Data and Analytics

Discover how blended credit data aggregates help B2B firms build custom risk models, evaluate solopreneurs, and deepen customer relationships during market shifts.

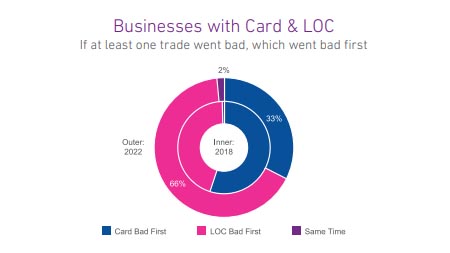

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

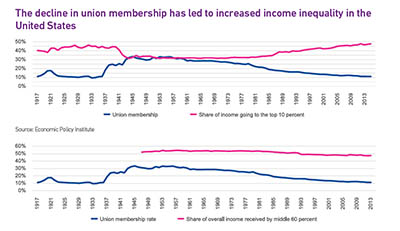

Since the COVID-19 pandemic, the U.S. labor market has shifted. Compared to pre-pandemic levels, there are more people employed yet a lower labor force participation rate, higher quit rates and more job vacancies which results in a tight labor market. A tight labor market is empowering workers, and they are exercising that power in the form of worker strikes. In addition, new technologies such as in the auto industry and new business models such as streaming in the entertainment industry, are creating driving the need for employers to address changes to worker contracts. Inequality in the employer/employee relationship over the past few years has fueled worker unrest and they are now exercising their power in a demand for higher wages and benefits or a greater share in profits. 2023 is proving to be a landmark year in terms of the number of strikes as well as union elections. The result of these strikes has proven beneficial to workers with employees at major companies receiving significant increases in yearly compensation and benefits. Labor union participation rates have been declining since 1983 and reached historic lows in 2022, however, the number of workers represented by unions increased for the first time since 2017. The United States is experiencing a shift in states and unionization rates with some historically low union states experiencing significant growth. While unionization rates in total are decreasing across most industries, others are increasing their union efforts and demanding and achieving results. It is a challenging environment for employers and employees as inflation and high interest rates put pressure on the United States economy. As unionization rates have declined it has increased income inequality and lead to reductions in middle class income. This pressure on many employees in the United States has driven union approval rates to the highest levels since the mid 1960’s, with the majority of adults seeing the decrease in unions as a bad sign for the country and the labor force. What I am watching: The power and effectiveness of union walk-outs and strikes is being recognized in the United States workforce. Earlier this year, UPS and the International Brotherhood of Teamsters representing more than 300,000 UPS employees, negotiated and approved a new 5 year-contract with more than 86% support. The union’s president stated, “the contract was the most lucrative ever at UPS and would serve as a model for other workers.” The success of this effort has resonated in the economy with most notably the United Auto Workers staging walk-outs across multiple auto manufacturing plants which has resulted in a tentative contracts with the three Detroit automakers. The results of unionization are being recognized and union efforts are spreading across multiple industries. With employees realizing there is power in numbers it is anticipated that unionization rates will continue to grow as employees seek equal representation in the labor force. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Since the height of the COVID-19 pandemic, new businesses are opening at a record pace. New businesses tend to be smaller based on number of employees as well as annual revenues. While new businesses make up a greater portion of new commercial credit accounts, they receive less credit.

As of Q1 2023, Metropolitan-Core contained 78.1% of businesses, up from 76.3% in Q1 2018. The growth came despite high vacancy rates in offices due to the rise in telecommuting. Remote working has been around for a long time, but became vastly more prevalent during the COVID-19 pandemic when people were required to stay home but employers wanted to continue business operations. As the height of the pandemic gets farther in the rearview mirror, more employers are requiring employees to come back to the office. However, more workers are still working remotely, at least part of the time, than before the pandemic. With fewer people going into offices, there is a shift of population clustering in metro-centers where office buildings are located to areas outside of the metropolitan-core in more suburban and rural areas. With more people spending more time closer to their homes, they patronize businesses near their homes, driving the post-pandemic growth rate of businesses opening to be much greater outside of the metropolitan-core areas. The labor market continues to be robust. 339K jobs were created in May, the most in four months, and way above market forecasts of 190K. On the flip side, unemployment ticked up in May 3.7% from 3.4% in April, and is now the highest level since October 2022. What I am watching: The high rate of post-pandemic new business openings is fueled by small businesses with fewer than 20 employees. Some of the businesses are even home-based side jobs by individuals working remotely for their primary job. It will be interesting to see how many of these small businesses can survive through the expected upcoming economic slowdown or recession. With higher interest rates and commercial lenders tightening criteria, businesses that are struggling will have a tough time securing financing to weather any upcoming storms. Now that the Federal government raised the debt-ceiling and averted a government default, all eyes will turn back to the Federal Reserve’s battle to fight inflation. They indicated a pause in interest rate increases starting with their June 14th meeting. However, with the labor market still robust, the Fed’s decision may be a swayed by the May inflation report that is scheduled for release on June 13th. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

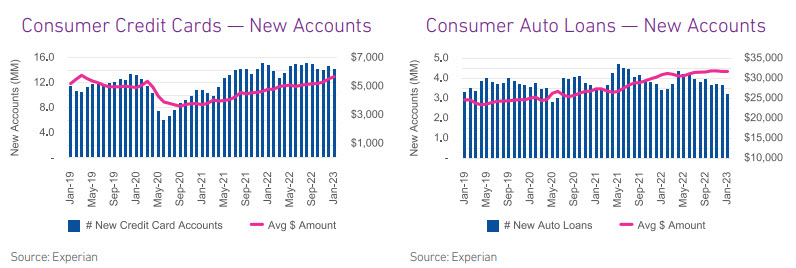

Consumers are borrowing to maintain spending levels even though higher interest rates make borrowing more expensive.

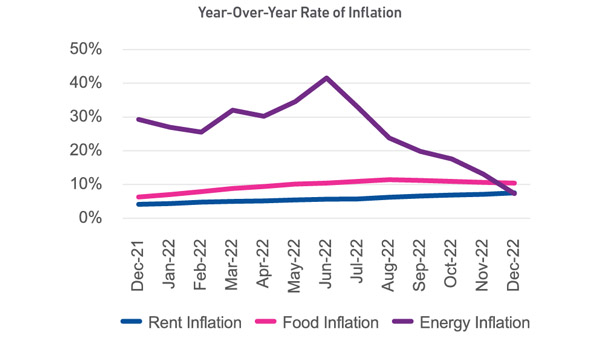

So far, the economy has been extremely resilient, with Q4 GDP coming in above expectations at 2.9%, inflation cooling, supply chain issues easing, and unemployment remaining low.

Happy New Year! The burning question for 2023 is whether the U.S. economy will fall into recession. A robust 2022 labor market has been a major factor in staving off recession culminating with a low unemployment rate of 3.5% in December. The number of people in the U.S. labor force surpassed pre-pandemic levels despite lower participation rates, indicating fewer job seekers. This can be explained in part by the increase in retirement of employees due generally to an aging population choosing to retire from the workforce during Covid. Over the past year, with higher demand for labor, easing of health concerns of the pandemic, financial pressure from inflation and 2022 financial markets experiencing their worst performance in 15 years, people are re-entering the labor force and the “unretirement” rate is on the rise. Individuals are returning to the work force in two forms; as employees, and as business owners, as new businesses continue to open at a rapid pace. New businesses continue to account for a growing portion of commercial trades with small businesses (under 10 employees) accounting for over 80% of new commercial credit account originations. New small businesses still require capital to operate however with inflation, high interest rates and decreases in consumer (sole proprietor) and commercial credit scores, average loan amounts are decreasing, driving commercial credit delinquencies up 95% year-over-year for businesses with fewer than 10 employees. What I am watching: In December, wages declined for the first time in almost two years, indicating that going forward, labor may not drive inflation to the same extent as before. When the Federal Reserve meets at the end of January, I will be watching whether interest rates are raised, or the slowing of the labor market is considered a positive sign for slowing inflation. The higher delinquencies and lower credit scores are pointing to a continued tightening of the commercial credit markets thereby making access to necessary capital more difficult and expensive. This negative pressure could stifle new business openings and increase business closures. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

Heading into the holiday season, we'll see if consumers continue to spend at high levels, or if higher prices, higher interest rates and lower savings create a drag on sales.