Small Business Credit Insights

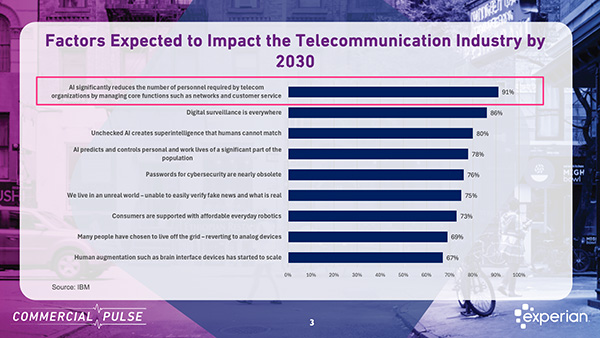

Is AI about to disrupt the telecommunications industry? In this week's Commercial Pulse Report, we explore potential AI disruption in the Telecommunications industry as the transition from analog to digital plays out, and industry consolidation takes hold. Watch The Commercial Pulse Update In 1979, a British new wave band called The Buggles released a song that would become an unlikely cultural landmark. Video Killed The Radio Star wasn’t just catchy—it was prophetic. The lyrics mourned the decline of radio as television and music videos began to dominate how audiences consumed content. Just a few years later, MTV launched, and the shift from audio to visual media was complete. Radio didn’t disappear, but it was permanently changed. One line from the song captures the unease of that moment perfectly “In my mind and in my car, we can’t rewind, we’ve gone too far,pictures came and broke your heart, put the blame on VCR.”The Buggles, 1979 It’s a lament about progress—about technology moving faster than society can comfortably absorb. And it’s a reminder that once disruption takes hold, there’s no rewinding the tape. Fast forward more than four decades, and the irony is hard to miss. MTV itself—once the symbol of disruption—has faded from cultural relevance, ending as it started by playing "Video Killed The Radio Star" on December 31st, 2025. That same cycle defines today’s telecommunications industry disruption, as AI, automation, and consolidation reshape how companies operate and compete. A Familiar Pattern of Disruption Telecommunications has lived through repeated waves of technological upheaval. The shift from analogue to digital fundamentally altered how networks were built, how services were delivered, and how companies competed. That transition drove efficiency, reduced headcount, and accelerated consolidation across the industry. Now, artificial intelligence represents the next inflection point. As highlighted in this week’s Commercial Pulse Report, AI is no longer a future concept for telecom—it’s a near-term operational reality. Industry research shows that a majority of telecom executives expect AI to materially reshape their organizations by automating core functions such as network management, customer service, and fraud detection. Just as video once replaced radio as the dominant format, AI is poised to redefine how telecom companies operate—faster, leaner, and increasingly software-driven. And as history has shown, efficiency gains often come with structural consequences. Consolidation, Scale, and Survival Disruption rarely happens in isolation. It tends to accelerate industry consolidation, and telecom is no exception. Over the past decade, mergers and acquisitions have reshaped the competitive landscape. In wireless, consolidation has resulted in three dominant players controlling the majority of the market. At the same time, the total number of private telecom establishments in the U.S. has declined sharply from its historical peak. This mirrors what happened in media. MTV consolidated attention, then streaming consolidated distribution, and now a handful of platforms dominate content delivery. Each wave reduced the number of viable players while raising the cost of participation. In telecom, AI may lower operating costs—but it also raises the bar for capital investment, data sophistication, and technological capability. Smaller firms face increasing pressure to either specialize, scale, or exit. What the Credit Data Is Telling Us One of the most telling insights from this week’s Commercial Pulse Report comes from telecom credit behavior. Telecom businesses tend to seek credit more frequently than companies in other industries, reflecting ongoing investment needs. However, the average size of credit lines has steadily declined, even as utilization rates have returned to pre-pandemic levels. In other words, telecom firms are doing more with less. This dynamic suggests that businesses may be turning to alternative funding sources, reallocating capital internally, or operating under tighter credit constraints—despite stable demand for connectivity and data services. For risk leaders and growth strategists, this creates a more complex environment. Traditional indicators alone may not fully capture resilience or vulnerability. Understanding industry-specific behavior becomes critical. We Can’t Rewind—But We Can Prepare The line from “Video Killed The Radio Star” still resonates because it captures a universal truth about disruption: We can’t rewind—we’ve gone too far. AI will not undo itself. The telecom industry will not revert to its pre-digital or pre-automation state. Just as radio adapted rather than disappeared, and MTV faded as new platforms rose, telecom companies will continue to evolve—some faster and more successfully than others. The question is not whether disruption will occur, but who is prepared for it. This week’s Commercial Pulse Report explores that question through the lens of macroeconomic conditions, small business credit health, and telecom-specific insights. Together, they offer a clearer picture of how innovation, consolidation, and credit trends are intersecting in early 2026. Because while technology may break hearts along the way, understanding the data helps businesses stay ahead of the next verse. Learn more ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

The Experian Small Business Index™ declined by 6.2 points month-over-month, remains up by 5.3 points Year-Over-Year Dec 2025 Index Value (Dec): 45.8 Previous Month: 52.0 MoM: -6.2 YoY: 5.3 (Dec 2024 = 40.5) The Experian Small Business Index™ decreased 6.2 points to 45.8 in December, which was 5.3 points higher year-over-year. The monthly decrease coincided with increases in certain business risk indicators, including higher delinquency rates and rising balances, alongside a reduction in new credit activity, suggesting a tighter lending environment. Broader economic conditions remained stable in December. The unemployment rate edged down to 4.4% from 4.5%, while inflation trends were mixed. Energy price inflation declined, the producer price index remained flat, and rent and food inflation increased. These conditions contributed to the Federal Reserve’s decision to maintain interest rates at its January meeting. Small businesses and consumers both showed improved optimism with both the NFIB Small Business Optimism Index and the University of Michigan Consumer Sentiment Index recording increases in December. Explore Experian Small Business Index Related Posts

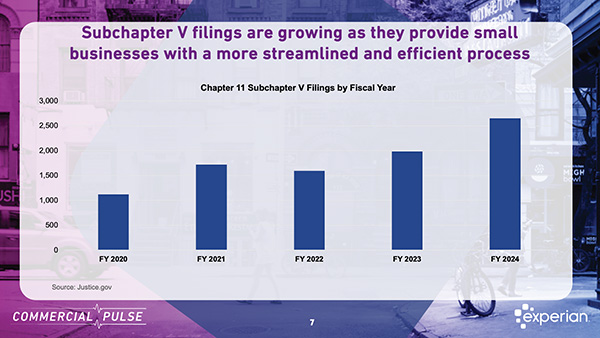

Bankruptcy isn’t just a back-page story anymore, it’s becoming the postscript to the startup surge. The January 27th Experian Commercial Pulse Report reveals a sharp contrast in the small business economy: while business formation remains historically elevated, bankruptcy filings are climbing to levels not seen in a decade. The data points to a critical inflection point—where entrepreneurial growth meets growing financial fragility. Watch The Commercial Pulse Update A Two-Sided Story: Formation and Failure The numbers we see highlighted in the news show a business ecosystem in flux. In December 2025, 497,000 new businesses were launched, a slight dip from November but still 53% above pre-pandemic averages. Since July 2020, an average of 446,000 new businesses have formed each month, underscoring an entrepreneurial surge that has become a defining feature of the post-COVID economy. However, this wave of new businesses comes with significant exposure. Many are lean operations, often led by first-time founders with limited access to capital and minimal financial buffers. These structural vulnerabilities are reflected in rising failure rates. In Q3 2025, business bankruptcy filings hit 24,039—the highest quarterly total since 2016. While some of this activity reflects larger firms restructuring through Chapter 11, a growing share involves smaller, younger businesses taking advantage of Subchapter 5, a newer option tailored for small business reorganization. Understanding Bankruptcy Types: Chapter 7, 9, 11, 12, 13, 15 and Subchapter 5 To better interpret the data, it helps to understand the bankruptcy options available to businesses: Chapter 7 – Liquidation: This is the most straightforward and final form of bankruptcy. Businesses cease operations and a court-appointed trustee sells off assets to repay creditors. Chapter 9 - Municipal Bankruptcy: Exclusively municipalities ( i.e. cities, counties, school districts.) Municipality retains control. No liquidation allowed. No need for disclosure statements. Chapter 11 – Reorganization: This allows a business to continue operating while restructuring its debt under court supervision. Often used by larger or financially complex companies. Chapter 12 - Family Farmer & Fisherman Reorganization: Exclusively for agriculture and fishing operations. Lower cost compared to Chapter 11. Owners keep farm/fishing operation. No need for disclosure statements or creditor committees. Chapter 13 - Individual Reorganization: Primarily for individuals but sometimes used for sole proprietors. Establishes 3 to 5-year repayment plan. Debtor keeps assets and continues operations. Debt limits apply. Chapter 15 - Cross-Border Insolvency: For businesses with assets and creditors in multiple countries. Facilitates cooperation between U.S. courts and foreign courts. Helps protect U.S. assets during international restructuring Subchapter 5 (of Chapter 11): Introduced by the Small Business Reorganization Act of 2019, Subchapter 5 simplifies and lowers the cost of reorganization for small businesses with less than $3 million in debt. Key advantages of Subchapter 5 include: No creditor committee or disclosure statement required Faster court timelines and higher plan confirmation rates Owners can often retain equity Subchapter 5 filings have more than doubled since 2020 and now account for a growing share of all Chapter 11 activity. Who’s Filing—and Why It Matters The report highlights a shift in the types of businesses filing for bankruptcy. These firms are: Small – fewer than five employees Young – under 10 years in operation Low-revenue – earning under $1 million annually These groups now represent the majority of business bankruptcies, showing that financial fragility is highest among the newest and smallest entrants in the market. Early Warning Signs: Commercial Credit Behavior Experian’s commercial credit database reveals clear behavioral patterns among at-risk firms: Higher credit seeking activity: These businesses are 3–4 times more likely to apply for credit before filing. Elevated commercial credit balances: They carry significantly higher balances than non-filing peers. Signs of financial stress: Increased delinquencies and utilization often appear months before a bankruptcy event. This creates an opportunity for lenders to proactively monitor portfolios and identify risk earlier, especially among firms that fit the high-risk profile. What This Means for the Small Business Economy The data paints a complicated picture. New business creation remains strong, driven by structural changes and a resilient entrepreneurial spirit. But these new firms are operating in an increasingly challenging environment, facing inflation, tighter credit conditions, and weakening demand. Subchapter 5 is helping many small businesses stay afloat by making reorganization more accessible. However, rising filings among small and young firms signal that financial strain is becoming more common at the foundational level of the economy. For lenders and risk professionals, the takeaway is clear: track not just the volume of small business activity, but the quality and sustainability behind it. Credit signals remain a powerful early indicator of distress and can help institutions support their small business clients more strategically. Learn More ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

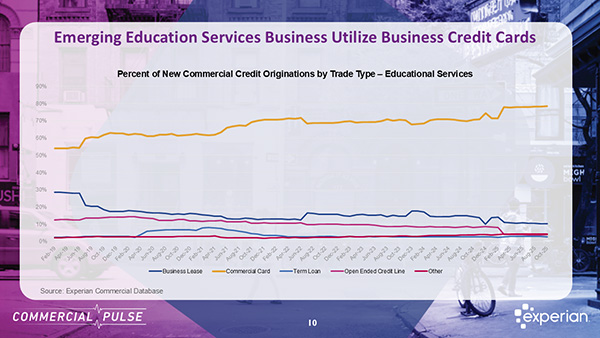

In the just-released Experian Commercial Pulse Report, we focus on a growth small business sector - Education Services, which enjoys healthy, consistent formation, and stable credit management. For Chief Risk Officers navigating an uncertain lending landscape, the question isn't just where growth is happening—it's where growth aligns with manageable risk. The Education Services sector presents exactly that combination, and the numbers tell a compelling story that contradicts conventional wisdom about small business exposure. Watch The Commercial Pulse Update A Sector Transformation Driven by Economic Realities The fundamentals driving Education Services' growth aren't temporary market anomalies; they're structural shifts in how young adults approach career preparation. With youth unemployment rates persistently running more than twice the general population, and young workers facing heightened job security concerns, the demand for skills-based training has fundamentally changed. The traditional four-year degree path is losing its popularity. While bachelor's degree holders still experience lower unemployment rates than those with associate's degrees, the gap has narrowed considerably in recent years. Meanwhile, the escalating cost of traditional college education is accelerating a pivot toward trade schools and specialized training programs, a trend reflected in rising post-secondary enrollment, particularly in trade education. This isn't speculation. Through November 2025, nearly 76,000 new education services businesses have opened— with 7,653 opening in November, the highest level on record. This represents a 205% increase in just two decades. Employment in the sector crossed 4 million for the first time in July 2025. These aren't vanity metrics; they signal sustained, fundamental demand. The Small Business Concentration: Risk or Resilience? Here's where traditional risk models might flash warning signals: businesses with fewer than 10 employees now represent nearly 80% of all educational services firms, up from 63% in 2019. For most sectors, such a high concentration of small businesses would trigger heightened scrutiny and tighter credit controls. But Education Services is defying that conventional risk calculus. Despite this shift in concentration toward smaller operators, credit performance metrics tell a different story—one of discipline and stability that should inform how risk leaders approach this segment. Credit Performance That Challenges Assumptions The credit behavior within Education Services reveals patterns that warrant a fresh risk assessment framework. Commercial credit cards dominate the sector, representing over 78% of monthly originations—a preference that actually provides lenders with valuable visibility into cash flow patterns and working capital management. What's particularly noteworthy: while many industries have experienced tightening credit limits over the past several years, average commercial card limits in Education Services have increased 23% since 2019, now exceeding $19,000. This expansion isn't resulting in overleveraged borrowers. Utilization rates remain relatively low, and average commercial credit scores have held stable throughout this rapid expansion phase. This combination, expanding credit access paired with stable utilization and consistent credit performance, signals something important: disciplined financial management even among newer, smaller operators. For risk leaders, this should prompt a critical question: are your current underwriting models properly calibrated to identify opportunity in this segment, or are they applying broad small business assumptions that miss sector-specific strength signals? Strategic Implications for Risk Leaders The Education Services growth story presents three strategic imperatives for Chief Risk Officers: First, industry-specific risk strategies deliver differentiated insight. Blanket approaches to small business risk assessment will systematically underprice opportunity in sectors like Education Services while potentially overexposing you elsewhere. The stable credit performance despite small business concentration demonstrates that sectoral dynamics matter more than size alone. Second, continuous monitoring beats static underwriting. The rapid composition shift in Education Services—from 63% to 80% small business concentration in just six years illustrates how quickly sector profiles can evolve. Risk strategies built on outdated sector snapshots will either miss growth opportunities or accumulate unrecognized exposure. Real-time portfolio monitoring and dynamic risk modeling aren't optional anymore. Third, growth doesn't automatically mean elevated risk. The Education Services sector challenges the reflexive association between rapid expansion and deteriorating credit quality. In this case, expansion has coincided with improving credit access and stable performance. The key differentiator? Understanding the fundamental demand drivers and recognizing when growth is structural rather than speculative. The Broader Context: Skills-Based Economy Acceleration Education Services isn't growing in isolation. It's responding to, and enabling, a broader economic transformation toward skills-based career pathways. As this transformation accelerates, the sector's role becomes increasingly central to workforce development, suggesting sustained long-term demand rather than cyclical opportunities. For financial institutions, this means Education Services represents more than a near-term growth play. It's a sector aligned with multi-year economic trends, serving businesses that fill a critical gap in how workers prepare for evolving job markets. Moving Forward The Education Services sector demonstrates that growth opportunities and manageable risk profiles can coexist, when you have the right analytical framework to identify them. For Chief Risk Officers, the question is whether your institution's risk infrastructure can recognize these nuances or whether you're leaving opportunity on the table. As 76,000 new businesses enter this sector and credit performance remains stable, the window for strategic positioning won't remain open indefinitely. Competitors with more sophisticated sector-level risk analytics will identify and capture these borrowers first. The data is clear. The opportunity is measurable. The question for risk leaders is simple: what's your strategy for Education Services? ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

The Experian Small Business Index™ improved by 15.9 points month-over-month and 9.1 points Year-Over-Year Nov 2025 Index Value (Nov): 52.0 Previous Month: 36.1 MoM: 15.9 YoY: 9.1 (Nov 2024 = 42.9) The Experian Small Business Index™ increased substantially in November by 15.9 points to 52.0. This also represents a YoY increase of 9.1 points. There was increased business activity with the end of the government shutdown in November. Business owners saw an increase in new account openings and approval rates, along with an increased number of new business formations. Negative credit conditions improved, with reductions in delinquencies and utilization. The Small Business Optimism Index from NFIB increased to 99.0 from 98.2 in October. There was an increase in the number of new business applications to 535K from 499K in October, the most in a single month since July 2020. Inflation fell in November, to 2.7% from 3.0% in September, the lowest level since July. November unemployment was up to 4.6% from 4.4% in September. The inflation and unemployment rates are likely to influence Federal Reserve policy decisions as they consider whether additional rate cuts are warranted in 2026 after a 25 bps drop in December. Explore Experian Small Business Index Related Posts

Experian Commercial Pulse Report Explores Implications of Rising Premiums As the year draws to a close, one issue looms large for millions of small business owners: the rising cost of healthcare. According to the latest Experian Commercial Pulse Report, small business survival may soon hinge on a single factor — whether enhanced Affordable Care Act (ACA) subsidies are extended into 2026. Watch the Commercial Pulse Update The Clock Is Ticking on ACA Subsidies The American Rescue Plan and Inflation Reduction Act temporarily expanded ACA subsidies, helping make coverage more affordable for millions. But those enhancements are set to expire at the end of 2025 — a policy shift that could unleash a wave of economic strain. The Kaiser Family Foundation estimates that if these subsidies lapse, individuals who purchase insurance through the ACA marketplace could see a 75% increase in premiums. Why does this matter so much for small businesses? Because half of all ACA marketplace enrollees are small business owners, entrepreneurs, or their employees. Coverage Is Shrinking, and Costs Keep Climbing Smaller businesses have historically been less likely to offer health insurance benefits than their larger counterparts. In 2025, only 64% of businesses with 25 to 49 employees offer health benefits — the lowest level ever recorded. And while large employers are still required by the ACA to offer coverage to full-time workers, they too are feeling the pressure. Since 2010, employers have gradually reduced the share of healthcare premiums they cover, even as deductibles have risen by 164% for single coverage plans. The result? Business owners are being squeezed from both sides — by rising insurance costs and a more financially stressed workforce. The Ripple Effects Could Be Widespread If enhanced subsidies aren’t renewed, many small businesses may have no choice but to: Shut down operations Cut staff Shift jobs into larger organizations that can offer coverage That would be a blow not only to small business dynamism but also to broader economic sectors. Reduced consumer spending could hit industries like retail, real estate, and manufacturing, while healthcare providers face payment cuts and job losses due to shrinking coverage pools. What’s Next? With Congress set to vote on subsidy extensions before the end of the year, the stakes couldn’t be higher. The outcome will likely define affordability, access, and entrepreneurship for years to come. For small business owners, now is the time to assess your coverage plans, understand your employee needs, and prepare for potential cost increases. For policymakers and industry leaders, it’s a critical moment to ensure healthcare reforms continue to support the backbone of the U.S. economy — small businesses. Experian continues to provide actionable data to help businesses, lenders, and policymakers navigate uncertainty. To access the full Commercial Pulse Report and explore more insights on small business credit and sector-specific performance: ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

High APR's, Steady Risk: Small Firms Stay Resilient Experian is very pleased to announce the release of the Q3 2025 Main Street Report. Brodie Oldham and Marsha Silverman will be unpacking the insights in the latest report during the Small Business Economic Review - December 9th, 10:00 a.m (Pacific), 1:00 p.m. (Eastern0 Register to Attend Webinar Report summary The holidays are here, and Black Friday sparks a surge in consumer spending, U.S. small businesses are proving remarkably resilient despite persistent economic challenges. The Experian Small Business Index shows tighter credit conditions, with modest delinquency movements, disciplined utilization rates, and an acceleration in new business starts. Download the latest report for more insight. Download Q3 Main Street Report About the Experian Main Street Report The Experian Main Street Report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what specific trends mean for credit grantors and the small-business community. Critical factors in the Main Street Report include a combination of business credit data (credit balances, delinquency rates, utilization rates, etc.) and macroeconomic information (employment rates, income, retail sales, industrial production, etc.). Related Posts

The Experian Small Business Index™ declined in October, dropping by 5.0 points month-over-month. Oct 2025 Index Value (Oct): 36.1 Previous Month: 41.1 MoM: -5.0 YoY: -4.6 (Oct 2024 = 40.7) The Experian Small Business Index™ decreased in October by 5 points to 36.1. This drop is attributable to decreased origination activity for small businesses and small business owners, along with an increase in delinquencies for small business owners’ consumer trades. Small business trade delinquency rates have remained stable. The NFIB reported a decrease in small business optimism to 98.2 in October from 98.8 in September, and the University of Michigan reported a drop in consumer sentiment to 51.1 in November from 53.6. Due to the extended government shutdown, several of the economic indicators were not reported for October, but there were signs of positive factors in the macroeconomic environment. US employers reported hiring 283K in October, up from 117K in September, and existing home sales were up 1.2% in October to 4.1M. Explore Experian Small Business Index Related Posts

The independent workforce is booming, but traditional financial services have struggled to keep pace. On a recent episode of Experian Business Chat, Michael Zevallos, co-founder of Giggle Finance, shared how his FinTech is bridging this critical gap for gig workers and micro-small businesses. Watch Our Interview The Problem: A Broken System for Independent Workers With over 10 years of experience in online lending and FinTech, Michael witnessed firsthand how the financial system failed anyone outside traditional W2 employment or large commercial businesses. During his time at OnDeck, starting in 2011, he witnessed numerous independent contractors and micro-small businesses being completely shut out of credit markets. "It wasn't just about meeting underwriting guidelines," Michael explains. "Smaller deals just didn't generate enough profitability. There were too many hands in the cookie jar—underwriters, salespeople, loan brokers, loan closers—all trying to interact with these deals." The traditional system relies on predictable W2 paychecks and consistent business histories spanning five-plus years. But gig workers operate differently. An Uber driver might work 10 hours one week, 20 the next, and zero the week after. This variability, while reflecting the freedom of independent work, made them invisible to traditional lenders. A Market Opportunity Hiding in Plain Sight What started as a niche problem became impossible to ignore. In 2020, the independent workforce became the fastest-growing segment of the economy. Suddenly, tens of millions of Uber drivers, barbers, content creators, online sellers, and freelancers needed financial services that simply didn't exist for them. That's when Michael and his co-founders launched Giggle Finance. Flipping the Script on Risk Assessment Traditional credit markets look backward, reviewing historical output, past credit scores, and established track records. But as Michael points out, "It captures your past, but it doesn't capture your present or more importantly, your future." Giggle Finance partnered with Experian to develop a more nuanced approach to risk: Experian's Clear Credit Risk and Clear Inquiry go beyond traditional credit files to identify different patterns of behavior and risk signals that matter for independent workers. This allows them to go beyond a traditional credit report, predict risk more accurately, and approve the right customers. NeuralID Technology analyzes how customers interact with the application itself, detecting fraud while building confidence in legitimate applicants. The Experian SMB Marketplace connects Giggle with customers who genuinely care about and value their credit, allowing them to approve more applications with greater confidence. The result? Giggle can assess risk and approve applications in under 10 minutes, requiring just 90 days of cash flow activity to get started. "Consider a freelance marketer who could previously handle two or three clients. With AI tools for content creation and analytics, they can now manage five or six times that workload."Michael Zevallos, Co-Founder The AI Revolution in Independent Work The conversation took an interesting turn when discussing how AI is reshaping the gig economy. While most people think about AI's impact on large enterprises, Michael sees it transforming independent contractors in profound ways. "Gig workers aren't just drivers or delivery couriers anymore," he notes. "They're becoming creators, consultants, designers—more tech-savvy and capable than ever before." Consider a freelance marketer who could previously handle two or three clients. With AI tools for content creation and analytics, they can now manage five or six times that workload. Many solopreneurs are evolving into full-fledged agencies, keeping headcount low while scaling to dozens of customers. From Emergency Funding to Growth Capital This AI-enabled transformation has fundamentally shifted why customers seek financing. Historically, small business owners came to Giggle because of emergencies—they needed to make payroll or cover an unexpected expense. Now, increasingly, they're seeking growth capital. The Uber driver who becomes a limousine company owner. The logo designer who can now produce dozens of designs using AI tools. These entrepreneurs need funding to hire people, invest in equipment, and market their expanding businesses. "That structural shift is very exciting for both the customers and for us at Giggle," Michael says. Building Long-Term Relationships Giggle isn't just there for a one-time transaction. Some customers have been funded over 20 times across four years, with Giggle supporting them through various business evolutions. Uber drivers have become truckers. Others have launched limousine companies. The relationship grows as the business grows. Looking ahead, Giggle plans to expand its offerings, including a potential line of credit product for more mature businesses. The goal is to remain flexible and responsive to changing business needs at every stage. The Path Forward: Collaboration Michael sees tremendous opportunity for banks and FinTechs to work together serving the gig economy. Banks bring trust, established brands, and balance sheets. FinTechs like Giggle bring product innovation, technology, and user experience. "If you put those strengths together, you can build a financial system that truly serves gig workers, independent contractors, and micro-small businesses," he explains. Giggle's technology can underwrite customers in seconds using real-time income data and AI, while bank partnerships could provide credit at scale. A Market That's Only Getting Bigger When Giggle launched in 2020, there were approximately 30 million independent workers in the United States. Today, that number has more than doubled to 70 million. By 2030, Experian and Giggle believe the independent contractor workforce will surpass the traditional W2 economy. "Everybody's a small business. Whether it's a college student with an Etsy store, a professional with a side consulting practice, or a full-time independent contractor, the entrepreneurial spirit is becoming the norm rather than the exception."Ekaterina Gaidouk, VP of Marketing Getting Started For entrepreneurs and small business owners interested in learning more, Giggle Finance operates entirely online at www.gigglefinance.com. The application process takes less than 10 minutes, and approved customers can have funds in their bank account the same day—no human intervention required. In an age where the nature of work is rapidly evolving, Giggle Finance represents a new approach to financial services: one that recognizes independent workers not as risky outliers, but as the future of the American economy. Related Posts