Topics

Discover how Experian’s Fraud Investigation Report unifies fraud and credit scoring to help risk managers detect threats early, streamline onboarding, and make smarter lending decisions.

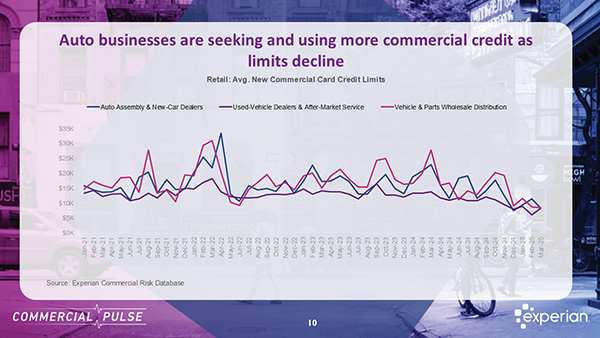

Experian's latest Commercial Pulse Report reveals rising car prices drive demand for used vehicles as commercial credit lines for b2b decline

Experian Commercial Pulse Report reveals decline in total number of ecommerce businesses, strong revenue, and fewer credit inquiries.

Blended credit scores combine personal and business data. Learn how they boost financial inclusion and help lenders make smarter decisions.

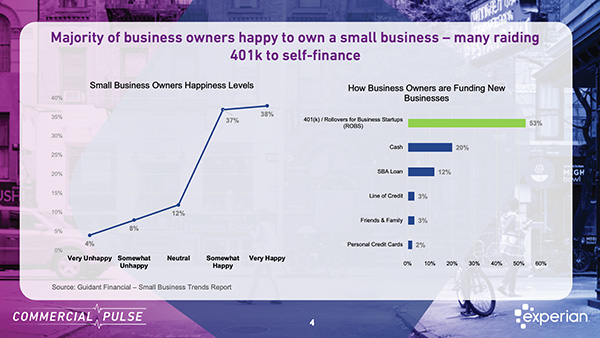

Commercial Pulse Report | 6/17/2025 Economic uncertainty is often seen as a deterrent to growth, but for many Americans, it’s become the fuel for a fresh start. As inflation wavers and traditional employment structures shift, more individuals are stepping out of corporate roles to pursue business ownership. In this week's Commercial Pulse Report, we take a closer look at what's driving this wave of entrepreneurial activity. Gen X Leads the Charge Toward Self-Employment According to Guidant Financial's 2025 Small Business Trends report, Generation X is leading the charge. Many in this age group are opting out of traditional career paths, motivated by a desire for autonomy, flexibility, and a more purposeful work life. According to Guidant’s report, Gen X holds the largest share of U.S. small business ownership, with a significant portion of these entrepreneurs transitioning from established careers. What’s driving this shift? Dissatisfaction with corporate life and a strong desire to be one’s own boss are leading motivators. It’s a story of experienced professionals reevaluating priorities and seeking more control over their financial future. And it appears to be a fulfilling decision—75% of small business owners report being happy with their choice to go independent. Retirement Savings Power New Ventures A surprising—but telling—statistic in ’s report: 53% of new business owners used 401(k) retirement funds to launch their ventures. This trend underscores a growing willingness to invest personal wealth into long-term entrepreneurial aspirations. Known as Rollovers as Business Startups (ROBS), this approach allows individuals to use retirement funds without early withdrawal penalties. It’s a bold move, signaling high confidence among business owners—but also highlighting gaps in access to traditional funding channels. Entrepreneurs are taking on more personal risk, in part because institutional capital isn't always accessible to young businesses. Interestingly, 56% of all new businesses are either newly founded or existing independent ventures, showing a diverse range of entrepreneurial approaches—from solo startups to revitalized legacy brands. The Credit Dillema for Young Businesses Experian’s data shows that businesses under two years old account for more than 50% of new commercial card originations. These companies are opting for credit cards over term loans due to fewer barriers to entry, but this often means lower funding limits. Meanwhile, newer businesses face steeper challenges securing traditional loans. They now represent just 15% of term loan originations, down from 27% in 2022. For lenders, policy makers, and service providers, these trends underscore the need to rethink how we support emerging businesses. From alternative funding tools to better credit-building pathways, there’s a growing opportunity to empower America’s newest entrepreneurs. Stay Ahead with Experian ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

Discover how blended credit data aggregates help B2B firms build custom risk models, evaluate solopreneurs, and deepen customer relationships during market shifts.

This handy guide explains the practice of Credit Portfolio Management, managing, and monitoring all aspects of your company's credit portfolio.

Experian’s Sentinel™ Commercial Entity Fraud Suite received a silver medal for "Best Know Your Customer/Business (KYC/KYB) Innovation.

Discover how business identity theft threatens B2B firms and learn effective strategies to protect your business and clients. Stay informed and secure.