Business Information Blog

The latest from our experts

Experian experts discuss effective marketing strategies for insurance agents and brokers to boost ROI and client engagement.

Explore how API integration transforms business efficiency, enabling seamless data management, automation, and advanced client segmentation for growth and risk management.

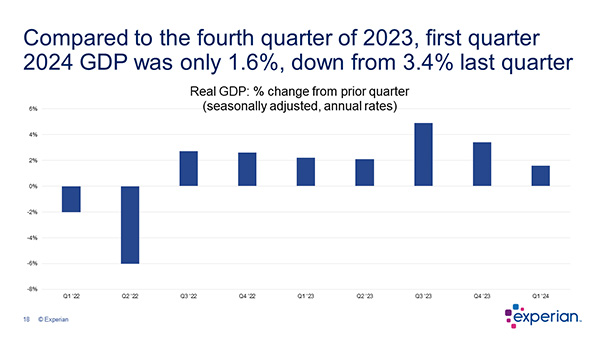

Experts from Experian provide a quarterly business credit review on Q1 2024 credit performance, along with an economic outlook.

The Beyond the Trends report highlights indicators which offer insights on labor, prices, commercial credit and economic conditions.

%%title%% Here are a few quick small business insights from our latest Commercial Pulse Report.

Explore instant decisioning in business automation, an approach to streamline credit decisions integrating data and automating processes.

How batch append credit scores can improve risk management and efficiency in financial services, with insights from Experian’s Erikk Kropp.

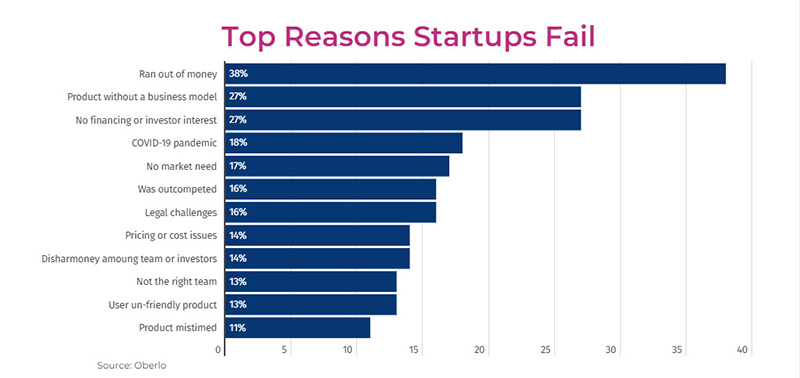

Download our latest Commercial Pulse Report for economic insights and a deep dive on reasons why so many startups fail in first 5 years.

Data is central to modernizing the credit approval process. We discuss useful formats beyond traditional business credit reports and scores.

We’re kicking off a series of posts over the next month on modernizing credit approvals featuring Sr. Product Manager, Erikk Kropp.

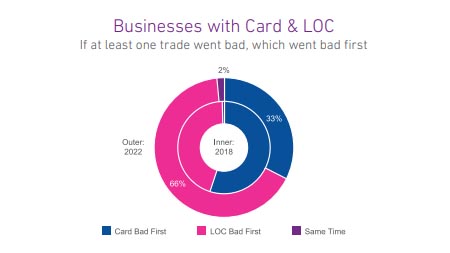

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Experian’s Kyle Matthies provides a roundup of international credit report usage statistics showing which regions are surging or declining.