Small Business Credit Insights

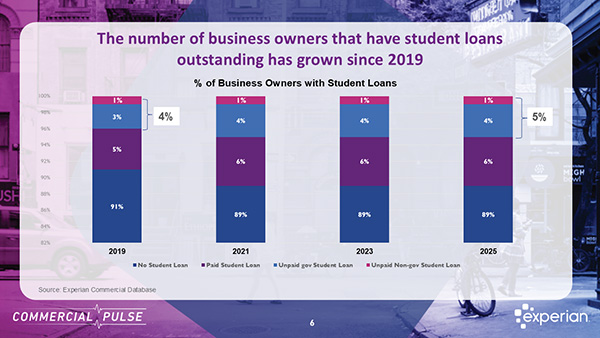

Experian Commercial Pulse Report - Business owners with unpaid student loans carry a higher risk for lenders.

The Great Recalibration Experian is very pleased to announce the release of the Q2 2025 Main Street Report. Brodie Oldham from Experian Commercial Data Science unpacks insights from the latest Main Street Report. Watch Quarterly Business Credit Review Webinar Main Street Recalibrates for a New Normal U.S. small businesses are demonstrating exceptional adaptability amid a complex post-pandemic economic environment. Inflation remains elevated above 3%, interest rates are steady between 4.25% and 4.50%, and global trade dynamics continue to introduce volatility. Despite these pressures, small firms are showing resilience, driven by improved digital capabilities, disciplined fiscal management, and a steady flow of entrepreneurial activity. In Q2 2025, an average of 447,000 new business applications were filed, with significant contributions from minority and younger founders. The Experian Small Business Index™ held steady, credit conditions remained tight. Traditional lenders continued to restrict approvals, with just 13% of applications approved by large banks. In response, small businesses increasingly turned to fintech and embedded finance solutions for faster, data-driven access to capital. Borrowing behaviors are shifting. The average small business credit card APRs now exceed 25%, firms are transitioning toward installment loans that offer structured repayment terms. Download the latest report for more insight. Download Q2 Main Street Report Related Posts

The experts from Experian reviewed recent small business credit performance. Experian’s Brodie Oldham, VP of Commercial Data Science, and Marsha Silverman, Strategic Analytic Consultant revealed several insights on how small businesses are performing during the Q2 Quarterly Business Credit Review. Inflation was also a big focus of the webinar. Brodie talked about inflation trends and highlighted insights from a recent CFO survey conducted with the Richmond Fed. It says more than 40% of CFOs expect to pass increased costs on to consumers, impacting inflation in both goods and services sectors. Brodie also explored the Federal Reserve's potential actions as inflation rises alongside a softening labor market and strong economy. Will we see a rate cut this year? Marsha Silverman explored the significant increase in new business formations in the United States following the pandemic. Before COVID-19, approximately 300,000 businesses were registering monthly with the US Census, but this number has surged to around 440,000 per month – a 50% increase. This growth is evident across all regions, especially in the southern US, driven by population migration to warmer climates. Additionally, Experian talked about the impact on lending, noting a rise in commercial credit issued to younger businesses within their first two years. Originally Presented:Date: Tuesday, August 19th, 2025Time: 10:00 a.m. (Pacific) / 1:00 p.m. (Eastern) Audience Poll Responses During the webinar we asked the audience the following questions and here is how they responded. Which macroeconomic factor is having the greatest impact on small business credit conditions this year? What actions if any have you taken in 2025 in response to additional tariff ? How are small businesses adapting to tighter credit conditions in 2025? Our Presenters: More reasons to watch: Leading Experts on Commercial and Macro-Economic Trends Credit insights and trends on 30+ Million active businesses Industry Hot Topics Covered (Inclusive of Business Owner and Small Business Data) Commercial Insights you cannot get anywhere else Peer Insights with Interactive Polls (Participate) Discover and understand small business trends to make informed decisions Actionable takeaways based on recent credit performance Watch On-Demand Related Posts

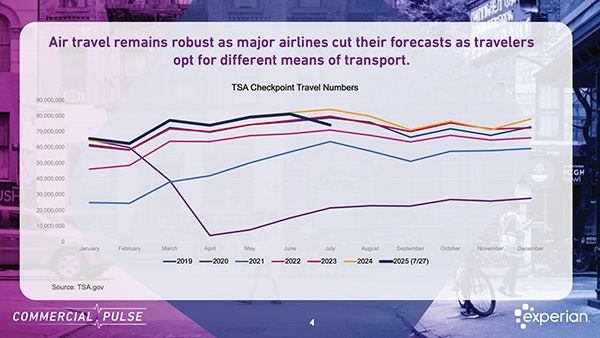

As temperatures rise across the U.S., so does the nation’s appetite for travel—and the Leisure & Hospitality sector is feeling the heat. In this week's Commercial Pulse Report, we examine how soaring consumer demand intersects with evolving credit conditions for businesses in travel, lodging, and transportation. Travel Rebounds, But the Story Is Mixed By every measure, Americans are traveling in droves. AAA projected over 72 million domestic travelers over the July 4th holiday—setting a record. Meanwhile, Memorial Day travel surged across all transportation types, especially road trips, which saw a 3.0% year-over-year increase. However, despite six new TSA checkpoint records in June, major airlines have cut forward-looking forecasts, signaling a notable shift: travelers are increasingly opting for alternatives like road and rail over the skies. This change in travel behavior has direct implications for how different business subsectors access and manage credit. Infrastructure Drives Commercial Credit Trends The Leisure & Hospitality industry is broad and fragmented—from mega-airlines and hotel chains to small sightseeing operators and independent RV campgrounds. This diversity is reflected in commercial credit data. Businesses with heavy infrastructure needs—like airlines and hotels—tend to carry higher loan and credit line balances. Airlines, in particular, average the highest number of commercial trades, a reflection of their large-scale operations and capital intensity. Hotels also hold sizeable credit, but with a twist. While revenues have rebounded beyond pre-pandemic levels, occupancy rates remain flat due to an increase in room supply from new construction. The hotel pipeline stood at 6,211 projects with over 722,000 rooms as of Q3 2024, signaling sustained investment even amid margin pressures. Rental Cars: High Volume, Higher Risk The rental car sector stands out—but not in a good way. Despite being a key enabler of domestic travel, these businesses exhibit the highest commercial credit risk across the industry. According to Experian’s Commercial Risk Classification, 32% of rental car companies are considered Medium-High to High Risk, compared to less than 10% in categories like air transport and sightseeing. The elevated risk may be due to a combination of factors: fleet acquisition costs, multi-location exposure, and operational disruptions during the pandemic. While credit trades in this segment remain high, inquiries have declined over recent years, possibly reflecting tightening lending standards or constrained demand for new credit. Encouraging Risk Trends—With Exceptions Across the broader Leisure & Hospitality industry, there’s been a decline in commercial credit risk since 2020. The share of businesses classified as Medium-High or High Risk dropped from 11.7% to 8.5% as of April 2025. Most firms now fall into the Medium Risk category—a sign of normalization in the sector. Delinquency rates remain low (under 1%), and the average Intelliscore Plus v2 score has remained stable across most subsectors. Still, credit conditions vary sharply by business type, underlining the importance of nuanced risk assessment in portfolio management. Smarter Credit Allocation Starts with Subsector-Level Insight The summer travel surge is a powerful reminder of the sector’s resilience—but not all players are experiencing the boom equally. For credit professionals and commercial lenders, the latest data from Experian suggests a growing divide: infrastructure-heavy firms are leaning into credit, while high-risk subsectors like rental cars may warrant closer scrutiny. Whether your clients are in air transport or roadside accommodations, understanding these credit trends will be key to navigating the second half of 2025. ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

The Experian Small Business Index™ was stable month-over-month, with a slight decrease to 44.7 in June. June 2025 Index Value (Jun): 44.7 Previous Month: 45.2 MoM: -0.5 YoY: -10.7 (Jun 2024 = 55.4) The index has evened out and remains relatively stable as the economy continues to operate on sound footing. Unemployment remains low and hourly wages continue to increase, and the economy added 147K jobs in June, a slight increase over May. Consumers are optimistic, and sentiment increased to 60.7, up from 52.2 in May. Small business optimism was steady at 98.6 in June, 0.2 points lower than May. Consumers continue their trend of starting new businesses, with 457K launched in June, a 2.2% increase over May. Inflation has remained even, with slight upticks in some sectors and slight decreases in others. Rent inflation continues a downward trend; it was 3.8% in June, down from 3.9% in May. Producer price inflation was also down 0.4 points to 2.3%, reaching its lowest level since September 2024. Some sectors had inflation rise, with food inflation up slightly from May to 3.0% from 2.9%, overall inflation was up 2.7% in June from 2.4% in May, and core inflation increased from 2.8% in May to 2.9% in June. The savings rate decreased to 4.5% in May, down from 4.9% in April, as consumers continue to spend. Explore Experian Small Business Index

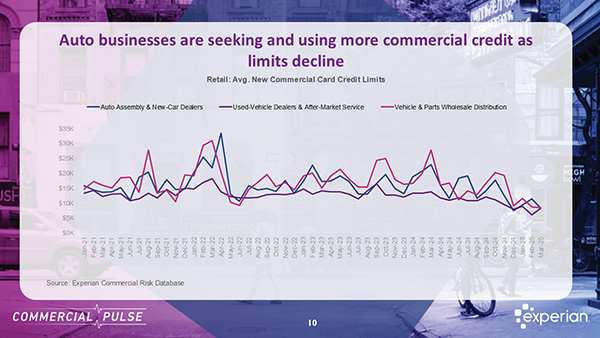

Experian's latest Commercial Pulse Report reveals rising car prices drive demand for used vehicles as commercial credit lines for b2b decline

Small Businesses remain resilient amid rate uncertainty and signs of job market weakness May 2025 Index Value (Apr): 45.2 Previous Month: 43.2 MoM: +2.0 YoY: -9.8 (May 2024 = 55.0) Last month’s dip was short-lived as May's economic figures remained strong, showcasing the continued resilience of the U.S. economy. Reduced tariffs, especially on China, eased market concerns amid ongoing trade talks. The unemployment rate remained steady at 4.2% and wages continued to rise. New business starts remained stable at 447K in May, close to the monthly average of 441K since July 2020, and still well above pre-pandemic levels. Consumer sentiment and small business optimism increased after recent declines, though uncertainty still affects these surveys. Consumer sentiment was 98.8 in May, a 3-point increase over April, but 11% lower than a year ago. Inflation news was mixed: overall and food inflation saw slight upticks, while core inflation stayed flat and rent inflation dropped to its lowest since November 2021. The Fed's cautious approach persists, but predictions of a rate cut in the coming months are growing as inflation remains relatively steady and potential signs of job market weakness emerge. Explore Experian Small Business Index

Experian Commercial Pulse Report reveals decline in total number of ecommerce businesses, strong revenue, and fewer credit inquiries.

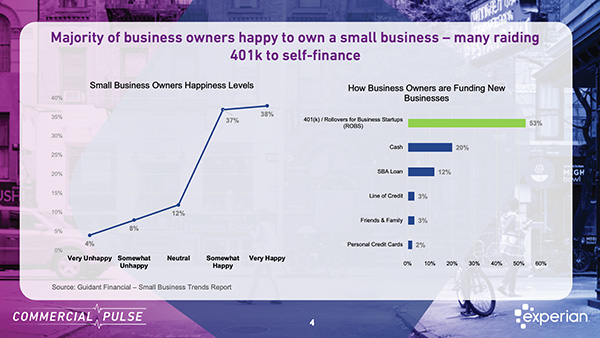

Commercial Pulse Report | 6/17/2025 Economic uncertainty is often seen as a deterrent to growth, but for many Americans, it’s become the fuel for a fresh start. As inflation wavers and traditional employment structures shift, more individuals are stepping out of corporate roles to pursue business ownership. In this week's Commercial Pulse Report, we take a closer look at what's driving this wave of entrepreneurial activity. Gen X Leads the Charge Toward Self-Employment According to Guidant Financial's 2025 Small Business Trends report, Generation X is leading the charge. Many in this age group are opting out of traditional career paths, motivated by a desire for autonomy, flexibility, and a more purposeful work life. According to Guidant’s report, Gen X holds the largest share of U.S. small business ownership, with a significant portion of these entrepreneurs transitioning from established careers. What’s driving this shift? Dissatisfaction with corporate life and a strong desire to be one’s own boss are leading motivators. It’s a story of experienced professionals reevaluating priorities and seeking more control over their financial future. And it appears to be a fulfilling decision—75% of small business owners report being happy with their choice to go independent. Retirement Savings Power New Ventures A surprising—but telling—statistic in ’s report: 53% of new business owners used 401(k) retirement funds to launch their ventures. This trend underscores a growing willingness to invest personal wealth into long-term entrepreneurial aspirations. Known as Rollovers as Business Startups (ROBS), this approach allows individuals to use retirement funds without early withdrawal penalties. It’s a bold move, signaling high confidence among business owners—but also highlighting gaps in access to traditional funding channels. Entrepreneurs are taking on more personal risk, in part because institutional capital isn't always accessible to young businesses. Interestingly, 56% of all new businesses are either newly founded or existing independent ventures, showing a diverse range of entrepreneurial approaches—from solo startups to revitalized legacy brands. The Credit Dillema for Young Businesses Experian’s data shows that businesses under two years old account for more than 50% of new commercial card originations. These companies are opting for credit cards over term loans due to fewer barriers to entry, but this often means lower funding limits. Meanwhile, newer businesses face steeper challenges securing traditional loans. They now represent just 15% of term loan originations, down from 27% in 2022. For lenders, policy makers, and service providers, these trends underscore the need to rethink how we support emerging businesses. From alternative funding tools to better credit-building pathways, there’s a growing opportunity to empower America’s newest entrepreneurs. Stay Ahead with Experian ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts