Small Business Credit Insights

As 2025 draws to a close, small business lenders, policymakers, and industry professionals are facing one big question: What’s next for small business credit and the broader economy? Join Experian’s team of commercial and macroeconomic experts for the Experian Small Business Economic Review on Tuesday, December 9th, 2025, at 10:00 a.m. Pacific / 1:00 p.m. Eastern. This exclusive quarterly webinar delivers data-driven insights into small business credit performance, lending trends, and the forces shaping the U.S. economy. Whether you’re a lender, credit manager, or business strategist, this session will help you make informed, confident decisions heading into 2026. Why You Should Attend Hear from Leading ExpertsGain firsthand insights from Experian commercial credit specialists who analyze the pulse of U.S. small business health. Explore Credit Trends on Over 30 Million BusinessesSee the latest data behind payment performance, delinquencies, and credit utilization — drawn from Experian’s unmatched business credit database. Understand Industry Hot TopicsDiscover how key sectors are performing and what business owner data is revealing about economic resilience and risk. Exclusive Commercial InsightsAccess information and analysis you can’t find anywhere else, helping you anticipate market changes before they happen. Interactive Peer PollingParticipate in real-time polls and compare your perspective with peers across financial services, banking, and commercial credit. Actionable Takeaways for 2026Learn what recent small business credit trends mean for your organization — and how to adapt your strategies for the year ahead. Ask the ExpertsGet answers to your most pressing questions about how small businesses are performing and what the next quarter may bring. Stay Ahead of the Curve In an uncertain economic climate, information is your greatest advantage. The Experian Small Business Economic Review gives you the data, context, and expert perspective you need to navigate what’s next with confidence. 📅 Date: Tuesday, December 9th, 2025🕙 Time: 10:00 a.m. Pacific | 1:00 p.m. Eastern Register To Attend

Explore retail industry risk trends for Q4 2025 inventory gaps and credit shifts impact CRO strategies in the latest Commercial Pulse Report.

The Experian Small Business Index™ shows a modest improvement, rising 3.7 points month-over-month. Sep 2025 Index Value (Aug): 41.1 Previous Month: 37.4 MoM: +3.7 YoY: -3.8 (Sep 2024 = 44.9) The Experian Small Business Index™ increased in September by 3.7 points to 41.1, the second straight month of increases. The Fed lowered interest rates for a second time in late October in response to weakening job reports from ADP but indicated another rate cut in December is not certain due to rising inflation. Inflation increased from 2.9% to 3.0% in September, and core inflation decreased from 3.1% to 3.0%. Rent and food inflation were both steady, and energy prices increased 2.8% from a year ago. The University of Michigan’s consumer sentiment stayed nearly even as the NFIB small business optimism index fell slightly to 98.8 in September from 100.8 in August. New businesses continue to open at a historically high rate, indicating continued optimism by entrepreneurs. Explore Experian Small Business Index Related Posts

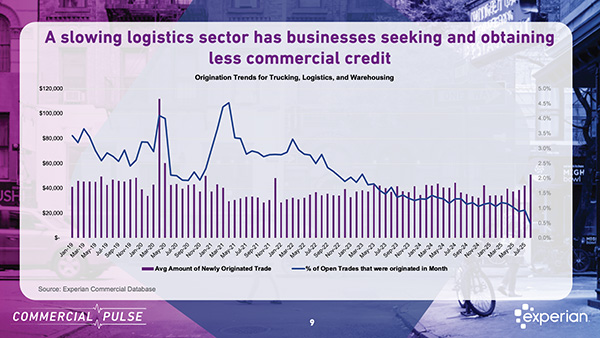

Logistics credit risk is rising according to Experian's latest Commercial Pulse report, signaling financial strain.

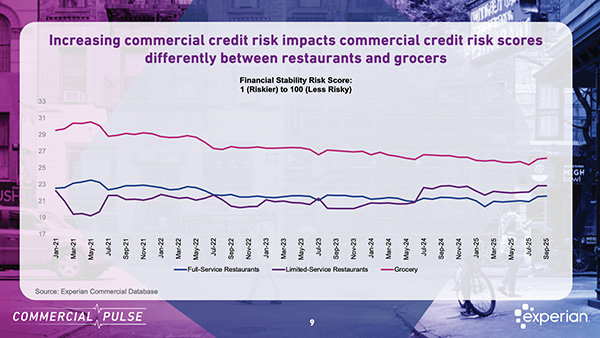

Rising costs are continuing to squeeze American wallets — and perhaps nowhere is that more apparent than in the food sector. According to the latest Experian Commercial Pulse Report (October 14, 2025), food prices are having a profound impact on where and how consumers choose to eat. With the Consumer Price Index for food rising 3.2% year-over-year, both full-service and limited-service restaurants are feeling the heat. Watch the Commercial Pulse Update Specifically, Full-Service Restaurant prices have surged 4.6%, while Limited-Service locations have seen more modest increases of 3.2%, the lowest pace in over a year. As price-sensitive consumers pull back on discretionary spending, Experian’s data shows a notable shift toward more affordable dining options—or a return to eating at home. Credit Demand Is Strong, But Approval May Be Slipping Even with shifting consumer habits, restaurants are not sitting idle. Experian’s credit data reveals that both Full-Service and Limited-Service Restaurants are actively seeking commercial credit — a likely sign of increased working capital needs in the face of inflation and tighter margins. However, access to that credit appears to be narrowing. Commercial inquiries from Full-Service Restaurants have risen to 1.7x pre-pandemic levels. Limited-Service Restaurants follow closely at 1.5x. Yet the number of credit-active Limited-Service establishments has declined, suggesting either a slowdown in approvals or reduced eligibility. This contrast implies that demand for financing is rising faster than approval rates, especially for smaller or newer businesses trying to stay competitive amid rising costs. Shrinking Credit Limits, Rising Utilization Restaurants are not only facing tighter access but also leaner terms. Average credit limits for new commercial card accounts have fallen significantly since 2021: Full-Service Restaurants: Down from $11,500 to under $6,000 Limited-Service Restaurants: Also trending downward Groceries (used as a benchmark for at-home eating): Down from $13,000 to $9,000 At the same time, credit utilization rates are climbing — an early warning sign that businesses are relying more heavily on revolving credit to manage day-to-day operations. Full-Service Restaurants now use 31.9% of available credit, up 4.6 points since 2023. Limited-Service Restaurants trail close behind at 31.8%. Groceries come in at 28.8%, showing increased pressure even in the at-home dining sector. Taken together, this combination of lower credit limits and higher utilization points to a tightening credit environment, which may be challenging for restaurants to navigate through the holiday and post-holiday seasons. Commercial Risk Trends Tell a Mixed Story One of the more nuanced insights in Experian’s report is how different restaurant types are weathering the current environment from a risk perspective: Full-Service Restaurants show only a modest decline in commercial risk scores (–0.8 points), suggesting relative resilience despite financial pressures. Limited-Service Restaurants, interestingly, saw a +1.4 point improvement in risk scores—indicating increased stability and better adaptation to current market conditions. In contrast, grocery retailers—the benchmark for “eat-at-home” sectors—experienced a -1.8 point drop in their risk scores, highlighting greater strain in that segment. This divergence reflects a growing consumer shift toward lower-cost food options like quick-service dining, potentially at the expense of both full-service restaurants and grocers. What It Means for Lenders and Business Strategy These trends carry significant implications for financial institutions, credit providers, and small business advisors: Rising inquiries + shrinking credit limits = greater risk of liquidity stress Stronger risk scores for Limited-Service = opportunity for more targeted lending or product offerings Elevated utilization rates = need to monitor credit performance closely, especially for revolving credit For business owners and operators, understanding these dynamics is crucial to building resilience in a volatile market. Strategic decisions around financing, menu pricing, staffing, and technology adoption will likely make or break performance through the next few quarters. Conclusion: A Sector Under Pressure — but not out While economic headwinds persist, the restaurant industry shows remarkable adaptability. Whether it’s shifting toward leaner operations, targeting lower-income consumers, or increasing credit usage to bridge cash flow gaps, the sector is evolving in real-time. As always, Experian’s insights provide a critical lens into these movements—helping lenders, business leaders, and policymakers make smarter decisions amid uncertainty. For the full analysis, including all small business credit trends, read the latest Experian Commercial Pulse Report. ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

The Experian Small Business Index™ shows a modest rebound, improving 4.6 points month-over-month. August 2025 Index Value (Aug): 37.4 Previous Month: 32.8 MoM: +4.6 YoY: -8.8 (Aug 2024 = 46.2) The Experian Small Business Index™ rebounded in August, up 4.6 points to 37.4. After slowing in the first half of the year, early data suggests the US economy is set to expand at a solid rate in the third quarter. The Fed cut interest rates by 25bp and signaled two additional 25bp cuts by the end of the year, which should help stimulate economic growth. The NFIB Small Business Optimism Index increased slightly in August to 100.8 from 100.3, the highest level since January 2025, on forecasts of better-than-expected growth in the upcoming months. However, the University of Michigan’s consumer sentiment continued to decline, as unemployment edged up slightly and job growth has been weak. Entrepreneurs continue to see this as a good time to start a business, with 474K new businesses launched in August, up from 471K in July. Explore Experian Small Business Index Related Posts

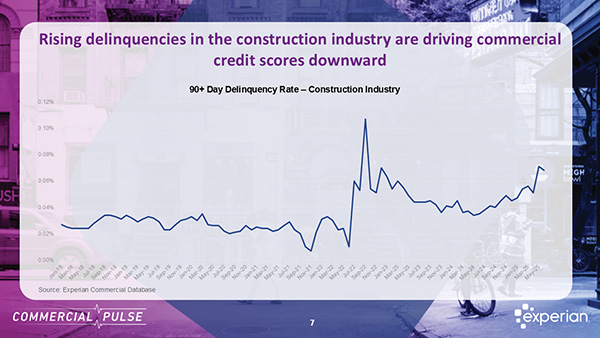

This week Experian focuses on the growing construction industry and early warning risk signals for lenders and risk managers.

Discover how small businesses have transformed since the pandemic, from digital adoption to growth resilience, in Experian’s latest report.

The Experian Small Business Index™ declined month-over-month by almost 12 points. July 2025 Index Value (Jul): 32.8 Previous Month: 44.7 MoM: -11.9 YoY: -16.8 (Jul 2024 = 49.6) The Experian Small Business Index™ declined in July to 32.8, down 11.9 points. Small businesses still look healthy, but business owners are starting to show some stress in their consumer credit profiles. The primary driver was tighter lending conditions, which reduced approval rates and increased delinquencies for consumers. Pressure has built on the small business owner due to rising student loan defaults and a softer labor market, which is beginning to erode consumer credit health. Inflation has remained even, with slight upticks in some sectors and slight decreases in others. Rent inflation continues a downward trend; it was 3.8% in June, down from 3.9% in May. Producer price inflation was also down 0.4 points to 2.3%, reaching its lowest level since September 2024. Some sectors had inflation rise, with food inflation up slightly from May to 3.0% from 2.9%, overall inflation was up 2.7% in June from 2.4% in May, and core inflation increased from 2.8% in May to 2.9% in June. The savings rate decreased to 4.5% in May, down from 4.9% in April, as consumers continue to spend. Explore Experian Small Business Index Related Posts