Industries

For utility companies, the customer onboarding process can sometimes be a complex, time-consuming, and unpleasant experience, especially if a manual credit decisioning process is in play. Every time a customer interacts with your utility company — be it via the website, telephone, in-person service call, mobile app, or social media — their experience sets the tone for the overarching relationship between the customer and your company. To improve the onboarding experience, many utilities are turning to machine learning to make faster and simpler credit decisions. However, creating a custom machine-learning decisioning engine is complex and can be costly. By leveraging machine-learning capabilities through Decisioning as a Service (DaaS) offerings, utilities can automate the decisioning process and create a frictionless customer experience. For example, a customer applying for service – even with a large utility — can be approved within seconds by an agent using a tablet. Using DaaS to Automate Your Credit Decisions DaaS can be used for many different types of decisioning — prescreening, prequalification, or instant credit. Utilities also use DaaS for authenticating and resolving identities and assisting with the rationalization of deposits. Other uses include improving the customer experience, credit line management, retention, cross-selling and collections optimization. The process is like using traditional decisioning methods where the customer or customer service agent enters the customer’s information into the website or system. The utility system then connects with the DaaS engine through an Application Programming Interface (API), The DaaS engine then aggregates real-time data from the credit bureaus and other data providers about the customer, runs them through business rules — and a decision is rendered. The decisioning engine uses rules and algorithms to create predictive models for credit, fraud and, bankruptcy risk, profitability, retention and other key areas. The DaaS engine then automatically determines the results, such as approval, decline, instant pre-screen, cross-sell, or a collection decision. More than just providing a result, the system helps your utility know exactly how to treat the customer based on their risk level. DaaS also helps utilities by customizing offers that deliver both business value and value to the specific customer. Additionally, the algorithms are continually updated so your decisions are always based on the current business climate, market drivers, and regulatory conditions. Creating a Seamless and Personalized Customer Experience From the customer’s perspective, the process is simple and seamless. Instead of waiting for hours — or possibly days — the customer receives an answer in real-time. If the decision is good news for the customer, they can move on with the process. And if the decision is not what the customer was hoping to hear, they can quickly move on and determine their next steps. There is no waiting, wondering, or anxiety. Using DaaS also creates a more personalized experience for the customer. DaaS recommends the next best step based on the customer’s specific situation, which is an informed way to begin your relationship and sets the right tone for the future. For example, DaaS may recommend no deposit based on risk-level, or a specific product or offer of value to the specific customer. Improving Operational Efficiency and Growing Revenue In addition to more loyal and satisfied customers, your utility company will see operational benefits and lower costs from using DaaS. Your employees no longer need to manually process credit applications and make decisions, thus eliminating paperwork, tasks, and time. Because DaaS provides centralized decision making, you can use the technology across different enterprise frameworks, call center environments, and processing systems. This dramatically increases your efficiency by eliminating manual processes which give your employees more time working to improve the customer experience. Because the process is more accurate than the traditional credit decisioning model, utilities can make better credit decisions. As a result, your utility can significantly reduce bad debt and fraud, which improves your overall financial health. At the same time, you can increase revenue by approving customers who are good credit risks but may have been denied using a manual or out-of-date decisioning model, and thus improve the customer experience. Additionally, your ability to more effectively cross-sell customers will help grow your revenue. Your utility’s success depends on its ability to make quick and accurate credit decisions while also providing a positive customer experience. By using an API to integrate DaaS into your systems, you can have confidence you are making accurate decisions while creating customer loyalty, improving revenue, and reducing costs. It’s simple, it’s easy and your customers will love it.

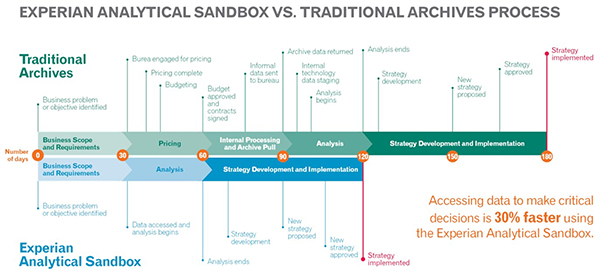

The appetite for businesses incorporating big data is growing significantly as the data universe continues to expand at an astronomical rate. In fact, according to a recent Accenture study, 79% of enterprise executives agree that companies that do not embrace big data will lose their competitive position and could face extinction. Especially for financial institutions that capture and consume an incredible amount of data, the challenge becomes how to make sense of it. How can banks, credit unions, and other lenders use data to innovate? To gain a competitive advantage? This is where analytics sandboxes come in. A sandbox is an innovation playground and every data-consuming organizations’ dream come true. More specifically, it’s a platform where you can easily access and manipulate data, and build predictive models for all kinds of micro and macro-level scenarios. This sounds great, right? Unfortunately, even with the amount of data that surrounds financial services organizations, a surprising number of them aren’t playing in the sandbox today, but they need to be. Here’s why: Infinite actionable insights at your fingertips One of the main reasons lenders need a sandbox environment is because it allows you to analyze and model many decisioning scenarios simultaneously. Analysts can build multiple predictive models that address different aspects of business operations and conduct research and development projects to find answers that drive informed decisions for each case. It’s not uncommon to see a financial services organization use the sandbox to simultaneously: Analyze borrowing trends by type of business to develop prospecting strategies Perform wallet-share and competitive insight analyses to benchmark their position against the market Validate business credit scores to improve risk mitigation strategies Evaluate the propensity to repay and recover when designing collection strategies A sandbox eliminates the need to wait on internal prioritization and funding to dictate which projects to focus on and when. It also enables businesses to stay nimble and run ad-hoc analyses on the fly to support immediate decisions. Speed to decision Data and the rapid pace of innovation make it possible for nimble companies to make fast, accurate decisions. For organizations that struggle with slow decision-making and speed to market, an analytics sandbox can be a game-changer. With all your data sources integrated and accessible via a single point, you won’t need to spend hours trying to break down the data silos for every project. In fact, when compared to the traditional archive data pull, a sandbox can help you get from business problem identification to strategy implementation up to 30% faster, as seen with Experian’s Analytical Sandbox: Cost-effective analytics Building your own internal data archive with effective business intelligence tools can be expensive, time-consuming, and resource-intensive. This leaves many smaller financial services at a disadvantage, but sandboxes are not just for big companies with big budgets. An alternative solution that many are starting to explore is remotely hosted sandboxes. Without having to invest in internal infrastructure, this means fast, data-driven decisions with little to no disruption to normal business, fast onboarding, and no overhead to maintain. For financial institutions capturing and consuming large amounts of data, having an analytical sandbox is a necessity. Not only can you build what you want, when you want to address all types of analyses, you’ll have the insights to support business decisions faster and cheaper too. They prove that effective and efficient problem solving IS possible! Ready to learn more about Experian's Analytical Sandbox and how it can help you optimize your business? Contact Commercial Data Science

A gastropub restaurant applies for business insurance and is approved. However, social media insights show the restaurant is declining. Even though underwriters usually take a quick look at social media postings, evaluating the trends of the business is not part of the decision process. Costly mistakes: Underwriting using only business supplied information How could something as basic as a business in decline be overlooked in the insurance underwriting process? Think about the process when reviewing a new business insurance application. The underwriter reviews the application and looks at traditional credit and public filing information. Although the underwriter checks out the company website, he doesn’t meet or interact with the company. He then must make a potentially costly business decision about its risk level. Even though the process appears thorough, it does not use the new wealth of information available. How social media provides information about business health If the insurance company had used unique and new sources of social media data, the underwriter would have seen a different picture of the restaurant. The trends in the number of reviews point to a declining business due to poor service, bland food, or increased competition. Traditional data sources miss these subtle signs that point to a higher risk of going out of business. While one poor review shouldn’t result in a denial, a pattern of a declining business is important. This can be spotted using tools that analyze the trends in reviews and ratings for the business line. After all you cannot compare restaurants, with high volumes of social media postings, with say a dry cleaner. By correctly using social media data during the underwriting process, insurers can give an additional lift on the model to determine the risk. Social media data can also help determine more information about the business. For example, an exercise gym may have treadmills and weight machines, or it might actually be a kickboxing studio, which has a much higher level of risk and premiums. Underwriters also get a much more granular view than a typical application, such as the parking situation and the hours. Because risk is higher for businesses with a liquor license, insurers can often learn if a bar didn’t disclose this on their application. Customer photos also often tell a story not detectable on the application, such as broken stairs or a fireplace without proper screens. Using artificial intelligence to analyze social media data Looking through social media for each application takes large amounts of time. Even more importantly, humans may be subject to bias and miss word patterns in reviews. By using an artificial intelligence tool with machine learning capability to analyze social media data for business insurance applications, underwriters can gain a much more accurate picture of the risk they are assuming by insuring a business. Additionally, an AI tool can analyze business health much more quickly than an underwriter could doing the social media check manually. Insurance companies that use artificial intelligence tools to analyze social media data during the underwriting process can more accurately predict the risk of a business. Because the processing speed, adding this additional step does not slow the process down. By reviewing what other people are saying about the business, your insurance company can decrease risk and save money on claims.

When a new customer wants to establish credit terms with you, the first thing they’re asked to do is fill out your credit application. When you hand over a paper application, did you know you could be negatively impacting your revenue or creating a poor customer experience? Some companies don’t. More than likely, your customer has filled out at least one digital application in the past. The initial perception your application says about your company is that you’re out of step with technology — which may lead them to wonder where else you may be lagging behind. Digital applications provide a simplicity factor, and by not offering one, your credit approval process is perceived to be more difficult, leaving the customer with more work to do —spending extra time writing their information by hand and returning the application — either by email, fax, or in person. Because many companies have already moved to a digital application, your pen-and-paper process sticks out to the customer — and not in a good way. Not to mention, manually processing a paper application takes longer — often much longer — than a digital application. This means customers leave without a credit approval, giving them time to change their mind about their purchase or find a better deal — meaning you just lost a new sale. And even if they still choose to work with you, their relationship with your company starts out with a less-than-amazing customer experience. After the paper application is completed, the workflow process is often time-consuming, error-prone, and cumbersome. The time involved also means that your company waits longer to receive revenue from the sale. By using a manual process, your team spends hours on processing and decisions that could be better spent directly servicing customers or working on other initiatives to grow business. DecisionIQ from Experian automates consistent real-time decisions, streamlining your entire process from applications to onboarding.

For lenders, alternative data can be the factor in edging out your competitors, especially when better decisions are needed to compete for emerging businesses and startups. Both startups and emerging businesses may represent a good growth opportunity, but they may also be high risk. The challenge? Businesses with thin credit profiles can be difficult to score. Social Media Insight TM provides lenders with another layer of data that can help you better assess the direction of these businesses, score them more accurately and open new growth opportunities. After all, nobody likes to leave money on the table. For emerging businesses who have a thin credit profile but have a strong social media reputation, Social Media Insight can be a factor in gaining access to credit and resources they deserve. Social Media Insight enables you to see the activity, trends and sentiment on a business, over time. In our Experian DataLab tests, we improved overall model performance by 12 percent and new and emerging businesses by 91 percent, boosting predictive performance over traditional data sets. Social Media Insight is directly sourced data providing you with over 70 attributes including trends and sentiment along with descriptive attributes. This powerful data enables you to more accurately score or assess new and emerging business as well as long established accounts. Want to learn more? Watch our on-demand webinar or contact your Experian representative today.

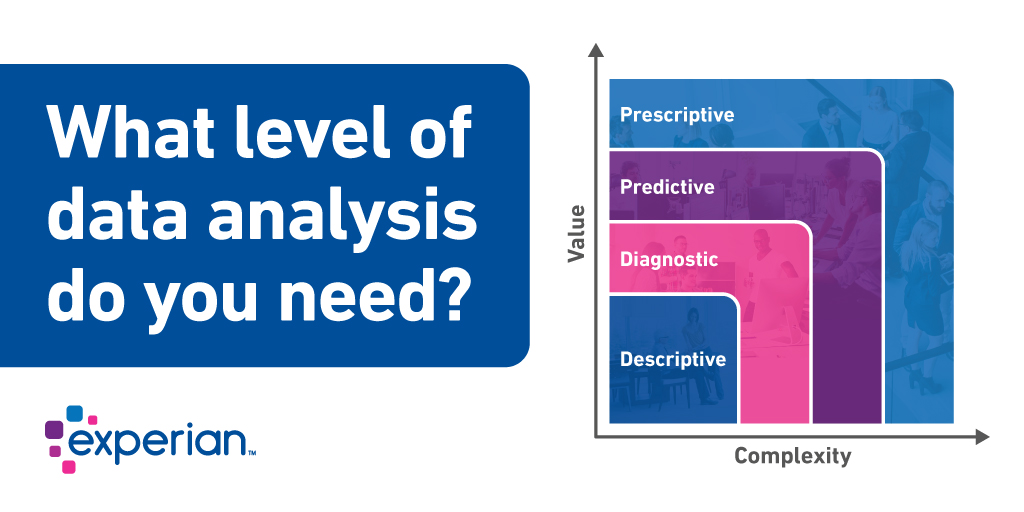

Data analysis surrounding lending practices for commercial lenders falls into 4 distinct buckets that define scope, usability, and purpose. In this post we will discuss how they differ in terms of value and complexity. Descriptive Analytics Descriptive analytics provide the current state of a commercial lender’s acquisitions, portfolio, or other parts of the lending lifecycle. This is “Reporting” in its simplest form. Defining and creating metrics can be as simple as a snapshot of the firmographic and performance elements of a portfolio to complex retro trends that define the effectiveness and success of a lender. Full coverage of the target market and accurate data play a big part in the success of this type of analysis. Selecting the wrong element, when creating a view, can lead the lender to a sub-optimal understanding of the state of their business. Looking at a competitor’s metrics can inform market share and pricing decisions. Experian commercial clients use Portfolio Benchmarking reports as an empirical view into the health of their business compared to their market peers. Adding data visualization on top of the descriptive-analytic reporting quickly closes the gap to a diagnosis. In the map below Texas, California, and Florida have higher rates of account opening and would be attractive target regions for acquisition. Diagnostic Analytics A Diagnostic view of lending performance will look at the portfolio health of a lender and its peers and determine what are the key success and opportunity drivers within comparable products. Larger financial institutions have been performing this type of analysis for years. Several years ago, fintech lending hit its stride challenging the large commercial lenders by providing targeted products in niche lending spaces with little or no traditional commercial credit data. Large commercial lenders used benchmarking and market analysis to understand where the fintechs were being successful. Large lenders use of alternative data sources and market intelligence helped them to recognize the gaps in identifying and evaluating the risk of those underserved businesses. Fintech use diagnostic analysis, to their advantage, to make fast decisions and pivot to market demand. In the chart above, you can see that ABC bank is able to identify where they are offering higher credit limits than their competitors. This client had similar bad rates to its peers causing the lender to have higher losses due to improperly assigned credit limits. Predictive Analytics Predictive analytics can help to scope the effectiveness of a strategic decision and plan for the long-term impacts of credit decisions. Financial institution use this type of analysis to forecast loan performance and plan for impacts to cash flow as economic and market conditions change. Machine learning is used in predictive analysis to be nimbler in the evaluation of vast amounts of data to provide more accurate prediction of future outcomes. Large financial institutions will use Machine Learning in predicting response to an offer through the lifecycle to the collection of outstanding debt. Prescriptive Analytics Predicting potential outcomes within a commercial lender’s strategies only gets them half way to a successful outcome. Providing insight on top of the analytic content is what drives the decisions to stay the course or pivot to an alternate course of action. Prescriptive analytics provides that direction. Machine learning can be used as a tool in prescriptive analytic engagements to develop models that can learn and pivot with changes to the market and behaviors of businesses within that market. Having the capability to adjust actions associated with outcomes allows the model to stay relevant and predictive over a longer period. As customer experience drives lending practices, commercial lenders look to use varying levels of analysis as stepping stones to better serve their small business clients. Got a question about analytics? We would be delighted to answer your questions. Commercial Data Science

You likely go to great lengths to protect your own identity from fraud and theft. But are you actively protecting your business’s identity as well? Even more importantly, do you make sure you are not doing business with fraudulent companies that have been victims of identity theft themselves? In many ways it’s harder to protect your business identity than your consumer identity. Information about most businesses is publicly available – and as easy to find as a simple Google search. Because businesses self-report much of their own information, it’s easy for a thief to add their name or address to a company. To make it even easier, many businesses do not protect their EIN the same way as they secure their SSN – which they should. At first glance, you may think having your personal identity stolen to be more damaging than a business identity. But in fact, the opposite is often true. Business owners often personally guarantee loans, even if the loan turns out to be fraudulent. And then if a business must close its doors due to the losses from the theft, the business owner now has no income and must repay the loan. How Business Identity Theft Happens Some thieves steal business identities by purchasing a shell corporation. Others take over a company’s data. But regardless of how the left happens, the criminals often go to great lengths to mirror the company. Some even rent space in the same building as the original company and using the same suppliers. At this point, the fraudulent company can start physically intercepting deliveries as well as applying for loans and credit, posing as the original company. Criminals start with one piece of information that is real, such as an address or EIN number. And then start operating as if they are the company and changing the data. Criminals often wait patiently while building up their reputation and credit history, then “bust out” with a large amount of fraudulent activity in a short period of time, and then walk away before they are discovered. Protect Your Own Business Identity Business owners must constantly monitor their business information to spot red flags that criminals have taken over. The earlier the theft is discovered, the less damage that occurs. Here are three things to look for to spot business identity theft of your own business: Look for new addresses added. Check your credit reports and government filings to verify the address. One of the first signs of theft is often a new address added to your business information. Verify that new registered owners have not been added. Thieves will often add a new principal — CEO, owner or partner — to the list of owners. The criminals can then conduct business as if they are an owner. Check business accounts daily. Use online banking — which also reduces the risk of stolen paper statements — to look for any transactions that you or your employees did not make. Consider setting mobile alerts for suspicious transactions to spot issues even faster. Verify Your Customers are Not Fraudulent Companies Before doing business with a company, do a business verification by making sure the company is who they say they are and not a and not a fraudulent company. Since verifications cost time and money, take each customer on a case-by-case basis regarding how deep to dig. If a customer orders $100,000 worth of computer equipment, you should do a more thorough investigation than for a business ordering a single $500 laptop. However, anytime you are extending a line of credit to a company, you should deep dive into a companies' history and data because you are taking on a high risk. Stacking loans is a common tactic – meaning companies take loans from multiple companies at the same time. Because many companies often verify customers by looking at their relationship with the business, they are verifying in a vacuum instead of seeing the entire picture. By using databases and tools that provide a holistic view of all activity, it becomes much easier to find the fraud. Here are five things to look for when verifying a company: Verify the EIN number. One scheme is to use a different EIN number and have all other pieces of information the same. Make sure the company you are doing business with is using the same EIN number as the legitimate company. Consider the number of open lines of credit. Because fraudulent companies often open multiple lines of credit at the same time, determine the current amount of open credit. Multiple large lines opened around the same time can be a red flag. Look at the number of sub-companies and activity between the companies. Criminals often set up a fraud ring by operating as sub companies underneath a single company. The “companies” then loan money to each other to boost credit scores and credibility. Note for periods of dormancy. When a business identity is first stolen, the criminals set up the company and then go dormant to build credibility through age. The company will then “bust out” by making a lot of transactions very quickly with multiple companies. Look for additional addresses. Check to see if the address you have been given is the same as the company’s headquarters. Multiple similar addresses can be a red flag. As business identity theft continues to rise, you must keep your eyes open for signs of theft — both with customers and your own business. A single credit check or google search simply isn’t enough. You owe it to your business and your future.

Scottsdale, Ariz., May 22, 2018 — Experian®, at its 37th annual Vision Conference, today announced it has become a certified vendor of the Small Business Financial Exchange, Inc. (SBFE), a nonprofit trade association that gathers and aggregates small-business payment data in the United States to help organizations build a complete picture of small business. “We’re excited to work with SBFE, which shares our mission to bring further innovation to the small-business credit landscape,” said Hiq Lee, president, Experian Business Information Services. “By combining the SBFE’s data richness with Experian’s vast consumer and commercial data assets and leading data science capabilities, we will use the power of data to help our clients make the right decisions.” As a SBFE Certified Vendor, Experian can combine its rich data — including traditional and alternative business data and consumer data on business owners — with SBFE’s data to provide the most comprehensive view of a small business in the market today. For example, financial institutions looking for broad and deep insights on small and emerging businesses will be able to find that information in a way no one has offered previously. Also for the first time, Experian clients that are nonfinancial institutions, such as e-commerce, communications, insurers, and software and hardware vendors, can qualify to access this financial data to help them make confident credit decisions by gaining deep visibility into a small business’s capital use and credit history through Experian. “Experian becoming an SBFE Certified Vendor makes perfect sense in support of our ongoing mission to serve our Members and the small-business community,” said Carolyn Hardin-Levine, CEO, SBFE. “Experian demonstrated its ability to meet SBFE’s high data security and governance requirements, controls, and independent oversight requirements. Additionally, Experian’s ability to deliver blended solutions combined with SBFE data will provide our Members with more options and drive innovation as part of SBFE’s single-feed, multicertified vendor model.” New product pipeline Experian fosters a culture of continuous innovation, from the way it works to the solutions it creates. The company plans to deploy its data scientists to apply leading-edge techniques, including machine learning and artificial intelligence, to discover and provide predictive insights and analytical tools to support better decisioning for its clients. It is anticipated that the work of its data scientists on the combined data sets will result in new product launches over the next 24 months. Vision Conference Each year, Vision combines in-depth research, cutting-edge technology and expertise from industry leaders to help Experian’s clients strengthen their balance sheets and plan for sustained growth. The 2018 conference sold out and runs May 20–23 in Scottsdale, Ariz. Contact: Jackie Brenne Experian Public Relations 1 714 830 5126 Jackie.Brenne@experian.com About Experian Experian is the world’s leading global information services company. During life’s big moments – from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organisations to prevent identity fraud and crime. We have 16,500 people operating across 39 countries and every day we’re investing in new technologies, talented people and innovation to help all our clients maximise every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index. Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group. About SBFE The Small Business Financial Exchange, Inc., and SBFE, LLC (collectively known as SBFE) is the country’s leading source of small-business credit information. Established in 2001, this nonprofit association’s database houses information on more than 32 million businesses and enables information exchange among members who provide small-business financing. Through its resources and relationships, SBFE makes possible innovative risk management solutions by providing industry insight and analysis of aggregated small-business financial data to its Members. SBFE is the only Member-controlled organization of its type and is serving as the most trusted advocate for the safe and secure growth of small business. For more information, visit www.sbfe.org.

Today Experian Business Information Services releases the Experian/Moody's Analytics Main Street Report for Q1 2018. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what certain trends mean for credit grantors and the small-business community. Q1 2018 saw credit conditions loosening and balances rising as more businesses access credit. The report states the overall outlook for small-business credit is positive. Delinquencies were down and default rates rose slightly, suggesting that credit conditions have peaked as the economy is in a late-cycle expansion. Continuing strength in the macroeconomy will keep small-business credit moving in the near term, along with higher profits from the recently passed tax legislation. Small-business credit will be less certain in the medium to long term as rising wages, interest rates and changes to the tax code take a toll. Download the latest report