Industries

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

Recent news of the SVB collapse highlights the vulnerability of small banks and their crucial role in serving local communities. Small and medium-sized financial institutions should prepare for additional interest rate hikes.

Bankruptcies and collections are on the rise since mid 2022. Pandemic-related relief and forgiveness suppressed collections for most of 2021 and the first half of 2022.

A recent credit study of a regional utility found significant numbers of small businesses with no credit profile despite a history of positive payments.

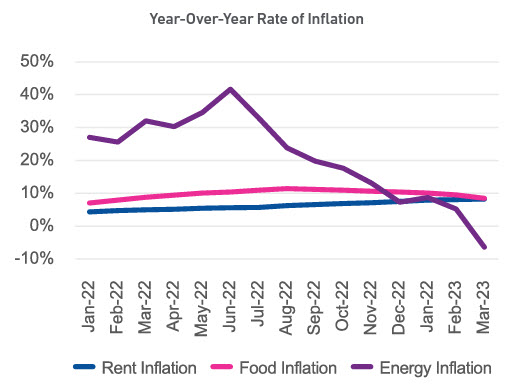

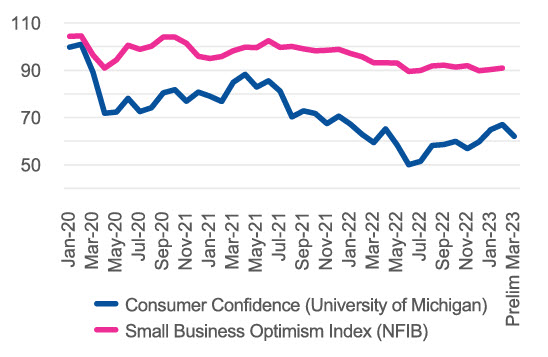

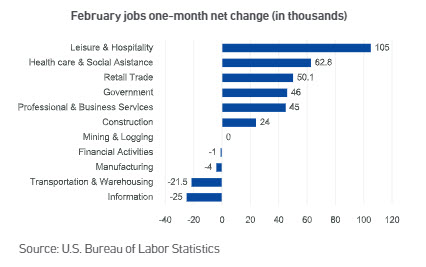

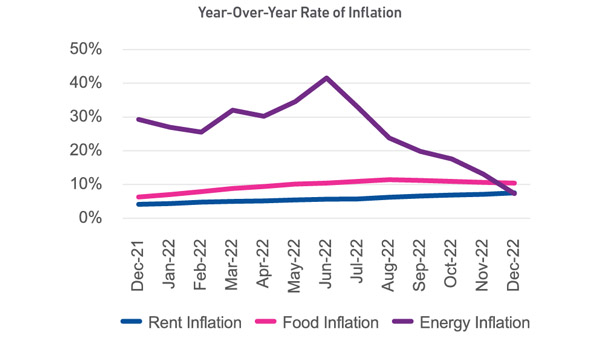

So far, the economy has been extremely resilient, with Q4 GDP coming in above expectations at 2.9%, inflation cooling, supply chain issues easing, and unemployment remaining low.

In this post we discuss reject inferencing and how it can help credit departments grow commercial accounts without taking on more risk.

Heading into the holiday season, we'll see if consumers continue to spend at high levels, or if higher prices, higher interest rates and lower savings create a drag on sales.

The team from Experian is very excited to be attending the TRMA 2022 Fall Conference in Louisville, Kentucky October 18-20th. As a Gold Sponsor, we can't wait to meet with you in person to hear your challenges, your goals and to share some of the things we have been working on. Please reach out and connect with us on LinkedIn to get a conversation started. Beth Bayer Neal Rogers Meg Wilson Mathew Robey James Brezack Don't miss Neal Rogers breakout session on Oct 20th at 10:45: Data-driven strategies to deliver consistent growth and maintain positive customer experiences As telco companies face an increasingly competitive environment, they are looking for ways to drive continuous growth. With industry-wide efforts to capture market share, telco providers are looking to enhance personalized targeting while mitigating risk and fraudulent activities while continuing to focus on serving underserved communities. In this session, we will explore how to acquire and approve more consumers with better data, less friction, fewer deposits, fewer vendors, and potentially less cost.Learning Objectives: Learn about enhanced, unrivaled data to bolster growth while mitigating risk and spearheading DEI.A case study illustrating the effectiveness of Experian’s composite risk model in helping to decrease deposits and increase approval time. It promises to be a great session, see you all in Louisville, KY!

Join Experian at #ITC2022 to learn to understand the mindset of the industry and learn about where the market is heading.