Commercial Insights

Articles related to Experian small business commercial insights.

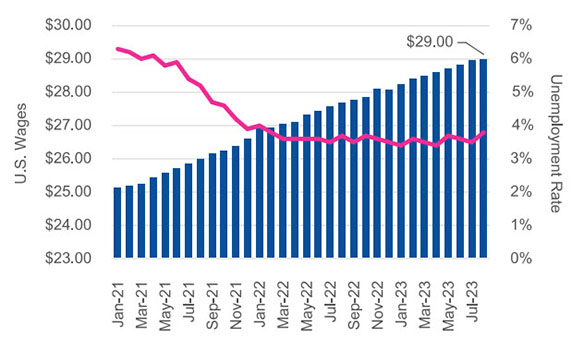

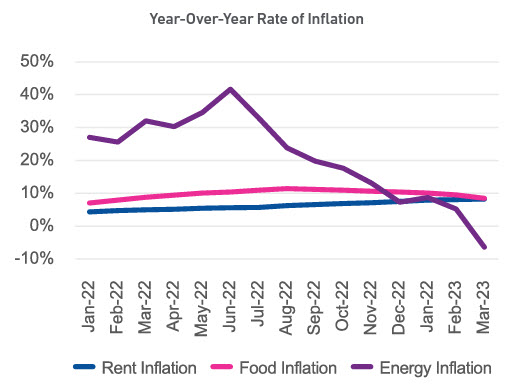

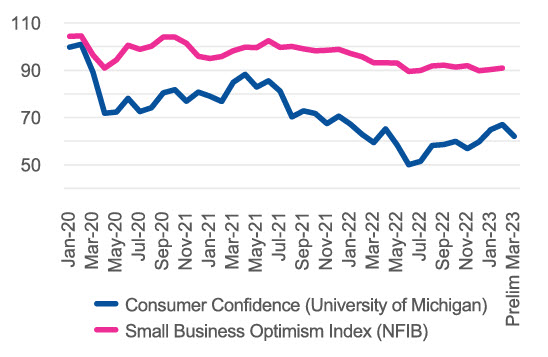

Since the height of the COVID-19 pandemic, the commercial real estate market is experiencing a paradigm shift as office professionals acclimated quite well to working from home, and many balk at going back to the office. As vacancy rates for offices hit record highs, supply of office space is greater than demand, reducing the value of many commercial properties. In parallel, The Federal Reserve’s 500bps of interest rate increases since March 2022 have made it more expensive for property owners to borrow and has left commercial real estate (CRE) lenders fearing greater risk of default will occur in the near future. August unemployment increased to 3.8% from 3.5% in July and is the highest since February 2022. Low unemployment continued to drive wages up with August wages reaching $29 per hour In anticipation of higher losses, CRE lenders are tightening their lending criteria, requiring higher down payments, shortening the loan term, and selling off or diversifying their CRE portfolios. Contrary to recent trends in office space pricing, and also contrary to impressions driven by media coverage focusing on increasing mall vacancies and mall closures, retail real estate appears to be rebounding since the pandemic. The average monthly rent per square foot for retail space has been increasing across the United States since the start of the pandemic. What I am watching There has been interest in re-purposing vacant commercial spaces into multi-family rental properties. As vacancies rise in office buildings and in some large urban malls, more CRE buildings are transitioning to hybrid residential/commercial spaces. A significant increase in residential living spaces should drive housing costs down, which would be a tremendous benefit to the public and help curb inflation. The labor market remains resilient but there are signs of weakening. While unemployment remained low at 3.8% in August, it is the highest since February 2022. The three-month moving average of jobs created in the U.S. declined to under 150K for the first time in a few years. If the labor market continues to weaken, employees will have less bargaining power and it is possible that employers will require workers to come back to work in-person in offices full time. If that comes to fruition, CRE owners and lenders will be in a much better position. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Since the height of the COVID-19 pandemic, new businesses are opening at a record pace. New businesses tend to be smaller based on number of employees as well as annual revenues. While new businesses make up a greater portion of new commercial credit accounts, they receive less credit.

The post-pandemic economic landscape is experiencing an alarming rise in fraudulent activity affecting both businesses and consumers. With 75% of creditors experiencing heightened fraud losses and a 50% increase in fraud reports as per the FTC, the situation grows increasingly challenging. The expansion of e-commerce and the increasing sophistication of the dark web as a marketplace for stolen data exacerbate cybercrime threats. Moreover, lenders struggle to differentiate vast numbers of newly-formed businesses from bad actors due to limited data history available for decisioning. Amidst this, while Artificial Intelligence offers substantial promise in combatting fraud, it also significantly expands fraudsters’ toolboxes and poses significant fraud risks to creditors and consumers. To address these pressing concerns, businesses must step up their fraud risk management game by proactively adopting new fraud detection data and capabilities, and by integrating commercial entity and consumer data into their fraud decisioning strategies. What I am watching: The latest inflation report and jobs report showed positive news for the economy. Unemployment remains low and job creation is slowing but still strong. Inflation was down to 3% in June, the lowest in over two years, and closing in on the Fed’s target of 2%. Despite earlier indications of more interest rate hikes this year, this encouraging news may lead the Fed to leave interest rates alone at their upcoming July meeting. Subscribe Today Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

As of Q1 2023, Metropolitan-Core contained 78.1% of businesses, up from 76.3% in Q1 2018. The growth came despite high vacancy rates in offices due to the rise in telecommuting. Remote working has been around for a long time, but became vastly more prevalent during the COVID-19 pandemic when people were required to stay home but employers wanted to continue business operations. As the height of the pandemic gets farther in the rearview mirror, more employers are requiring employees to come back to the office. However, more workers are still working remotely, at least part of the time, than before the pandemic. With fewer people going into offices, there is a shift of population clustering in metro-centers where office buildings are located to areas outside of the metropolitan-core in more suburban and rural areas. With more people spending more time closer to their homes, they patronize businesses near their homes, driving the post-pandemic growth rate of businesses opening to be much greater outside of the metropolitan-core areas. The labor market continues to be robust. 339K jobs were created in May, the most in four months, and way above market forecasts of 190K. On the flip side, unemployment ticked up in May 3.7% from 3.4% in April, and is now the highest level since October 2022. What I am watching: The high rate of post-pandemic new business openings is fueled by small businesses with fewer than 20 employees. Some of the businesses are even home-based side jobs by individuals working remotely for their primary job. It will be interesting to see how many of these small businesses can survive through the expected upcoming economic slowdown or recession. With higher interest rates and commercial lenders tightening criteria, businesses that are struggling will have a tough time securing financing to weather any upcoming storms. Now that the Federal government raised the debt-ceiling and averted a government default, all eyes will turn back to the Federal Reserve’s battle to fight inflation. They indicated a pause in interest rate increases starting with their June 14th meeting. However, with the labor market still robust, the Fed’s decision may be a swayed by the May inflation report that is scheduled for release on June 13th. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

Women led businesses lag behind on venture capital funding, and are turning to commercial loans and lines to bridge the gap Start-ups founded or cofounded by women receive only 44% of financial backing, but generate more revenue. While it is very encouraging to see the progress of women in business advancing, the pace of progress is slow and more could be done to achieve parity. Women’s salaries are slowly catching up, but they are still only about 80% of men’s wages. There are continued barriers to mothers participating in the labor force due to the limited capacity of childcare facilities, the high costs to families for childcare, and the low wages for childcare workers making lower skilled work sometimes more attractive in a tight labor market. These forces disproportionately affect women whether they work for wages or work for themselves as a small business owner. In addition to the issues facing women as workers, there are unique challenges they face as start-up founders as well. There is a known disparity in the funding provided to start-up businesses pitched by a woman versus a man and that is leaving women without the full funding they need to launch new businesses successfully. Added diversity within venture capital and angel investor groups could help change this dynamic so women can access that capital and expertise when launching their businesses at the same rate as their male counterparts. Without this, they are left to rely on self-funding and loans from banks — if they can get approved. The good news is that many women are making it work and the number of successful women-owned businesses continues to climb. What I am watching: The debt-ceiling standoff continues to cause uncertainty in the financial system with no compromise in place and a looming June 1 deadline, according to Secretary Janet Yellen. This situation is going to dwarf all others until there is a resolution, so all eyes are going to be on Congress and the President. Other signs in the economy suggest that inflation may finally be responding to the aggressive interest rate hikes enacted by the Fed. The Fed will have a more difficult decision on whether to raise interest rates one more time in June or hold them steady and wait to see if inflation continues to improve. Subscribe Today Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out.

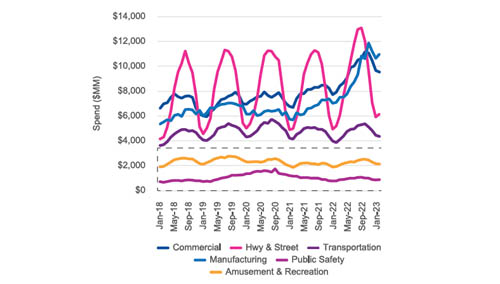

In its continued efforts to tame inflation, the Federal Reserve increased interest rates ¼ point last week, the tenth consecutive increase in just over a year. The cumulative increase is 500bps since March 2022, bringing the Fed Funds rate to 5.00%-5.25%, which is the highest since 2007. While inflation is still above the Fed’s target rate of 2%, they indicated a pause in rate increases. The labor market continues to be strong with April unemployment down to 3.4%, matching the low of January which is the lowest unemployment since 1969. Despite all the efforts by the Fed to have a soft landing, the economy could be upended if Congress does not increase the debt ceiling soon. With inflation slowing, and the labor market strong, a soft landing is possible. Treasury Secretary Yellen said the U.S. could default on debt as early as June 1st. If the U.S. defaults on outstanding debt, many forecast disastrous impacts to the world economy. Despite the recent decline in residential construction spending, construction spend remains strong in both residential and non-residential sectors. The construction industry is one of the few industries that saw a boom throughout the pandemic. Even though over the past few months both residential and non-residential experienced a decline in construction starts and construction spend, the volumes remain above pre-pandemic levels. High construction demand is being met with the formation of many new construction companies. New construction companies are seeking credit at a higher rate, but delinquencies in the construction industry are increasing. Higher risk and higher interest rates are causing commercial lending to tighten, and construction companies are seeing fewer loan originations and smaller loans/lines of credit. What I am watching: The non-residential construction industry is expected to see steady growth in 2023 due to project backlogs but could slow in 2024. Due to higher mortgage rates, the residential construction industry is expected to see a significant decline in housing starts through 2023 with the sector stabilizing in 2024. Aside from the immediate key drivers of interest rates and cost of capital, other areas of focus will be on the labor force and the demand for skilled vs. non-skilled labor. The number of skilled workers is decreasing yet the demand for skilled labor is increasing. The construction industry will have to attract the necessary talent to support the growth. Operational changes in the construction industry will be a driving factor. The construction industry is seeing a shift toward technology in all aspects of construction. Utilization of robotics is increasing which could replace portions of the workforce. Smart Cities, Smart Homes, Green Building are all trending which will materially change construction projects. The Construction Industry is experiencing a noticeable shift and companies will continue to adapt to keep up with demand.

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

Recent news of the SVB collapse highlights the vulnerability of small banks and their crucial role in serving local communities. Small and medium-sized financial institutions should prepare for additional interest rate hikes.

If you crave economic insight into small business trends, download the Spring Beyond the Trends report from Experian, a unique outlook on the economy.