Commercial Pulse Report

The bi-weekly Commercial Pulse provides a directional update on small business credit. It delivers a quick read on current market impacts, high level credit trends, score and attribute impacts, and other market related activities.

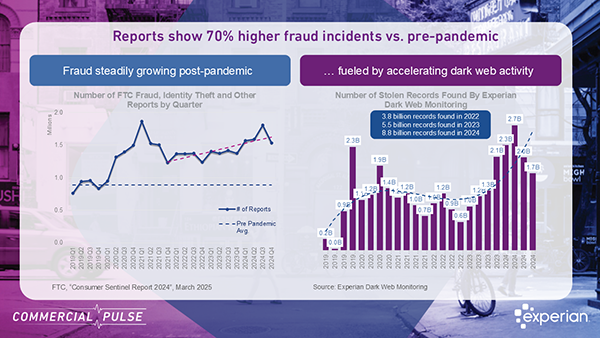

This week we focus on 2025 small business financial fraud, why it has increased, key stats, and strategies to protect your business.

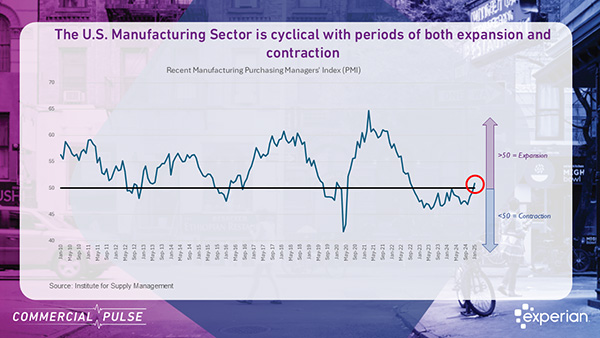

Experian reports the manufacturing sector may be on the verge of a shift after more than two years of contraction | Commercial Pulse Report

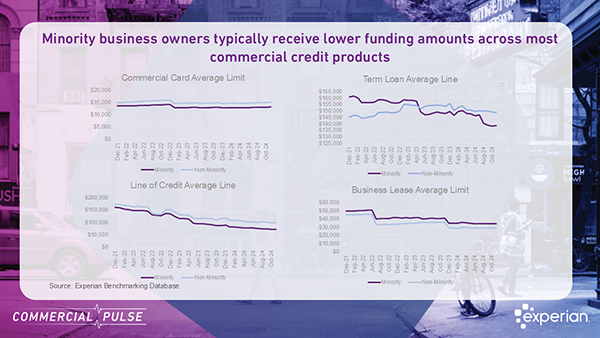

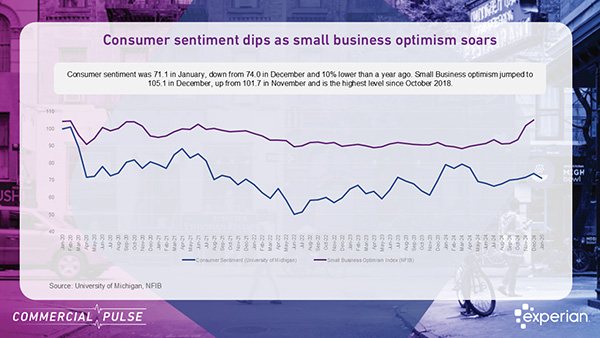

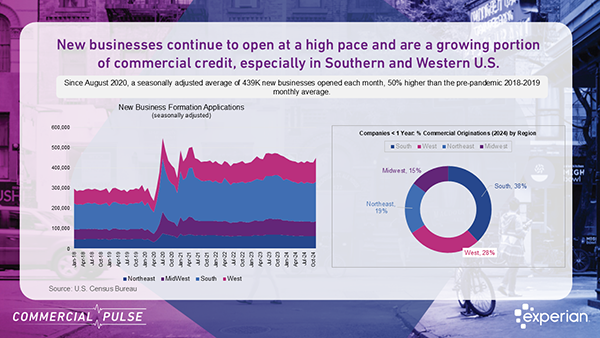

The Commercial Pulse Report | 2/25/2025 The latest Experian Commercial Pulse Report provides a snapshot of the evolving U.S. economic landscape, highlighting key macroeconomic trends and the growing impact of minority-owned businesses. As inflation persists and credit markets tighten, small businesses are navigating a complex financial environment. However, within this challenge lies a significant opportunity—supporting minority-owned businesses, a rapidly expanding sector generating over $2 trillion in annual revenue. Watch Our Commercial Pulse Update Macroeconomic Highlights: Inflation, Employment, and Consumer Trends Inflation and Interest Rates - Inflation remains a key concern for small businesses, rising to 3.0% in January, marking the fourth consecutive monthly increase and the highest level since June 2024. Core inflation, which excludes food and energy, also increased to 3.3%, signaling persistent pricing pressures across industries. Rent inflation showed some relief, dropping to 4.4%, but food inflation remained high at 2.5%, while energy inflation increased for the first time in six months. Employment and Wages - The U.S. labor market is showing mixed signals. The unemployment rate stands at 4.0%, slightly down from December, yet job creation has slowed dramatically. Only 143,000 jobs were added in January, a significant drop from 307,000 in December, marking the weakest growth in three months. At the same time, wages have risen to $30.84 per hour, which may contribute to inflationary pressures for businesses. Consumer Spending and Retail Sales -Retail activity has softened, with January retail sales declining 0.9% month-over-month, the largest drop since March 2023. However, year-over-year sales remain up 4.2%, indicating that while consumers are spending more cautiously, demand is still present. Small Business Sentiment and Credit Markets - The NFIB Small Business Optimism Index declined to 102.8 in January from 105.1 in December, reflecting growing concerns among business owners. The uncertainty index surged 14 points to 100, the third-highest level on record, suggesting businesses are wary about future economic conditions. Credit access remains a major concern, reflected in the Experian Small Business Index, which dropped to 40.5, down from 42.9 last month and 11 points lower year-over-year. This decline underscores the increasing difficulty small businesses face in securing credit to fund growth and operations. The Opportunity: Minority-Owned Businesses Are Thriving but Need More Support One of the most compelling insights from this month’s Commercial Pulse Report is the remarkable growth of minority-owned small businesses. These enterprises are expanding at a much faster rate than non-minority-owned businesses and now represent a significant share of new commercial account originations. Key Growth Trends Over 8 million minority-owned businesses contribute more than $2 trillion in annual receipts, representing a powerful economic force. Between 2014 and 2019, the number of minority-owned businesses increased by 35%, compared to just 4.5% growth among non-minority businesses. Minority-owned businesses make up 41% of new commercial accounts, up from 37% in 2021, underscoring their increasing role in the broader business ecosystem. Funding Gaps and Credit Access Challenges Despite this rapid growth, minority-owned businesses continue to face challenges in accessing credit: On average, they receive 7% - 37% less funding across most commercial lending products. Businesses under six years old account for 44% of new commercial accounts for minority-owned firms, compared to just 31% for non-minority firms, yet they struggle to secure the funding they need to scale. This funding gap is not due to higher credit risk—minority-owned businesses exhibit comparable commercial credit performance to their non-minority counterparts. Industries Driving Minority Business Growth Minority-owned businesses are expanding into high-growth sectors such as: 🏗 Construction🛍 Retail🍽 Accommodation & Food Services💡 Technology & Healthcare These industries require significant upfront capital for expansion, making access to credit crucial for long-term success. What This Means for Lenders and Policymakers The disconnect between strong minority business growth and limited access to funding presents a major opportunity for lenders. For Lenders: Expanding lending opportunities for minority-owned businesses represents a high-growth market with proven credit performance. Bridging this funding gap can unlock billions in economic activity while serving an underserved business community. For Policymakers: Addressing structural barriers to credit access can further accelerate job creation, economic expansion, and financial inclusion in communities nationwide. Final Thoughts: Investing in the Future of Small Business The U.S. small business landscape is evolving. While macroeconomic headwinds—such as rising inflation and uncertain credit markets—present challenges, minority-owned businesses are demonstrating resilience, expansion, and growing demand for capital. For lenders, this is a $2 trillion opportunity to support a fast-growing sector with proven potential and unmet capital needs. By addressing credit access barriers, financial institutions can drive both economic growth and financial inclusion in the years ahead. Download the Commercial Pulse Report Visit Experian Small Business Index Related Posts

Commercial Pulse Report insights, including small business optimism vs consumer confidence, and the Experian Small Business Index.

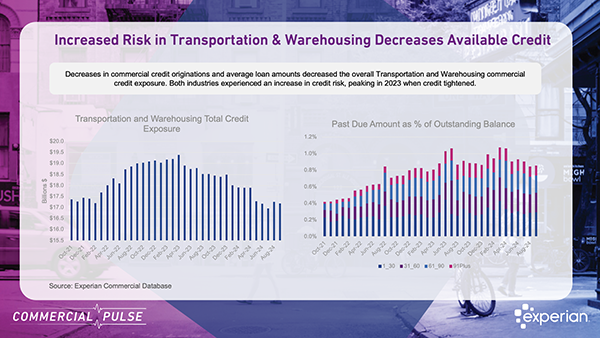

The January 28, 2025, Commercial Pulse Report reveals fascinating insights into the evolving U.S. economy, with a spotlight on the transportation and warehousing sector—a critical backbone of global trade and supply chains. Watch Our Commercial Pulse Update Over the past year, this industry has experienced steady growth, largely fueled by younger businesses. Companies less than two years old now account for a remarkable 50% of new commercial credit accounts in the sector. This entrepreneurial surge reflects the industry's role as a magnet for new opportunities amid expanding global trade. Rising Credit Risks Amid Growth While the sector’s growth is a promising trend, it has come with challenges. Credit risk for transportation and warehousing businesses peaked in 2023, prompting lenders to tighten underwriting standards. This shift has led to a noticeable reduction in the total volume of commercial credit granted within the sector, making it harder for businesses to access the funding they need. Source: Experian Commercial Pulse Report Global Trade and Its Influence The broader trade environment has also played a role in shaping this industry. Global trade expanded by 3.3% in 2024, with services trade leading the way at a 7% increase. However, the U.S. trade deficit widened to $78.2 billion in November, driven by rising imports and geopolitical uncertainties. Tariff adjustments under President Trump’s administration could further impact this industry, introducing a layer of unpredictability for 2025. Looking Ahead The transportation and warehousing sector stands at a crossroads, balancing opportunities for growth with mounting credit constraints and external pressures from the global trade landscape. Businesses operating in this space will need to stay agile, exploring innovative strategies to navigate financial challenges and capitalize on expanding trade networks. For more insights into how these trends are shaping the small business economy download the Commercial Pulse Report, visit Experian’s Commercial Insights Hub or reach out to your Experian account team to explore customized solutions for your business. Download Commercial Pulse Visit Commercial Insights Hub Related Posts

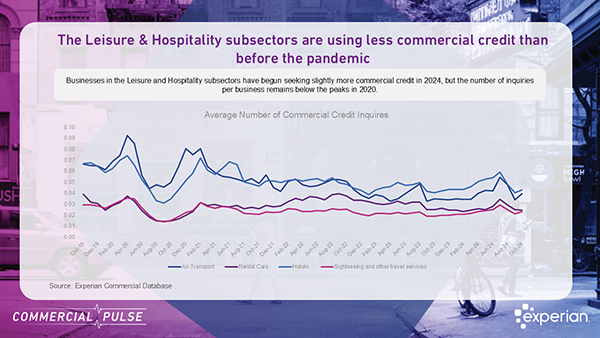

Explore Leisure & Hospitality trends in the commercial pulse report. Insights to help credit managers drive smarter decisions

Discover industry-specific risk trends: Construction and Food Services face higher delinquencies, while Retail and Healthcare show stable performance. Learn more!

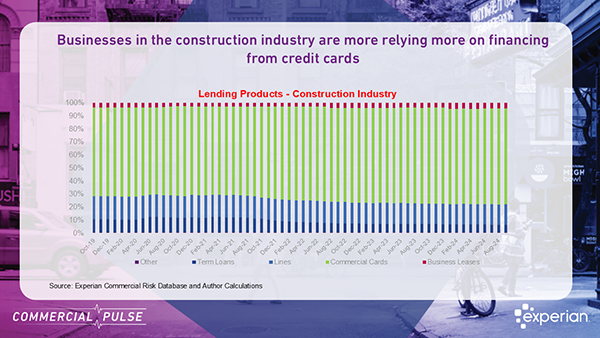

Discover key trends in housing and construction from Experian’s November 2024 report. Explore rising costs, resilient strategies, and future opportunities!

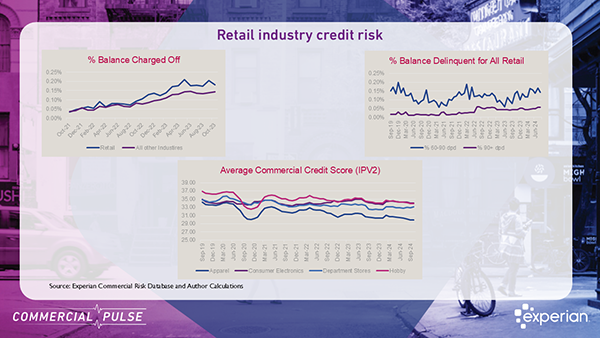

Commercial Pulse Report | 11/12/2024 Welcome to our November 12th, 2024 Commercial Pulse Report preview! Experian’s new Commercial Pulse Report highlights the economic trends shaping the retail landscape as we head into the holiday season. With 2.8% GDP growth in Q3 and steady unemployment at 4.1%, the economy shows resilience, yet retail businesses are navigating a mix of growth and caution in credit and spending trends. Watch Our Commercial Pulse Update This week as the holiday season gets under way, the team pulled together some interesting insights on the retail industry. With 2.8% GDP growth in Q3 and steady unemployment at 4.1%, the economy shows resilience, yet retail businesses are navigating a mix of growth and caution in credit and spending trends. Rising Credit Demand in Retail: Over the past year, commercial credit demand among retail businesses has surged by 25% as retailers boost inventory levels in anticipation of holiday sales. While demand is strong, businesses are finding that lending conditions are tighter than in previous years, especially in discretionary retail sectors. Lending Disparities Across Retail Sectors: Not all retailers benefit equally from this increased credit demand. Discretionary sectors like home goods are facing a drop in new commercial accounts and smaller loan sizes, reflecting a more cautious lending environment. Meanwhile, Consumer Electronics and Department Stores are seeing credit demand nearing pre-pandemic levels, indicating resilience in these areas. Higher Delinquency Rates Impacting Credit Scores: Rising financial pressures are pushing up delinquency rates, putting additional strain on commercial credit scores across the retail sector. This trend is a reminder for retailers to manage credit carefully, even as they position themselves for peak season sales. Slower Retail Sales Growth: Retail sales continue to grow but at a decelerating rate, with only 1.7% year-over-year growth from September 2023 to September 2024—a significant slowdown from previous years. Retailers are adjusting to a post-pandemic normalization as consumer demand steadies. With both opportunities and challenges ahead, this report offers insights to help retailers navigate the season. For more, check out Experian’s Commercial Insights Hub to see how these trends may impact your business. Download Commercial Pulse Report Commercial Insights Hub Related Posts