Commercial Insights

Articles related to Experian small business commercial insights.

Experian's latest Commercial Pulse Report reveals rising car prices drive demand for used vehicles as commercial credit lines for b2b decline

Experian Commercial Pulse Report reveals decline in total number of ecommerce businesses, strong revenue, and fewer credit inquiries.

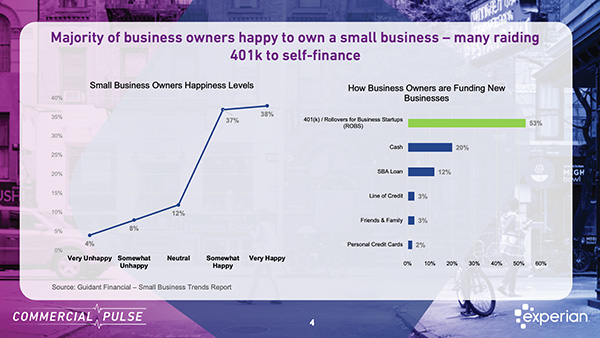

Commercial Pulse Report | 6/17/2025 Economic uncertainty is often seen as a deterrent to growth, but for many Americans, it’s become the fuel for a fresh start. As inflation wavers and traditional employment structures shift, more individuals are stepping out of corporate roles to pursue business ownership. In this week's Commercial Pulse Report, we take a closer look at what's driving this wave of entrepreneurial activity. Gen X Leads the Charge Toward Self-Employment According to Guidant Financial's 2025 Small Business Trends report, Generation X is leading the charge. Many in this age group are opting out of traditional career paths, motivated by a desire for autonomy, flexibility, and a more purposeful work life. According to Guidant’s report, Gen X holds the largest share of U.S. small business ownership, with a significant portion of these entrepreneurs transitioning from established careers. What’s driving this shift? Dissatisfaction with corporate life and a strong desire to be one’s own boss are leading motivators. It’s a story of experienced professionals reevaluating priorities and seeking more control over their financial future. And it appears to be a fulfilling decision—75% of small business owners report being happy with their choice to go independent. Retirement Savings Power New Ventures A surprising—but telling—statistic in ’s report: 53% of new business owners used 401(k) retirement funds to launch their ventures. This trend underscores a growing willingness to invest personal wealth into long-term entrepreneurial aspirations. Known as Rollovers as Business Startups (ROBS), this approach allows individuals to use retirement funds without early withdrawal penalties. It’s a bold move, signaling high confidence among business owners—but also highlighting gaps in access to traditional funding channels. Entrepreneurs are taking on more personal risk, in part because institutional capital isn't always accessible to young businesses. Interestingly, 56% of all new businesses are either newly founded or existing independent ventures, showing a diverse range of entrepreneurial approaches—from solo startups to revitalized legacy brands. The Credit Dillema for Young Businesses Experian’s data shows that businesses under two years old account for more than 50% of new commercial card originations. These companies are opting for credit cards over term loans due to fewer barriers to entry, but this often means lower funding limits. Meanwhile, newer businesses face steeper challenges securing traditional loans. They now represent just 15% of term loan originations, down from 27% in 2022. For lenders, policy makers, and service providers, these trends underscore the need to rethink how we support emerging businesses. From alternative funding tools to better credit-building pathways, there’s a growing opportunity to empower America’s newest entrepreneurs. Stay Ahead with Experian ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

Experian Summer Beyond The Trends Report Now Available We are excited to announce the release of the Summer 2024 Beyond the Trends report. The report offers a unique view of the small business economy based on what we see in the data. With up-to-date information on over 33 million active businesses and how they perform from a credit standpoint, in this report, Experian shares insights and commentary on how economic conditions, public policy, and other factors might shape future small business performance. Here's our V.P. of Commercial Data Science, Brodie Oldham with his quick take. Overall, the sentiment among small businesses regarding growth is cautiously optimistic. Optimism Despite Challenges There is a general sense of optimism reflected in the U.S. Chamber of Commerce Small Business Index, which has risen to 69.5. Additionally, 73% of small businesses expect higher revenues, and 46% plan to increase investments, indicating positive growth expectations despite facing persistent challenges such as inflation, worker shortages, and rising operational costs. Government Support and Initiatives Various government programs and initiatives are bolstering small business growth by improving access to capital and providing targeted support. These initiatives include the Investing in America Small Business Hub, expansion of Women’s Business Centers, and improvements in the 7(a) and 504 Loan Programs, all aimed at facilitating job creation, growth, and sustainability. Technological Adaptation The adoption of AI and other advanced technologies by small businesses is enhancing operational efficiency and cutting costs. A significant increase in the use of AI-driven systems, such as CRM and automated inventory management, indicates that small businesses are leveraging technology to drive growth and stay competitive. Resilience Amid Economic Pressures Despite facing economic headwinds like tighter credit conditions due to higher interest rates and ongoing supply chain disruptions, small businesses have shown resilience. They continue to navigate these challenges by employing innovative strategies and adapting to the evolving economic landscape. Download your copy of the latest report and check out more insights on small businesses on our Commercial Insights Hub where you can subscribe to updates. Download Beyond The Trends Report Commercial Insights Hub

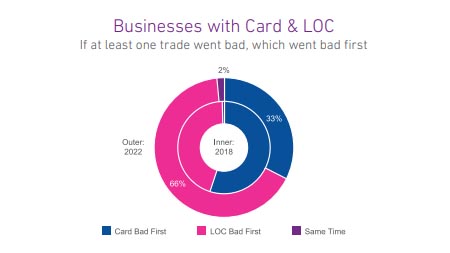

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

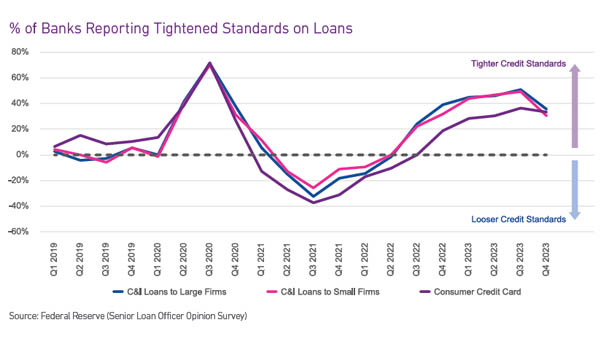

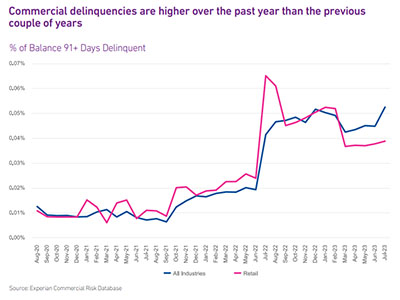

Small business owners’ optimism remains low due to concerns about the economy and credit conditions. According to the NFIB survey, business owners do not expect current business conditions to improve in the coming months and report that financing is their top business problem. Stringent credit underwriting policies are creating an environment where owners’ current borrowing needsare not met. According to the Federal Reserve’s SLOOS report, many lenders were loosening credit policies in mid-2022, making credit readily available to small business owners. As inflation and interest rates began to rise, commercial credit delinquencies began to increase at a rapid pace and lenders tightened credit underwriting criteria to mitigate accelerated risk. It appears that efforts have worked. Across most commercial credit financial products, the increase in delinquency rates slowed over the past few months. The loans originated under the tighter underwriting is proving to be lower risk. At the same time, account closures have increased suggesting that high risk default accounts are being removed from lenders portfolio’s thus leveling late-stage delinquency curves. As observed in the commercial credit cards space, late-stage delinquencies are leveling out. Lenders continue to issue commercial cards to lower-risk borrowers and while the average loan/line amount for all other financial products has been decreasing month over month, commercial card limits have increased. Monthly lower risk commercial card originations coupled with monthly high risk commercial card account closures is in part slowing and leveling late-stage delinquency rates in the commercial credit market. What I am watching The commercial credit market could shift in 2024. As reported in the SLOOS survey, while lenders are still tightening credit, fewer of them tightened in Q4 2023. If the economy can achieve a “soft-landing” rather than go into recession, lenders will be even more likely to loosen credit standards. The Federal Reserve is expected to start reducing interest rates in 2024, thereby making borrowingmore affordable. According to the December NFIB survey, business owners are planning capital outlays, increases in inventory, increases in hiring in the coming months but require commercial credit to do so. These business expansions will rely on the availability of credit.

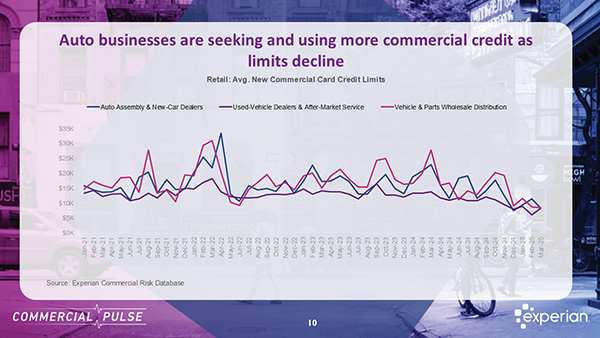

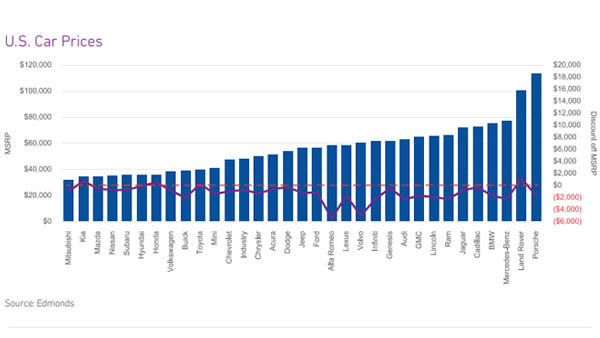

As new car production is finally nearing pre-pandemic levels, supply is catching up to demand. For many potential new car buyers that held off because of the tremendous mark-up on new and usedcars during the pandemic, the beginning trend of new car incentives and discounts is welcoming. However, the increase in car loan interest rates are eating up any incentives being offered, and those consumers who have patiently waited are actually worse off now than if they had purchased a car during the past couple of years. Many consumers did purchase cars during the pandemic, driven by necessity. During the pandemic, jobs were lost due to business shuts downs, and many were forced to seek new job opportunities. As remote work became the new normal and the demand for delivery of food and products skyrocketed, people purchased cars at marked up prices to employ themselves to meet this increasing demand. It turned out to be a good business decision as higher interest rates now make car purchasing an even more expensive experience. What I am watching: It will be interesting to see how quickly the automotive industry and car dealers increase the incentives to offset the increased cost of borrowing to purchase a car. After the aggressive interest rate increases by the Federal Reserve to combat inflation over the past 18 months, there is rumbling that the Fed will soon begin cutting rates. If interest rates come down and borrowing for auto loans is more reasonable, the increase in demand will be a welcome sight for the auto sector that finally was able to ramp up supply.

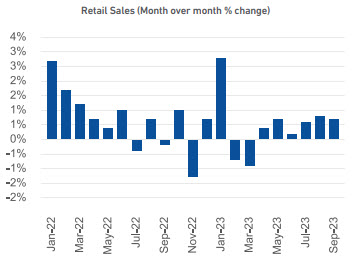

The perception of economic conditions among small business owners grows more pessimistic with the NFIB optimism index still well below the 49-year average and a persistent belief that access to borrowing is likely to get worse. With inflation coming in at 3.7%, still stubbornly above the Fed’s 2% target, it is possible there will be more rate hikes in the coming months, which will make the cost of borrowing even higher. At the same time, small businesses are facing higher financing costs, the cost of labor continues to increase as workers can demand higher wages as employers struggle to find qualified workers for all their open positions. Meanwhile, there are still many signs pointing to a strong economy despite these challenges. Unemployment is still very low by historical standards as noticed by employers trying to fill open positions. Consumer spending continues to be strong with retail sales experiencing their sixth month-over-month gain in a row. As for credit tightening, both businesses and lenders report tightening but it may not be as bad it seems. Regular borrowing by small businesses on a monthto-month basis has recovered to pre-pandemic levels suggesting that even as borrowing costs are higher, small businesses still do have access to credit. New term loans are showing the average loan amount increasing and the number of new originations is only down 3% from the last quarter. Revolving accounts are faring less favorably but are also more likely to have variable interest rates that are sensitive to the increase in Fed rates. What I am watching: The Fed will have a difficult decision to make about interest rates at their next meeting on November 1 and in the coming months. Inflation has come down dramatically from its peak, but progress has stalled in the last few months. Unemployment is still very low and consumer spending is strong, but consumer and small business optimism is down. Housing costs are very high and high interest rates have slowed home sales as the cost to enter is high and existing homeowners are reluctant to sell. All these mixed signals make the path forward to achieve the coveted soft landing difficult to navigate and different Fed chairpersons have indicated different ideas on the matter. How the economy continues to fair in the coming holiday season and the response of the Fed to those conditions will be very closely followed as a result.

The labor market remains robust with low unemployment (3.8%) and 366K new jobs created in September. Job openings in the U.S. were 9.6MM as of the end of August, an increase of 690K or 5.8% since July. Retail sales in August had a month-over month increase for the fifth consecutive month. As we head into the holiday shopping season, despite headlines of large retailers struggling, the retail industry appears poised for success. It is likely that those retail businesses that survived the difficulties of the pandemic are the most financially sound and are driving the statistics. Over the past year, retailers are seeking less credit and taking on less debt than the previous few years. Despite inflation, consumers are still spending, and retailers are benefitting. Commercial delinquencies have been increasing over the past year. Delinquencies within the retail sector were trending above overall commercial delinquencies until just a few months ago when retailers exhibited lower rates than overall. These are all positive signs heading into the holiday shopping season which tends to make or break a retailer’s year. The September labor report was stronger than expected. Unemployment remained low at 3.8% and 366K new jobs were created which was the highest amount since January. In addition, the jobs created in July and August were revised upward significantly. What I am watching: With the labor market still tight, it will be interesting to see if the retail sector will be able to staff accordingly to support the holiday crunch. If staffing is difficult, retail stores may struggle to keep up with demand. Now that the student loan moratorium has ended, it will be important to monitor the impact to consumer spend. The increased expense of the student loan monthly payments will likely leave individuals with less discretionary income to spend on retail purchases. In addition, business owners who have student loans will have less money to invest in their business