Business Information Blog

The latest from our experts

Integrating credit decisions means moving toward an automated solution that integrates credit decisions with ERP, CRM, or other custom system, employing APIs.

Helping credit management professionals with 4 common mistakes credit and risk managers need to avoid to successfully manage their portfolio.

Experian Product Manager, Erikk Kropp, discusses best practices for automating credit decisioning for a faster approval process.

Experian has introduced Social Media Insight, breakthrough social media data for managing risk. Use social media data to mitigate risk.

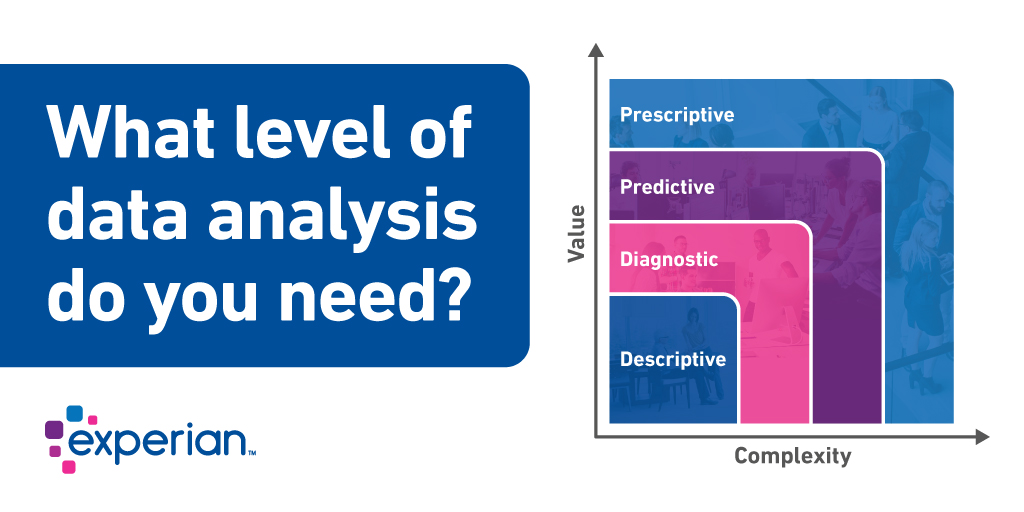

Data analysis surrounding lending practices for commercial lenders falls into 4 distinct buckets that define scope, usability, and purpose. In this post we will discuss how they differ in terms of value and complexity.

All business customers are not created equal. Successful credit management requires you to carefully evaluate the financial health of every business

You likely go to great lengths to protect your own identity from fraud and theft. But are you actively protecting your business’s identity as well?

Experian has announced it has become a certified vendor of the Small Business Financial Exchange, Inc. (SBFE.) As a SBFE Certified Vendor, Experian can combine its rich data with SBFE’s data to provide the most comprehensive view of a small business in the market today

Today Experian Business Information Services releases the Experian/Moody's Analytics Main Street Report for Q1 2018. The report brings deep insight into the overall financial well-being of the small-business landscape, as well as providing commentary around what certain trends mean for credit grantors and the small-business community.

Gavin Harding appeared on the BAI Banking Strategies podcast recently to talk about how small businesses are doing from a credit perspective.

Are you contemplating an ERP deployment? Start getting ready for using ERP software by cleaning, enriching and linking vendor data

In this business Q&A we share information on the upcoming change to consumer credit profiles related to tax liens and judgements, and potential impact to commercial credit scores.