Business Information Blog

The latest from our experts

Experian Small Business Index suggests the US economy is set to expand in the third quarter, spurred on by recent rate cuts.

Learn how Experian unifies fraud and credit scoring to help risk managers detect threats early when lending to small businesses.

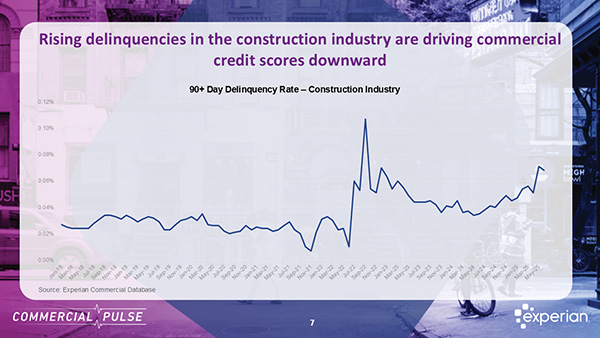

This week Experian focuses on the growing construction industry and early warning risk signals for lenders and risk managers.

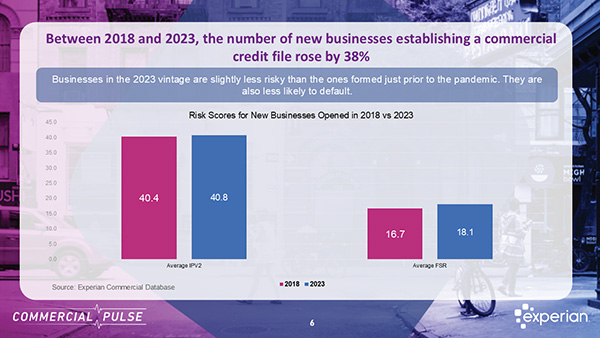

Discover how small businesses have transformed since the pandemic, from digital adoption to growth resilience, in Experian’s latest report.

The Experian Small Business Index™ declined in July to 32.8, down 11.9 points. The index tracks the health of small business owners nationwide

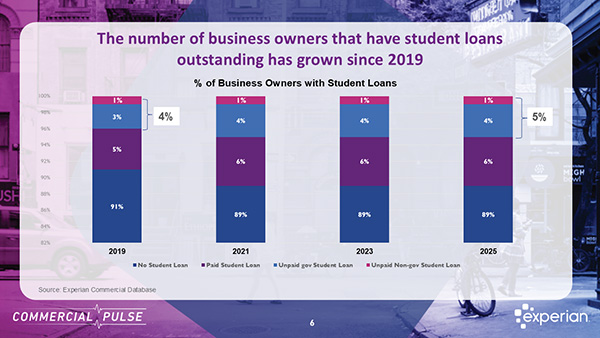

Experian Commercial Pulse Report – Business owners with unpaid student loans carry a higher risk for lenders.

Main Street Report – small businesses are navigating an environment marked by persistent inflation, elevated interest rates, and volatility.

Find out what’s really happening on Main Street during the Quarterly Business Credit Review webinar, August 19th, 10am Pacific.

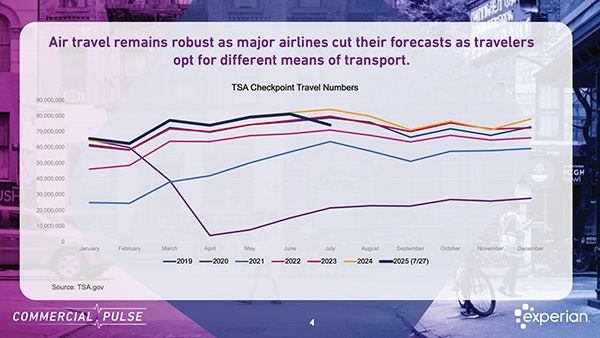

The Experian Commercial Pulse Report reveals key credit trends and risks in the hospitality and travel industry as summer travel surges.

The Experian Small Business Index shows signs of stability with a slight decrease month over month amid low unemployment and rising wages.

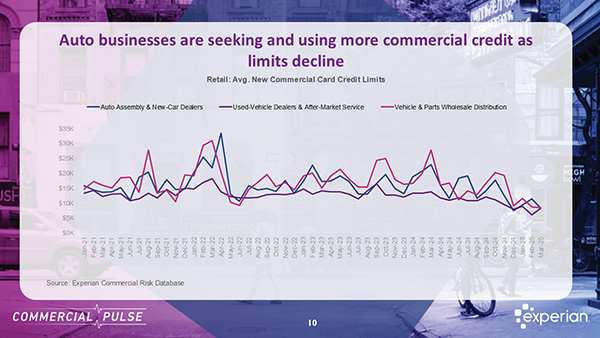

Experian’s latest Commercial Pulse Report reveals rising car prices drive demand for used vehicles as commercial credit lines for b2b decline

Experian Small Business Index shows small businesses remaining resilient amid rate uncertainty and signs of job market weakness