-term industry specific risk model consulting services. Signs of loan stacking, particularly in young companies with excessive UCC filings, can often be spotted using this service. For MCAs and all other forms of commercial lending to work, all parties have to play by the rules. Discouraging loan stacking not only benefits lenders, but also the borrowers who depend on the services these lenders provide.