Business Information Blog

The latest from our experts

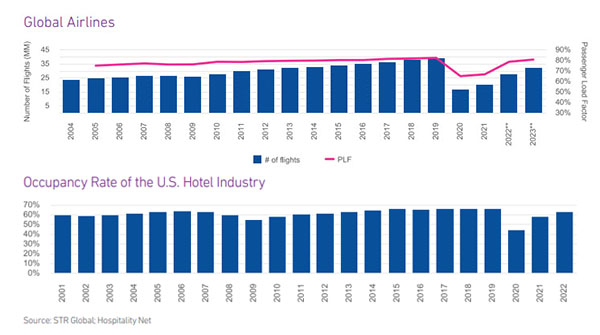

Now that most worldwide travel restrictions have been lifted, the industry is rebounding. It appears that travel businesses relied on more commercial credit to weather the storm of the pandemic and raised prices to help recove

Catch the latest brew on fraud strategy at our 15-minute Sip and Solve session hosted by Bonnie Gerrity, sharing best practices over coffee.

Experian discusses record business creation and fraud strategy with Credibly Founder and Co-CEO Ryan Rosett.

This post highlights recent commercial fraud insights from Experian and the advantages of taking a multi-layered approach to fraud strategy.

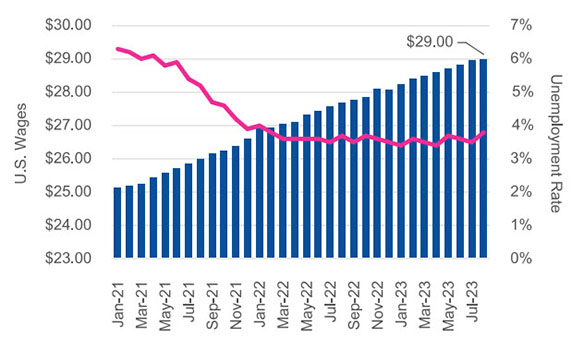

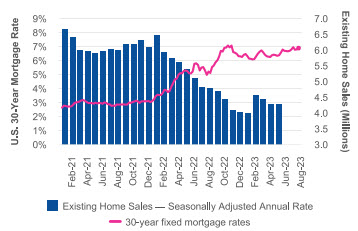

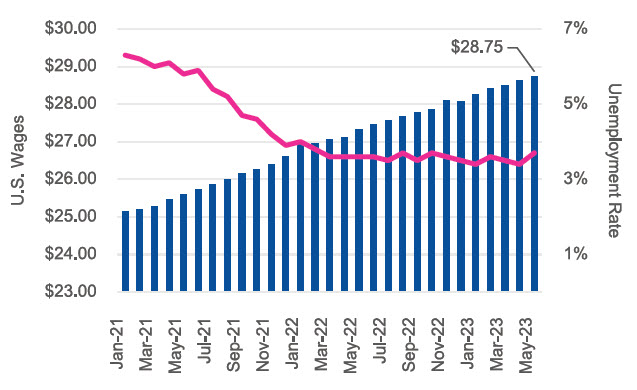

Since the height of the COVID-19 pandemic, the commercial real estate market is experiencing a paradigm shift as office professionals acclimated quite well to working from home, and many balk at going back to the office. As vacancy rates for offices hit record highs, supply of office space is greater than demand, reducing the value of many commercial properties. In parallel, The Federal Reserve’s 500bps of interest rate increases since March 2022 have made it more expensive for property owners to borrow and has left commercial real estate (CRE) lenders fearing greater risk of default will occur in the near future. August unemployment increased to 3.8% from 3.5% in July and is the highest since February 2022. Low unemployment continued to drive wages up with August wages reaching $29 per hour In anticipation of higher losses, CRE lenders are tightening their lending criteria, requiring higher down payments, shortening the loan term, and selling off or diversifying their CRE portfolios. Contrary to recent trends in office space pricing, and also contrary to impressions driven by media coverage focusing on increasing mall vacancies and mall closures, retail real estate appears to be rebounding since the pandemic. The average monthly rent per square foot for retail space has been increasing across the United States since the start of the pandemic. What I am watching There has been interest in re-purposing vacant commercial spaces into multi-family rental properties. As vacancies rise in office buildings and in some large urban malls, more CRE buildings are transitioning to hybrid residential/commercial spaces. A significant increase in residential living spaces should drive housing costs down, which would be a tremendous benefit to the public and help curb inflation. The labor market remains resilient but there are signs of weakening. While unemployment remained low at 3.8% in August, it is the highest since February 2022. The three-month moving average of jobs created in the U.S. declined to under 150K for the first time in a few years. If the labor market continues to weaken, employees will have less bargaining power and it is possible that employers will require workers to come back to work in-person in offices full time. If that comes to fruition, CRE owners and lenders will be in a much better position. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Since the height of the COVID-19 pandemic, new businesses are opening at a record pace. New businesses tend to be smaller based on number of employees as well as annual revenues. While new businesses make up a greater portion of new commercial credit accounts, they receive less credit.

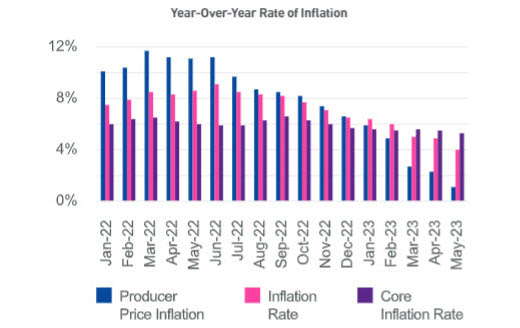

The Federal Reserve’s efforts to tame inflation with aggressive interest rate hikes over the past 15 months appear to be working with July’s core inflation rate reaching the lowest level since October 2021. The U.S. labor market remains strong with low unemployment and 187K knew jobs created in July. As inflation eases and the economy continues to be strong, it is becoming more likely that we could experience a soft landing.

Gain insight on small business credit conditions by attending our quarterly webinar.

Highlights from the latest Beyond the Trends report Are you curious about the trends affecting the small business economy? The just released Summer 2023 Beyond the Trends report is packed with valuable insights based on data from over 25 million active businesses and the expert opinions from Experian’s V.P. of Commercial Data Science. This post covers some of the report's highlights, download your copy for the full scoop. A word from the report’s author: Energy Prices and Consumer Relief One of the most crucial takeaways from the report is that consumers and small businesses can expect continued relief in fuel prices in the coming months. This relief is due to the increased production of fuel in the United States and other countries. This production, coupled with other global and domestic factors, will provide more affordability in fuel costs for consumers and small businesses. This will help them manage their expenses better and, in turn, help producer costs decline, leading to more positive economic developments. Small Business Delinquency Small businesses, especially those that were propped up by stimulus money, are beginning to feel the pinch of inflation that is eating into their margins. Due to this, their savings are running lean, and many businesses are experiencing a rise in delinquencies. Delinquency rates have now exceeded pre-pandemic levels. Still, the report suggests that this is where they would expect delinquencies to be as the economy begins to grow gradually. Optimism Amidst Challenges Despite the lingering challenges and uncertainties brought about by the pandemic, small business owners remain optimistic. The report shows that the overall sentiment among small business owners is still positive, and they continue to seek out opportunities and innovations that could lead to growth and success. This is a positive development, and it's critical for businesses to continue to be agile and open to new opportunities and ideas. In closing: Small businesses are facing challenges such as filling job openings, higher costs, delinquencies and rising debt, but they remain optimistic and focused on opportunities for growth. By staying true to their values and fundamentals, businesses can thrive even in uncertain times. Grab your copy of the Summer 2023 Beyond the Trends report for more interesting insights on small businesses and their challenges. Download Beyond The Trends Summer 2023 Report

The post-pandemic economic landscape is experiencing an alarming rise in fraudulent activity affecting both businesses and consumers. With 75% of creditors experiencing heightened fraud losses and a 50% increase in fraud reports as per the FTC, the situation grows increasingly challenging. The expansion of e-commerce and the increasing sophistication of the dark web as a marketplace for stolen data exacerbate cybercrime threats. Moreover, lenders struggle to differentiate vast numbers of newly-formed businesses from bad actors due to limited data history available for decisioning. Amidst this, while Artificial Intelligence offers substantial promise in combatting fraud, it also significantly expands fraudsters’ toolboxes and poses significant fraud risks to creditors and consumers. To address these pressing concerns, businesses must step up their fraud risk management game by proactively adopting new fraud detection data and capabilities, and by integrating commercial entity and consumer data into their fraud decisioning strategies. What I am watching: The latest inflation report and jobs report showed positive news for the economy. Unemployment remains low and job creation is slowing but still strong. Inflation was down to 3% in June, the lowest in over two years, and closing in on the Fed’s target of 2%. Despite earlier indications of more interest rate hikes this year, this encouraging news may lead the Fed to leave interest rates alone at their upcoming July meeting. Subscribe Today Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Job satisfaction, or the lack thereof, is causing a shift in the workforce. Over half of employees in the United States are “quiet quitting” and actively looking for other jobs. In part, this is driving the number of self-employed individuals to rise. Growth in the self-employment rate for females is outpacing that of males. Female business owners account for double the number of new businesses open less than two-years when compared with males. Female business owners are seeking credit but across most industries receive less funding. Male and Female business owners have comparable credit risk profiles and utilize a similar mix of commercial credit products, yet male business owners, on average, receive higher credit funding amounts. Even in most industries where new credit originations skew to one gender, male business owners are granted higher credit funding amounts. This disparity in commercial credit lending has an adverse affect on female business owners and forces them to pursue other financing options. What I am watching: As an impending recession approaches, the labor market is expected to constrict which will reduce options for employees. Job vacancies are likely to be limited, quits will decline and self employment will slow as individuals seek the security of more traditional jobs. While people may not take the leap to start their own business as much, it will be interesting to see if the vast number of new businesses created over the past couple of years can survive an economic downturn. Subscribe Now Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

The annual inflation rate continued to decline with May coming in at 4% which was the eleventh consecutive monthly decrease and the lowest level since March 2021. Lower inflation is driven primarily by lower energy costs which decreased 11.7% year over year. Core inflation, which excludes volatile energy and food, slowed to 5.3%. Despite inflation still much higher than the Fed’s 2% target, the Fed paused interest rate hikes after 10 consecutive rate increases in the last 15 months. The Fed indicated that additional hikes may come later this year. New businesses continue to open at a high rate. Despite that these newer, and specifically smaller, businesses are making up a larger and larger portion of commercial credit, they have additional funding needs. According to the Federal Reserve’s 2023 Small Business Credit Survey, almost 70% of businesses with zero employees use personal funding sources for their business while only 27% of them obtain funding from financial institutions or lenders. Since the non-employer businesses reported on 36% had a decline in revenue in 2022 (vs. 38% of employer businesses’ revenue declined in 2022), there is a huge opportunity for financial institutions to tap into this market and support small business growth. What I am watching Small businesses with very few or no employees flourished coming out of the pandemic. It will be interesting to see how many of these micro-businesses will survive the headwinds of inflation, higher interest rates and less access to credit. With an economic slowdown on the horizon, the Fed actions in the coming months will be critical to the outcome. It is yet to be determined if the U.S. economy will achieve the hoped-for soft landing rather than a recession. Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out. Subscribe Today