Financial Services

Explore how the rapid rise in new business formation presents a unique opportunity for firms to expand digital relationships, automate small business credit processes, and stay ahead in a transforming economy.

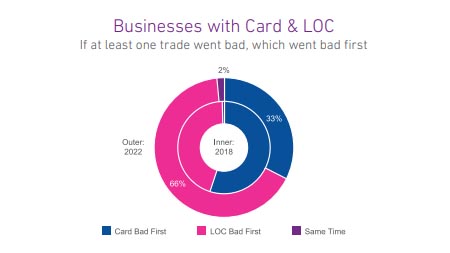

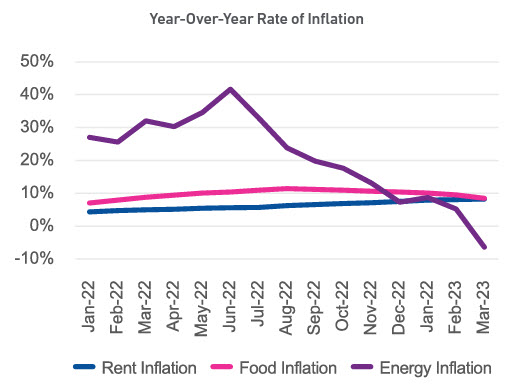

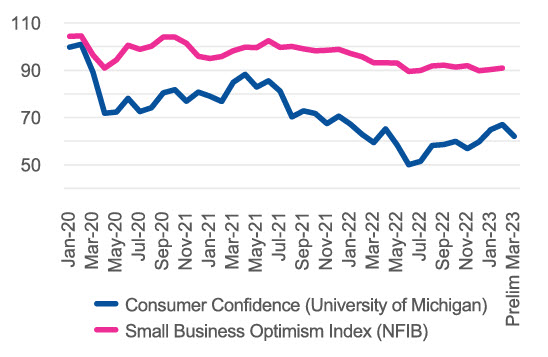

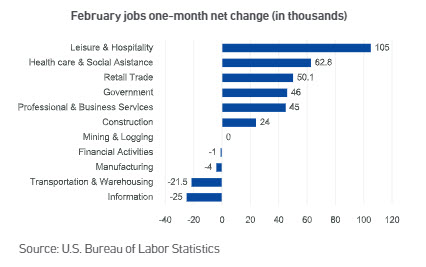

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

Recent news of the SVB collapse highlights the vulnerability of small banks and their crucial role in serving local communities. Small and medium-sized financial institutions should prepare for additional interest rate hikes.

Bankruptcies and collections are on the rise since mid 2022. Pandemic-related relief and forgiveness suppressed collections for most of 2021 and the first half of 2022.

In this post we discuss reject inferencing and how it can help credit departments grow commercial accounts without taking on more risk.

Heading into the holiday season, we'll see if consumers continue to spend at high levels, or if higher prices, higher interest rates and lower savings create a drag on sales.

In our Business Chat, Greg Carmean shares how the latest SBFE attributes help lenders better assess small business risk and tap into growth opportunities.

As the economy continues to recover, commercial service providers have a significant opportunity to expand their market share by growing their business and commercial portfolios through new customer acquisition. Compared to consumer relationships, which typically carry a more limited number of accounts, business customers offer the opportunity for a more expansive relationship, with the ability to onboard the customer into multiple accounts and products. A relationship with a business customer may start with a single checking account, and if the customer is pleased with the service and experience, that relationship may blossom with the customer’s adoption of additional products and services including telephone lines and devices, business credit cards, loans and lines of credit for business needs, software, and treasury management products, among many others. To gain more share of the wallet, commercial service providers must offer an excellent digital customer experience as the cornerstone of a successful customer relationship, as the market becomes more and more competitive. Business customers are quickly transitioning their operational processes to be digital-first, and they expect vendors and suppliers, across many industries especially financial institutions, to be a step ahead in offering digital account opening and support. How fraud tools help the customer experience Commercial service providers must continuously innovate their operations and account onboarding strategy to stay competitive and shut out cybercriminals. A robust fraud prevention strategy should help to reduce losses and operational costs. By prioritizing fraud tools that enable automation, commercial service providers can reduce costs by eliminating labor-intensive processes. The challenge for service providers becomes how to effectively manage that trade-off: creating a technology-enabled process that accurately disrupts fraud attempts while not inconveniencing and adding undue friction to legitimate customers. For example, fraud tools that activate during the onboarding phase can help service providers offer a better customer experience, allowing low-risk accounts to pass through with minimal friction while applying safeguards to slow down applicants in the danger zone for further review. Many commercial service providers are unaware of the amount of undiscovered fraud that lies within their customer portfolio. Undiscovered fraud is a subset of your approved customers who represent a risk of future fraud. These cases exist because many legacy fraud tools take a one-size-fits-all approach to screening for fraud. But these customers are at a higher risk for future fraud occurrence. Now, advanced fraud prevention improves the experience for the majority of customers by enabling a less intrusive application process, reducing friction within the customer experience, and increasing operational efficiency. Preventing fraud with an integrated framework of tools There are three major types of application fraud: First-Party Fraud —the perpetrator opens an account without an intent to repay the creditorThird-Party Fraud — the perpetrator opens an account under someone else’s identitySynthetic Fraud — the perpetrator uses stolen information and creates a fictitious identity with pieces of real information, in order to carry out fraud. Tailoring your approach to specific fraud makes for a better customer experience and bottom-line savings. However, identifying and remediating all types of fraud requires a cascade of tools, experts, and data sources. Experian’s commercial fraud suite can be customized within a commercial service provider’s operational workflows to address each form of fraud with the correct treatment. Experian’s tools are supported by the most robust consumer and business data available, in addition to new, third-party sources, giving commercial service providers the ability to gain efficiency through a single partnership, as opposed to manually integrating data from multiple disparate tools and sources. One way we have created efficiencies for commercial service providers is by blending consumer and business data through our next-generation business verification solution Multipoint Verification. It helps clients cross-reference application information with robust databases backed by blended bureau data and new, third-party data sources. With Multipoint Verification, commercial service providers can leverage practical intelligence gathered from signals that describe the validity of attributes like the applicant’s phone number, professional social media profiles, historical employment information; and business information like a business’ web domain, email addresses, mailing address, industry classification, corporate linkage, Tax ID, and much more. Once the business owners have been verified, providers can score their applicants with Experian’s First Party Fraud Score, a new-generation blended predictive scoring model designed to identify first-party fraud risk or the likelihood of a first payment default within the first 6 months of account opening and to identify credit bust-out scenarios. Growing business customer bases with fraud prevention tools Customer expectations of online applications have changed in recent years, and your lower-risk good customers can enjoy that lower friction experience while higher-risk applications get more scrutiny. Focusing on the customer experience in how you screen for fraud can be a great growth opportunity. By using a comprehensive suite of tools such as Experian’s Commercial Entity Fraud Solutions, which specifically addresses each fraud type and applies the right type of friction when needed, your firm can drive operational efficiency that reduces risk and cost. Learn more about Multipoint Verification