Topics

I have been on the road meeting with clients at advisory events, forums, and industry thought leadership conferences, and what I continue to hear is a concern about the upcoming recession. The drivers of the next recession are up for debate but the consensus is that it is inevitable. The U.S. Economy is complex and the signals are mixed as to where the greatest impact will be felt. Protecting your business, whether consumer or commercial focused, is dependent on the stability and strength of your lending criteria and customer engagement practices. You want to protect your customers as well as your business in the case of a market stumble. You are laser-focused on making the best possible decision when reviewing credit applications and setting loan terms, however, financial situations change over time for both individuals and companies. This is especially true when a recession hits and unemployment begins to rise, consumers stop spending, and commercial delinquencies begin to rise. When these macroeconomic changes occur, the credit you have extended to your portfolio might be at under market stresses and at a stronger risk of nonpayment, and this can affect your business’s health and sustainability. By stress testing your portfolio, you can determine what may happen, when stresses are exerted, by a receding economy, on your portfolio. You can use credit information, macroeconomic data, and alternative data to build models that forecast what is likely to happen in the future and how stresses, will affect the ability for people or businesses to pay their bills. While larger regulated companies may be required to perform forecasting and stress testing, lenders of all size can benefit from the process. Gathering the Right Data for Accurate Stress Testing The accuracy of your stress test depends on the type and quality of data used for forecasting. Recessions are cyclical and likely to re-occur every few years, it is recommended that companies use historical data from the 2008 recession for analysis and to make accurate predictions. Young businesses may not have complete historical data going back to the 2008 recessionary time period. A partner like Experian can create look-alike business samples, from the vast holistic data, to simulate the likely impact of macroeconomic scenarios. For example, a financial services firm has been providing small business loans between $50,000 and $100,000 for the past three years and wants to predict future losses. To gather the data for loss forecasting, you need to create a business and product profile identifying loans or businesses with similar characteristics, to stress and forecast performance. These profiles are used to build a look-alike sample of businesses and loan products that look and perform like your current portfolio and will add the sample size and retro time periods needed to create a statistically viable analysis sample. Selecting a Forecasting Strategy Once you have the historic credit, macroeconomic, and alternative data on your portfolio or look-alike retro sample for modeling, you need to stress test the data. Most stress test analyses start with a vintage based analysis. This type of analysis looks at the performance of a portfolio across different time periods (Example: March 2007, March 2008, March 2009, etc..) to evaluate the change in performance and the level of impact environmental stresses have on the portfolio's performance. Once you have this high-level performance, you can extrapolate into the future performance of the portfolio and set capitalization strategies and lending policies. Identifying Loss Forecasting Outcomes Regulators and investors want to know the business is solvent and healthy. Loss forecasting demonstrates that your company is thoughtful in its business processes and planning for future stresses. For regional lenders that are not regulated as closely as large national or global lenders, forecasting shows investors that they are following the same rules as larger regulated lenders, which strengthens investor confidence. It also demonstrates effective management of capital adequacy and puts you on a level playing field with larger lenders. Companies with limited data can start with credit data for look-alike sample development and add historical data and alternative type data as they grow for a holistic portfolio view. Setting up Governance Business policies and macroeconomic stresses change over time, it’s essential to set up a governance schedule to review forecasting processes and documentation. Your stress testing and forecasting will not be accurate if you design it once and do not update it. Most companies use an annual schedule, but others review more frequency because of specific circumstances. Effectively Documenting Loss Forecasting The key element of loss forecasting is effectively documenting both sample and strategy taken in the evaluation of your portfolio. A scenario you might face is when a regulator looks at the analysis performed and you have selected sample data at the business level instead of the loan level, documentation should capture the explanation of why you made the decision and the understood impacts of that decision. While the goal is to have complete data, many companies do not have access to high-quality data. Instead of foregoing loss forecasting, the use of documentation to note the gaps and build a road-map for the data can be of great value. Here are additional key points to include in the documentation: • Data sources • Product names • Credit policies • Analysis strategy • Result summary • Road-map and governance schedule By creating a stress-test analysis strategy for forecasting loss, your company can make sure its portfolio and financial status remain as healthy tomorrow as they are today while maintaining transparency and investor confidence. The next recession is out there, this is a great time to strengthen processes for future successes.

It's International Fraud Awareness Week and Experian would like you to know how big the problem is for businesses. Here are some sobering facts, did you know? Every year 3.7 trillion dollars is lost to fraud? it would take the average person to spend 130 million dollars per day in their lifespan to cover that amount. Fifty four percent of businesses are only "somewhat confident" in their ability to detect fraudulent activity. And that's compared to only 40 percent who are very confident. 52 percent of businesses have chosen to prioritize the user experience over detecting and mitigating fraud. Organizations worldwide lose an estimated 5 percent of their annual revenues to fraud, and an incident of fraud costs a company a median loss of $145,000. .

Experian Business Information Services recently introduced a powerful new marketing platform called Business TargetIQ. Product Manager, Kelly DeBoer answered a few questions about the product and described use cases that promote greater collaboration between credit and marketing departments. What does Business TargetIQ do? Business TargetIQ is our new marketing platform so it's a B2B marketing platform where clients can access data for marketing applications. How is it different from other business marketing platforms? It is unique in that it not only includes your standard or core firmagraphic information but also includes Experian's credit attributes. Does it have credit data? What does that mean to marketing or collaboration? Typically marketing data and credit data are housed in separate silos of information. With this tool the information will be combined together which will allow the tool not only to be used in traditional marketing applications for targeting but can also be in that risk factor which applies to different divisions within our client's applications or use cases of the data. Who would most benefit from Business TargetIQ? The thing about Business TargetIQ is it truly applies to all different verticals, as well as all different contacts within the company. So whether it's a financial vertical or a trade vertical, retail, just across the board all clients can utilize this. Anybody that's doing marketing can utilize this platform. What core problems does Business TargetIQ solve? It solves a lot of different problems, so, the most common client issues that are brought to our attention are gaps in data, as well as in the marketing initiatives. So they may have data in-house but they have holes within the data. Our tool will allow them to not only upload their client records and fill in a lot of those gaps that they may have, whether it be contact information, or firmagraphics or address information. It will standardize that data and fill in those gaps. But will also provide the means to again use that data. Our business database which has over 16 million records. They can then utilize that information for prospecting, for data append, for analytics, for research applications, so it solves a lot of problems with regard to marketing and data concerns. How does credit data help with prospecting? So what we find is clients come to us and they may say you know I have an idea of what our clients look like, they're in this SIC or in this industry code, or they have this sales volume or employee size, but what they may not know is on the back end which really helps identify and target those businesses is the credit attributes, so the risk factors around those. So do they have delinquencies in their payments? Have they filed bankruptcies? Do they have UCC filings? So it allows them to take it that next step and not only really define what their clients look like, but identify clients that look like that. Learn More About Business TargetIQ

As a Senior Consultant with Experian Advisory Services, Gavin Harding works closely with many of Experian's FinTech and Financial Institution clients to find solutions to complex problems. We sat down recently to talk about bank partnerships, how they come about, what makes them successful, and how Experian supports them. Do you see a lot of collaboration between banks and FinTechs? The latest statistics show that 67 percent of banks and FinTech’s are either currently cooperating, or in discussions about cooperating, or exploring collaboration. So, yes a very significant proportion are considering collaborations. Why collaborate at all? You know it's interesting, they have different skill sets, different assets, different backgrounds. So for example; banks have really deep, broad customer relationships. You know think about your Mom or Dad bringing you to your local bank to open up your first account. Think about your student loan. Think about your mortgage. What kinds of relationships exist? So banks have really deep and broad relationships. But traditionally the experience with banks has not necessarily been great in terms of turnaround, in terms of the friction or pain involved in getting a loan or opening an account. On the other side, FinTech’s are really good at that customer experience. They describe it as either low or no friction. So very quick turnaround times. But they're very much transactional-focused, meaning single products. So FinTech has the technology and the experience, and banks have the depth of relationships with customers. You bring those two parts together and you've got a pretty amazing potential opportunity. There are as many relationship types shapes and sizes as there are people on the planet. Everything from cooperation on basic operations, meaning, a FinTech takes applications for a bank and then passes them on. All the way over to full-fledged integration of systems, personnel, capabilities, skill sets, and so on. So pretty much the broad spectrum. What works well? So it works really well when they are well-matched. So what I mean by that is, when the skill sets from one organization match the other. When one enhances the other, and it works really well when there are long and detailed discussions and preparations for the relationship. Meaning, they align and discuss goals, objectives, what each organization's role is, what each brings to the table, and very specifically how they are going to cooperate. What are the pitfalls? Well, the same pitfalls. So the pitfalls are that the relationship goals differ, or aren't aligned, or that one organization feels like they are bringing more to the relationship and that the partnership is equal, or when it feels as if each partner, each organization is not getting value from the relationship over time, and once again that reinforces the need for those detailed discussions before getting into that partnership or relationship. How does the process work? So it begins with a discussion. I've seen these partnerships start with a discussion over dinner at a conference. I've seen them start through a LinkedIn connection. I've seen them start over coffee. So it really starts with an exploration of who's out there? What organizations may be interested in even discussing some kind of collaboration? So it starts with the conversation at the very basic level, even when we see in the Wall Street Journal major strategic alliances between organizations, starts with people, and starts with that very simple conversation and connection. What are some key elements to be aware of? Well again it comes down to what each party brings to the relationship and what the goals are. So a good alignment of the capacity of skill sets, an alignment of investment in terms of time and resources, and very specifically a definition of who does what, what the accountabilities are, and what everybody's expectations are. They are fundamental to the success of any type of business arrangement or partnership. How does Experian support these partnerships? So the interesting thing is we have very deep relationships with both sides. So we bring data, solutions, consulting expertise to FinTech’s and to banks. So, it's really interesting we find ourselves in the middle of a lot of these conversations, and how we help is by understanding systems, technology, data, the best of both organizations involved in the conversations, and how to bring all of that together for a good focused efficient successful outcome. A couple of years ago this was new meaning that banks saw FinTech’s growing, and kind of looked at them a little bit maybe as competition, as potentially the enemy, FinTech’s saw themselves as disrupting the world and completely innovative and new. What's starting to happen is both sides are coming together, realizing that they are both part of the same financial industry, serving the same customers, maybe in different or new ways with different products. But in the same industry. So there is very much a coming together, an alignment a co-mingling, consolidation of all these various aspects of the industry. And I think it's really positive for consumers. More products, more quickly, and a better experience overall. Do you think a FinTech's ability to create more dynamic mobile experiences is a key element Certainly and so the big question we help banks answer in this space is, do we build it? Do we buy it? Do we partner? and build and buy or partner refers to the technology the infrastructure and the experience. So if you have a pretty big bank and they've got a old website, old process, lots of paper, lots of regulations, lots of pain in the process. Well they can look at one of the more advanced sophisticated mature FinTech’s and essentially use their platform, their engagement, their data, connect that to the bank's customers and in a very very short time transform that experience in a very positive way for their banking customers. Learn about FinTech Lending Solutions

We sat down with John Krickus, Senior Product Manager for Experian's Scoring solutions to ask about the new Social Media Insight, and how this data and score are being used to help businesses strengthen scoring models, and create opportunities for emerging small businesses with limited credit history but strong social media profiles. What is Social Media Insight? We're very excited to bring what we consider a breakthrough capability. Social Media Insight is an expansion, a use of new information beyond traditional credit data, that both improves the performance of our scores, provides attributes to our clients, and is directly sourced from the social media providers - no screen scraping. What type of social media data is used? So the social media data comes from sources that, like with our other data sources, we are not allowed to publicly disclose, but we are focused on business social media sites. So we're not going after consumer social media data, but social media data from business-oriented sites, so that we can better evaluate small and midsize businesses. What steps are taken to prevent artificially boosting the ratings of a business? So that's a question that we often receive about artificially boosting ratings. We work with social media companies, they have many techniques to identify where the reviews are coming from and to prevent someone gaming the system. Is it 100 percent full proof? No, but it is very effective. How effective has social media data been in predicting risk? As we've seen with using the data in our scoring solutions, we've seen a tremendous boost in score performance. There have been two real gains from using social media data. First is, we've developed about 70 social media attributes. We can now include those attributes and make these attributes available to our clients to improve the performance of risk scores. The second area really devolved from client feedback as we piloted the data. They indicated to us that there were social media data elements that are very helpful. So, we've been able to attain information such as pricing, parking situation, hours of operation, and those additional data elements have also helped our clients in improving their risk performance scores. What type of data do our clients get with Social Media Insight? We're able to provide our clients one of three types of data. First, we can provide a social media IntelliScore. That's our normal IntelliScore with commercial data, and now social media data. So, you get a higher performance. We've boosted performance by 37 percent with our IntelliScore. Second, we can provide those same social media attributes to our clients. So, they can incorporate those social media attributes into their scoring models. And third, we have the descriptive data. I mentioned hours of operation for example, social media data also provides a better description of the business. So, you just don't get an Exercise Gym, you get whether that gym is kickboxing or whether that's just exercise equipment. Can I target specific kinds of businesses? Can it be used for Marketing? We do have the ability to use social media data for identifying better businesses to do business with. Our initial focus though is in developing the attributes and the score for risk management. So that's really the focus for this first phase of Social Media Insight. How might Social Media Insight help an Insurance company? Insurance companies have been very anxious for this data, and they're getting a different view of the business. We're going beyond traditional trade, public record, background information, and now we're able to provide a view of how long has that business been rated? How are the ratings? What's the trend in the number of ratings? So, it's not just your level rating, but are you getting reviews over time? All that information provides a really unique view of the business that we've never seen before. How can Experian clients access Social Media Insight? Our clients can access the data one of two ways. We can provide a batch file. So, if you have a portfolio and you want to add social media attributes and a social media score to that you can provide us a file in batch. We also have our new API access, and we're very excited about that. So that allows you online real-time access to obtain the social media insight data, and it's very easy to program to. Can Social Media Insight help emerging businesses gain access to capital? Yeah that's an excellent area for Social Media Insight. It's really the newer smaller businesses that don't have a very deep credit history, that Social Media Insight now provides a view that previously it may have lacked information, therefore, credit may not have been extended. Now by having a social media site data available. We're adding depth of information to that business. We've actually found that businesses with social media data, as a group, are less risky than businesses without. How does Social Media Insight help improve risk model performance? So, the view that the social media data provides, we have found has boosted model performance, more than doubling model performance for those new emerging businesses. But even for established businesses we've seen double-digit gains in the measure of performance for models such as KS, and again you're getting a view of a business, number of reviews, and we normalized that. So, if you're in an area that's very active with social media data we take that into account. So, if you have 10 reviews in your history, which are in a very active area, you may not get as much of a positive as if you had 10 reviews and a less active social media area. So that combination really boosts performance and predictiveness of the data. How do Social Media Insight help our clients reduce risk? And really that's been one of the biggest breakthroughs with the social media data. Is by being able to boost the performance as I discussed earlier on KS, those new to the world businesses. They now are able to more confidently make decisions in their portfolio, because there is now a wealth of information. They're able to improve their models with this new additional information and have a very good performance improvement with it before and after. So, there's an across the board performance improvement. How does Social Media Insight help to automate the decisioning process? When you have an automated system, you want to have a higher level of confidence. The higher level of confidence you have, the stronger you can, for example, having automatic approve and automatic reject areas. By adding social media data we're able to get a stronger KS performance, which means you have more confidence in the models, and you can now increase the percentage your portfolios that you're putting through either automated or highly automated decision making. It's a significant boost in performance however you cut it. We're very excited about this unique new information source. Social media data is totally different from any other business credit information that's available, and when it's utilized in a model, in a decisioning system, the gain in performance are dramatic, and we're very excited to bring this capability to our clients. Learn about Social Media Insight

Are the credit models you are using to make lending decisions more than 2 or 3 years old? If so, you are likely making less than optimal credit decisions. You may be turning down a customer who is a good risk — while taking on customers who are more apt to default on their obligations. Every year a model isn’t updated, its accuracy decreases. The economy changes. The consumer’s or business’s financial situation changes. Updating your models, using the most current data and attributes available, you can have confidence that you are making good credit decisions. To make the most accurate credit decisions possible, many businesses are now turning to data-driven decisioning models that are powered by artificial intelligence (AI) within machine learning engines. While the standard regression model works well in some industries, the lift in predictive value from using AI data models can be very important in other industries, such as retail, fraud and marketing. These models use sophisticated algorithms to predict the customer’s future ability to repay their obligation, which means a much more accurate decision than traditional models. Starting with High Quality Data While data has always been at the core of credit decisions, models using machine learning are even more dependent on data. These models can be very accurate, but their accuracy depends on having the necessary data to understand what happened in the past and present behavior to make a prediction for what will happen in the future. The more data provided, the higher the accuracy of the decision. Here are three things to consider when building your data-driven decisioning model: Clean Data – As innovation spurs business and technology to run faster and more efficient, the quality of the data underneath all of that innovation becomes even more important. Machine learning becomes smarter the more data it consumes. This means the accuracy of the credit decisions made by the model is largely dependent on the quality of the data provided. Data from third-party sources often contains mistakes, missing fields, and duplicate information, which results in less accurate credit decisions. Correct Data Points – The accuracy of the results depends on considering the right criteria in the form of data points in the model. When you use machine learning and AI algorithms, they can predict which specific data points will help increase the performance of the model for the specific customer and the specific type of credit decision. Often, data points that you may not consider are the ones that can make a big impact on the accuracy of the decision. Real-Time Data – In the past, there was often significant lag time between collecting and being able to use the data. By using real-time data with machine learning models, you can get a clear picture of the most current view possible and see changes in the different data points as they occur. This lets you make a much more accurate prediction of what will happen, with the consumer or business, than was previously possible with a traditional credit decisioning process. Using Alternative Data to Get the Full Picture Often, additional data — typically referred to as alternative data — that is not readily available from traditional data providers is used to enhance the accuracy and predictive ability of a model. While the model can seem complete without this information, the model may provide suboptimal results without it. Machine learning models can predict the situations and exact type of alternative data a model needs to produce an accurate decision. Experian offers a wide variety of alternative data that clients can use to improve decision models. For example, a business owner may be taking out short-term loans to increase her cash flow, which makes her a much higher credit risk than she appears to be without this data. Weather information is also a common type of alternative data; a business located in Tornado Alley may need higher cash reserves to be a good credit risk. On the other hand, businesses located in an area impacted by a recent weather event, such as a hurricane, may be a good credit risk even with a lower score because both their business and local economy is recovering. Regularly Evaluating Your Data Model You must build in governance and make sure you are evaluating how the model is working on a regular basis, like having an annual checkup with your healthcare providers. Once you begin using a data model, you can’t simply set it and forget it. Ask the following questions to periodically evaluate your models: Are there changes in the outcome of the models? You need to verify that your attributes are still predicting the same outcomes as intended, as well as capturing the same data. For example, say you have an attribute in your model that counts the number of credit lines open for a small business. If the attribute changes and those types of credit lines are no longer reported by the data provider, that number can go from three or four to zero, without there being a change in the number of credit lines open by the business. Because the data that goes into your model has changed, your model is not accurate unless you update the attribute. Is your model stable? You need to make sure that degradation hasn’t reached a point where the predictive value is no longer accurate. For example, scores before the 2008 recession have a different meaning than afterward, due to the changes in the financial system. The future of your business depends on making accurate credit decisions. Instead of using outdated models, use the latest technology and methods available by using machine learning data-driven models. It’s simple. It’s quick. And most importantly, data-driven models are accurate. Related articles: How To Modernize Decisioning with Automation and Real Time Respones Integrating Credit Decisions with the Back Office Improving Customer Experience Through Decisioning as a Service (DaaS)

For utility companies, the customer onboarding process can sometimes be a complex, time-consuming, and unpleasant experience, especially if a manual credit decisioning process is in play. Every time a customer interacts with your utility company — be it via the website, telephone, in-person service call, mobile app, or social media — their experience sets the tone for the overarching relationship between the customer and your company. To improve the onboarding experience, many utilities are turning to machine learning to make faster and simpler credit decisions. However, creating a custom machine-learning decisioning engine is complex and can be costly. By leveraging machine-learning capabilities through Decisioning as a Service (DaaS) offerings, utilities can automate the decisioning process and create a frictionless customer experience. For example, a customer applying for service – even with a large utility — can be approved within seconds by an agent using a tablet. Using DaaS to Automate Your Credit Decisions DaaS can be used for many different types of decisioning — prescreening, prequalification, or instant credit. Utilities also use DaaS for authenticating and resolving identities and assisting with the rationalization of deposits. Other uses include improving the customer experience, credit line management, retention, cross-selling and collections optimization. The process is like using traditional decisioning methods where the customer or customer service agent enters the customer’s information into the website or system. The utility system then connects with the DaaS engine through an Application Programming Interface (API), The DaaS engine then aggregates real-time data from the credit bureaus and other data providers about the customer, runs them through business rules — and a decision is rendered. The decisioning engine uses rules and algorithms to create predictive models for credit, fraud and, bankruptcy risk, profitability, retention and other key areas. The DaaS engine then automatically determines the results, such as approval, decline, instant pre-screen, cross-sell, or a collection decision. More than just providing a result, the system helps your utility know exactly how to treat the customer based on their risk level. DaaS also helps utilities by customizing offers that deliver both business value and value to the specific customer. Additionally, the algorithms are continually updated so your decisions are always based on the current business climate, market drivers, and regulatory conditions. Creating a Seamless and Personalized Customer Experience From the customer’s perspective, the process is simple and seamless. Instead of waiting for hours — or possibly days — the customer receives an answer in real-time. If the decision is good news for the customer, they can move on with the process. And if the decision is not what the customer was hoping to hear, they can quickly move on and determine their next steps. There is no waiting, wondering, or anxiety. Using DaaS also creates a more personalized experience for the customer. DaaS recommends the next best step based on the customer’s specific situation, which is an informed way to begin your relationship and sets the right tone for the future. For example, DaaS may recommend no deposit based on risk-level, or a specific product or offer of value to the specific customer. Improving Operational Efficiency and Growing Revenue In addition to more loyal and satisfied customers, your utility company will see operational benefits and lower costs from using DaaS. Your employees no longer need to manually process credit applications and make decisions, thus eliminating paperwork, tasks, and time. Because DaaS provides centralized decision making, you can use the technology across different enterprise frameworks, call center environments, and processing systems. This dramatically increases your efficiency by eliminating manual processes which give your employees more time working to improve the customer experience. Because the process is more accurate than the traditional credit decisioning model, utilities can make better credit decisions. As a result, your utility can significantly reduce bad debt and fraud, which improves your overall financial health. At the same time, you can increase revenue by approving customers who are good credit risks but may have been denied using a manual or out-of-date decisioning model, and thus improve the customer experience. Additionally, your ability to more effectively cross-sell customers will help grow your revenue. Your utility’s success depends on its ability to make quick and accurate credit decisions while also providing a positive customer experience. By using an API to integrate DaaS into your systems, you can have confidence you are making accurate decisions while creating customer loyalty, improving revenue, and reducing costs. It’s simple, it’s easy and your customers will love it.

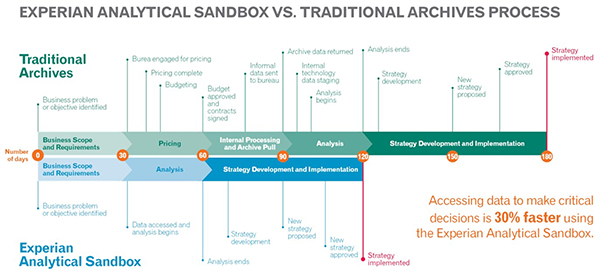

The appetite for businesses incorporating big data is growing significantly as the data universe continues to expand at an astronomical rate. In fact, according to a recent Accenture study, 79% of enterprise executives agree that companies that do not embrace big data will lose their competitive position and could face extinction. Especially for financial institutions that capture and consume an incredible amount of data, the challenge becomes how to make sense of it. How can banks, credit unions, and other lenders use data to innovate? To gain a competitive advantage? This is where analytics sandboxes come in. A sandbox is an innovation playground and every data-consuming organizations’ dream come true. More specifically, it’s a platform where you can easily access and manipulate data, and build predictive models for all kinds of micro and macro-level scenarios. This sounds great, right? Unfortunately, even with the amount of data that surrounds financial services organizations, a surprising number of them aren’t playing in the sandbox today, but they need to be. Here’s why: Infinite actionable insights at your fingertips One of the main reasons lenders need a sandbox environment is because it allows you to analyze and model many decisioning scenarios simultaneously. Analysts can build multiple predictive models that address different aspects of business operations and conduct research and development projects to find answers that drive informed decisions for each case. It’s not uncommon to see a financial services organization use the sandbox to simultaneously: Analyze borrowing trends by type of business to develop prospecting strategies Perform wallet-share and competitive insight analyses to benchmark their position against the market Validate business credit scores to improve risk mitigation strategies Evaluate the propensity to repay and recover when designing collection strategies A sandbox eliminates the need to wait on internal prioritization and funding to dictate which projects to focus on and when. It also enables businesses to stay nimble and run ad-hoc analyses on the fly to support immediate decisions. Speed to decision Data and the rapid pace of innovation make it possible for nimble companies to make fast, accurate decisions. For organizations that struggle with slow decision-making and speed to market, an analytics sandbox can be a game-changer. With all your data sources integrated and accessible via a single point, you won’t need to spend hours trying to break down the data silos for every project. In fact, when compared to the traditional archive data pull, a sandbox can help you get from business problem identification to strategy implementation up to 30% faster, as seen with Experian’s Analytical Sandbox: Cost-effective analytics Building your own internal data archive with effective business intelligence tools can be expensive, time-consuming, and resource-intensive. This leaves many smaller financial services at a disadvantage, but sandboxes are not just for big companies with big budgets. An alternative solution that many are starting to explore is remotely hosted sandboxes. Without having to invest in internal infrastructure, this means fast, data-driven decisions with little to no disruption to normal business, fast onboarding, and no overhead to maintain. For financial institutions capturing and consuming large amounts of data, having an analytical sandbox is a necessity. Not only can you build what you want, when you want to address all types of analyses, you’ll have the insights to support business decisions faster and cheaper too. They prove that effective and efficient problem solving IS possible! Ready to learn more about Experian's Analytical Sandbox and how it can help you optimize your business? Contact Commercial Data Science

A gastropub restaurant applies for business insurance and is approved. However, social media insights show the restaurant is declining. Even though underwriters usually take a quick look at social media postings, evaluating the trends of the business is not part of the decision process. Costly mistakes: Underwriting using only business supplied information How could something as basic as a business in decline be overlooked in the insurance underwriting process? Think about the process when reviewing a new business insurance application. The underwriter reviews the application and looks at traditional credit and public filing information. Although the underwriter checks out the company website, he doesn’t meet or interact with the company. He then must make a potentially costly business decision about its risk level. Even though the process appears thorough, it does not use the new wealth of information available. How social media provides information about business health If the insurance company had used unique and new sources of social media data, the underwriter would have seen a different picture of the restaurant. The trends in the number of reviews point to a declining business due to poor service, bland food, or increased competition. Traditional data sources miss these subtle signs that point to a higher risk of going out of business. While one poor review shouldn’t result in a denial, a pattern of a declining business is important. This can be spotted using tools that analyze the trends in reviews and ratings for the business line. After all you cannot compare restaurants, with high volumes of social media postings, with say a dry cleaner. By correctly using social media data during the underwriting process, insurers can give an additional lift on the model to determine the risk. Social media data can also help determine more information about the business. For example, an exercise gym may have treadmills and weight machines, or it might actually be a kickboxing studio, which has a much higher level of risk and premiums. Underwriters also get a much more granular view than a typical application, such as the parking situation and the hours. Because risk is higher for businesses with a liquor license, insurers can often learn if a bar didn’t disclose this on their application. Customer photos also often tell a story not detectable on the application, such as broken stairs or a fireplace without proper screens. Using artificial intelligence to analyze social media data Looking through social media for each application takes large amounts of time. Even more importantly, humans may be subject to bias and miss word patterns in reviews. By using an artificial intelligence tool with machine learning capability to analyze social media data for business insurance applications, underwriters can gain a much more accurate picture of the risk they are assuming by insuring a business. Additionally, an AI tool can analyze business health much more quickly than an underwriter could doing the social media check manually. Insurance companies that use artificial intelligence tools to analyze social media data during the underwriting process can more accurately predict the risk of a business. Because the processing speed, adding this additional step does not slow the process down. By reviewing what other people are saying about the business, your insurance company can decrease risk and save money on claims.