Business Information Blog

The latest from our experts

Third-party analytics and data companies working with property and casualty insurance carriers are introducing sophisticated risk modeling techniques, but there are often regulatory complexities to consider.

Today we are very proud to be taking the wrapper off the next generation of our flagship commercial credit management application, BusinessIQSM 2.0.

Experian has released the Experian/Moody's Analytics Main Street Report for Q4 2018. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what certain trends mean for credit grantors and the small-business community.

Getting ahead of the economic downturn by performing stress tests and forecasts.

Today Experian and Moody's Analytics released the Q3 2018 Main Street Report. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what certain trends mean for credit grantors and the small-business community.

It's International Fraud Awareness Week and Experian would like you to know how big the problem is for businesses.

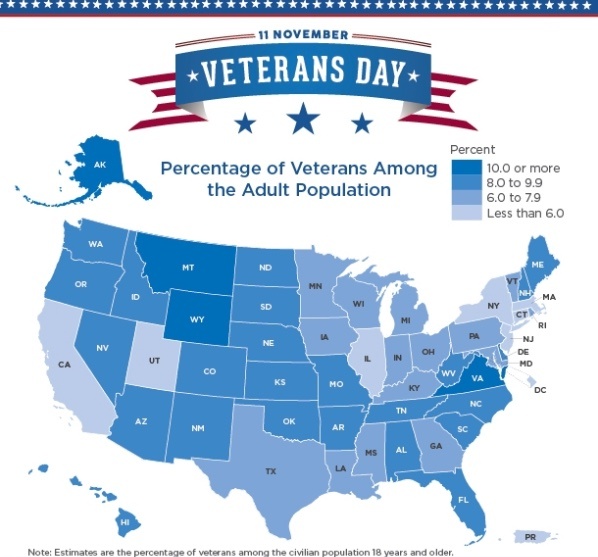

Today we are celebrating Veterans Day in the United States. With deep gratitude for their service and the many sacrifices made for our country, Experian salutes Veterans across the country, and around the world, and we extend our warmest wishes for a Happy Veterans Day.

Experian’s Business TargetIQ™ is a marketing platform that combines B2B marketing and credit risk data to deliver a powerful new approach to prospecting.

We spoke with Gavin Harding about what makes successful partnerships between fintechs and banks work, and how Experian supports them.

Alternative data such as social media data can be used to lift the business credit scores of thin-file businesses. We explain how.

To make the most accurate business credit decisions possible, many companies are turning to data-driven decisioning models powered by artificial intelligence (AI) within machine learning engines.

For utility companies, the customer onboarding process can sometimes be complex, especially if a manual credit decisioning process is in play. We explore ways to improve that process with DaaS.