Uncategorized

Blended credit scores combine personal and business data. Learn how they boost financial inclusion and help lenders make smarter decisions.

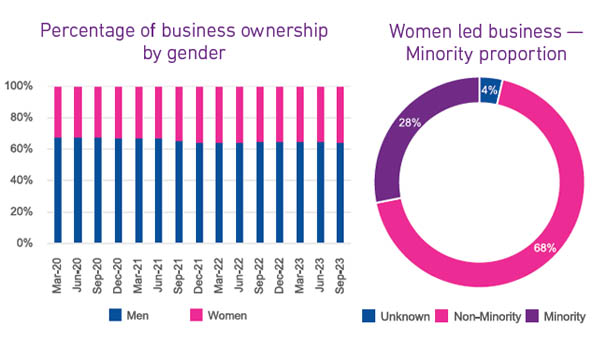

As of recent years, women-owned businesses in the United States have experienced significant growth and have become a substantial force in the economy. It is estimated that there are more than fourteen million women owned business generating over two trillion dollars in annual revenue. The growth in women owned businesses has been fueled by a myriad of reasons, is occurring across all age groups and serves a diverse number of industries. Even with the growth in the number of women owned businesses and the economic impact these business have, women owned businesses are still underserved in the commercial credit markets. Female business owners tend to operate in industries that have a greater need for continuous working capital, thus women owned businesses tend to rely on revolving credit lines. Even with this demand for capital, women business owners are hesitant to apply for financing, and when they do, they are receiving a growing proportion of commercial credit, but the amount of credit granted still trails that of men. The recent growth in women owned businesses could be a driving factor in this disparity. New business have limited to no commercial credit history forcing lenders to evaluate the guarantor’s personal credit. On average, female business owners have a lower consumer credit score, which could be because they are carrying more personal debt to fund their businesses, ultimately decreasing their access to commercial credit. There are a number of factors that when combined, are limiting equal access to commercial credit for female business owners. The good news is that the number of successful women owned businesses continues to climb, and more grants and loans are available to women business owners. What I am watching While inflation in the U.S. is easing, it is still above the Fed’s 2% target. It is widely expected that the Federal Reserve will begin to lower interest rates later this year. It appears that the anticipated recession which led lenders to tighten credit will not occur. Therefore, lenders will likely begin to loosen credit criteria and potentially provide more opportunities for women-owned businesses to obtain the credit they need to operate and expand.

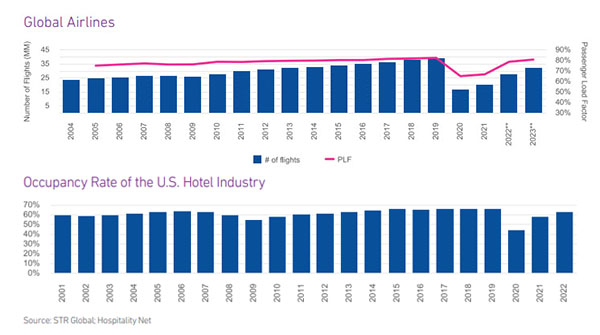

Now that most worldwide travel restrictions have been lifted, the industry is rebounding. It appears that travel businesses relied on more commercial credit to weather the storm of the pandemic and raised prices to help recove

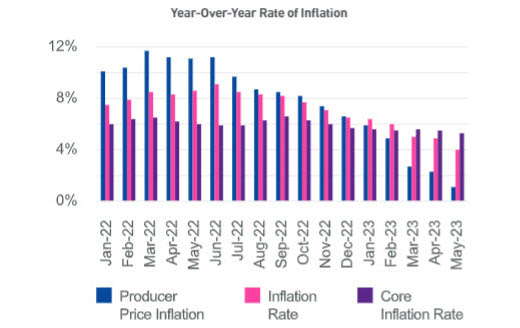

The annual inflation rate continued to decline with May coming in at 4% which was the eleventh consecutive monthly decrease and the lowest level since March 2021. Lower inflation is driven primarily by lower energy costs which decreased 11.7% year over year. Core inflation, which excludes volatile energy and food, slowed to 5.3%. Despite inflation still much higher than the Fed’s 2% target, the Fed paused interest rate hikes after 10 consecutive rate increases in the last 15 months. The Fed indicated that additional hikes may come later this year. New businesses continue to open at a high rate. Despite that these newer, and specifically smaller, businesses are making up a larger and larger portion of commercial credit, they have additional funding needs. According to the Federal Reserve’s 2023 Small Business Credit Survey, almost 70% of businesses with zero employees use personal funding sources for their business while only 27% of them obtain funding from financial institutions or lenders. Since the non-employer businesses reported on 36% had a decline in revenue in 2022 (vs. 38% of employer businesses’ revenue declined in 2022), there is a huge opportunity for financial institutions to tap into this market and support small business growth. What I am watching Small businesses with very few or no employees flourished coming out of the pandemic. It will be interesting to see how many of these micro-businesses will survive the headwinds of inflation, higher interest rates and less access to credit. With an economic slowdown on the horizon, the Fed actions in the coming months will be critical to the outcome. It is yet to be determined if the U.S. economy will achieve the hoped-for soft landing rather than a recession. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today

Gary Stockton: Experian has just released the Q4 2017 Main Street Report. We partner with Moody's Analytics on this report each quarter, and Derrek Grunfelder-McCrank is the economist who works on the report. We asked him a few questions about the trends that we're seeing in this quarter's data. Gary Stockton: The latest Main Street Report states that small business credit conditions remain positive. Is there a primary factor that's driving this stability? Derrek G. McCrank: Yeah there certainly is Gary. The primary factor that's driving stability in small business credit is the broader U.S. economy. Right now we have the labor market that's tight. This is resulting in wage increases for consumers as a result. Consumer spending has been reliable. Inflation is starting to pick up in a slow steady manner. On top of it all at the end of last year we just got tax reform. Right now the outlook for small business credit is positive. And that doesn't look set to change anytime soon. Gary Stockton: and are you seeing greater numbers of small businesses investing in that business by borrowing for equipment purchases? Derrek G. McCrank: Well Gary while we can't say for certain. The data seems to suggest that this isn't happening to the extent it could just yet. One of the questions in the NFIB's monthly survey is about whether firms are planning capital expenditures in the next three to six months. Since the end of the last recession. We've seen the positive response rate to this question steadily increasing. However it still sits below its long term average. Couple this with tax reform coming so late at the end of last year, and a decent number of firms are likely to have waited until the new year when they could invest in their business with a little more certainty. Gary Stockton: Well historically small businesses been keeping bankruptcy in check, but this quarter we saw it up slightly. Is this a major concern? Derrek G. McCrank: This isn't a cause for concern yet. Though it is something to monitor going forward. In the first quarter of 2017 the small business bankruptcy rate bottomed out, it hi its floor. As the year progressed, the bankruptcy rate moved off of that floor and that appears to be all that happened. In fact I'm hopeful that this might indicate a return to a more dynamic environment for small businesses which I look forward to discussing in a little more detail and our upcoming webinar. But for now, given the state of the economy, I'm optimistic for the state of small business credit. Gary Stockton: On the flip side, the Northeast saw a steep decline in business bankruptcies in Q4. Can you share some insight on what might be driving that? Derrek G. McCrank: Sure, so in the fourth quarter. the Northeast saw declines in its severely delinquent or 90 days past due rate coupled with a slight uptick in its business bankruptcy rate. What happened with business bankruptcies mirrored the trend nationally, so it shouldn't be a cause for concern this year, the declines in the severely delinquent rate were driven by two primary factors - geography and industry, from a geographic point of view, Connecticut, New Hampshire and Maine were the driving forces behind the reductions in severe delinquency, and from an industrial point of view financial services, public administration and the manufacturing industries are credited with declines in severe delinquency. Download the latest report

According to the Kauffman Foundation Index of Startup Activity, only 0.31 percent of U.S. adults ever starts a business. That's 310 people out of every 100,000. That's a shocking statistic for a country of 325 million people. In fact, new business starts have been in a slow, steady decline since the late 70's. Source: Kauffman Foundation In 2015, just over 600,000 new businesses were established in the United States. These businesses created 3 million jobs, and because the average new business had roughly 4.5 employees, almost all fit the profile of an american small business. In a July hearing by the House Committee on Small Business titled "Reversing the Entrepreneurship Decline", Representative Steve Chabod of Ohio, and ranking member Nydia M. Velazquez of New York, along with members of the house panel, set out to understand why the number of startups is declining by hearing testimony from leading experts on the subject of entreprenurship to identify possible solutions. The panel of experts included Dr. Gregory Crawford, President of Miami University's Farmer's School of Business, who told how Miami gets students involved with local startups by maintaining a permanent presence at Cintrifuse in Cincinnati. Cintrifuse is a start-up catalyst, a public/private partnership that exists to build a sustainable tech-based economy for the Greater Cincinnati region. Also, through the San Francisco Digital Innovation Program, which enables students to spend entire semesters living in Silicon Valley. Four days a week, they are in an apprenticeship at a start-up. Like any nascent entrepreneur, they do everything from ideation to product development to cleaning up the office at the end of the day. It must be working, Forbes recently wrote an article titled "Why Ohio Is The Best State in America To Launch a Startup" featuring two Miami graduates who went on to found OROS Apparel. Karen Kerrigan, President of the Small Business and Entrepreneurship Council cited several trends uncovered in a Gap Analysis study by SBE Chief Economist, Raymond J. Keating. The study found that over the course of the last decade, the economy has developed a gap of roughly 3.7 million businesses, businesses which would have existed, if only people had started them. Joe Schocken, CEO of Broadmart Capital spoke about the effects of globalization and automation. The economy is struggling to absorb the impacts of automation and globalization, and now sees companies disappearing at a faster rate than new companies are forming. A recent study by Forrester Research projects that automation and robotics will displace nearly 25 million jobs, or 17 percent of the workforce by 2027, and cause a net job loss of 9.8 million. During her opening remarks, Representative Velazques pointed out "in New York, nearly half the small businesses are owned by immigrants, and nationally, immigrants make up approximately 30 percent of new entrepreneurs." Nationally, more than half of the startups valued at $1 billion or more were founded by immigrants, and more needs to be done to foster entrepreneurship Access to capital was a constant during this hearing, being mentioned several times as a leading barrier to success in stimulating growth in startup creation. New businesses must spend a great deal of time and energy on finding capital, rather than executing their business plans, and too often this capital is simply unavailable. The problem is particularly pronounced for traditionally disadvantaged demographics such as women and minorities. Representative Velazquez cited one study which noted if minorities started businesses at same rate as non-minorities we would have 1 million additional employers, generating 9.5 million more jobs for our local economy. In recent years there has been a decline in the number of venture firms. Remaining firms have focused their efforts on a few key states. Since the 2008 recession, 50 percent of new businesses have originated in 20 of 3,100 counties scattered across the United States. In California, venture funds increased as a percentage of total U.S. fundraising from 57 percent in 2015 to 66 percent in 2016. More needs to be done in reaching entrepreneurs in other parts of the country. The panel focused on several areas where Government could help, answering questions and offering suggestions. Karen Kerrigan said regulatory relief, tax reform and improving access to capital were key areas where reform could help. An enrepreneur's first touch with regulation mostly begins at the local and state level where they are met with licensing, zoning, registration, fees and other regulations that are often burdensome and costly for starting a business. She also said our tax code needs to be internationally competitive and designed to encourage growth. Growth breeds confidence, optimism and entrepreneurial opportunity. By improving access to capital by relieving community banks of unneeded regulation, and modernizing and streamlining an array of Security and Exchange Commission rules and compliance requirements, small businesses and entrepreneurs will have a wider array of financing options in addition to new ways to finance their venture such as crowdfunding. Mr Schocken offered several ideas focused on streamlining equity crowdfunding, removing barriers and restrictive regulations and also improving inter-agency cooperation on globalization and automation saying, most of the jobs that will replace jobs lost to automation would likely come from small business, so the formation of a special commission focused on the innovation economy would be a great idea. You can watch the full video of the "Reversing the Entrepreneurship Decline" house panel session below.

In just one week, Augmented Reality (AR) proved itself to be the Next Big Thing in popular entertainment. Within days of Niantic Labs release of Pokémon Go, in which players "hunt" and "capture" fantastical creatures using their smartphone cameras, tens of millions of Americans have become hooked on the game. According to media reports, the app has already been installed on twice as many phones as Tinder™, is used twice as much as Snapchat, and is surpassing the all-powerful Twitter in its number of daily active users. The skyrocketing value of parent company Nintendo's stock price has provided further testament to the game's perceived long-term stamina. Beyond its nostalgia value -- the game is based on the popular Japanese cartoon and videogame series from the 1990s -- Pokémon Go is winning over hearts, minds and dollars due to its artful blending of fantasy game play and real-world locations. To play the game, participants must move through the physical world, often traveling many blocks or even miles in search of their elusive digital prey. Such material engagement -- and the physical exertion required to complete many of the quests -- is a far cry from the sedentary "couch potato" stereotype so long associated with video-gaming. Marketing opportunities for local businesses It's also offering surprisingly lucrative marketing opportunities for many local businesses. Shops, restaurants and other commercial operations who find themselves near one of the game's many "Pokéstops"(virtual pit stops) and "gyms" (digital combat arenas) are seeing a marked uptick in foot traffic. Many stores are actively advertising via social media their proximity to game elements and the Pokémon that players have found nearby. Chicago's famed Art Institute received wide coverage for their boasting of various Pokémon found within their hallowed galleries, complete with iPhone screen shots of cartoon monsters perched amidst the Renoirs and Chagalls. Pokémon have invaded the Art Institute! Catch them if you can and find 14 PokéStops around the museum. #PokemonGO pic.twitter.com/MICPddACuf — Art Institute (@artinstitutechi) July 11, 2016 Assuming the appeal and popularity of AR is more than just a passing summer fad, the short-and long-term potential for local businesses appears to be huge. For example: Referrals: A referral program is one fast and easy way for local businesses to take advantage of the Pokémon Go phenomenon. For example, shop owners can offer to play for players' "incense," a virtual commodity used to attract the game's creatures, in exchange for the use of screenshots showing rare Pokémon that show up near their establishment. They can offer players similar rewards for store photos and check-in’s that players post on social media sites such as Yelp or Facebook. Shops can even offer game-based "bounties" for the capture of Pokémon found in or near their stores, thus driving up foot traffic. Local Sponsorships: Seeing a cash cow (or cash chiamander) when they see one, Niantic, Inc., is reportedly developing a program that will allow local businesses to actively sponsor themselves as Pokéstops or Pokémon hiding locations, virtually forcing eager monster-hunters through their doors. Sponsors will be charged on a "cost per visit" basis -- similar to "cost per click" fees on the Internet -- according to Niantic CEO John Hanke. National Sponsorships: As the success of Pokémon Go spurs the creation of other AR games and experiences, national sponsorships may provide developers with yet another, highly lucrative source of income. "National branding could be huge," said Mark Schaefer (@markwschaefer), globally-recognized speaker, educator, and business consultant. "Imagine, a Pokémon character drinking a Coca-Cola. That would be hilarious. The Nintendo stock price went through the roof because of that very idea." But such commercialization of the Pokémon Go experience must be done with discretion, according to Schaefer. "The whole Pokémon Go game experience is built on passion for this product; passion and trust," he explained. "Most players loved Pokémon as children. It's an emotional trigger. If the game starts to look like a NASCAR jacket, with ads all over it, people are going to reject it. But I think that, in this day and age, people expect a certain amount of sponsorship. There can even be a certain amount of surprise and delight associated with sponsorships. The key is to make such sponsorships integral to -- and in the spirit of -- the game itself." In a sense, Pokémon Go is the "Space Invaders" of AR, a breakout game that serves as a "proof of concept" for a whole new entertainment platform. Expect more, increasingly immersive and engaging games that seamlessly blend the physical and virtual worlds to follow. And with them, more opportunities for businesses large and small to generate real-world business by becoming part of the gaming experience. If you are a local business looking for some creative ways to capitalize on the Pokémon craze, check out Fundera's great blog post - How to use Pokémon Go to Drive Business.