A report from Argyle in partnership with Experian Employer Services surveyed hundreds of finance/tax and Human Resources (HR) executives with U.S. employers to explore workforce compliance challenges and the processes in place to address them. HR and payroll professionals face a host of complications in their efforts to better serve employees and stakeholders within their organizations. Their compliance challenges increased with the rise of remote and hybrid work, resulting in a significant number of organizations self-reporting that they fail to stay properly informed on federal, state and local regulatory changes. The processes HR, payroll and tax teams utilize to manage employer compliance requirements has a big impact on an organization’s vulnerability to costly penalties and can also make or break the employee experience.

Employment Law Compliance

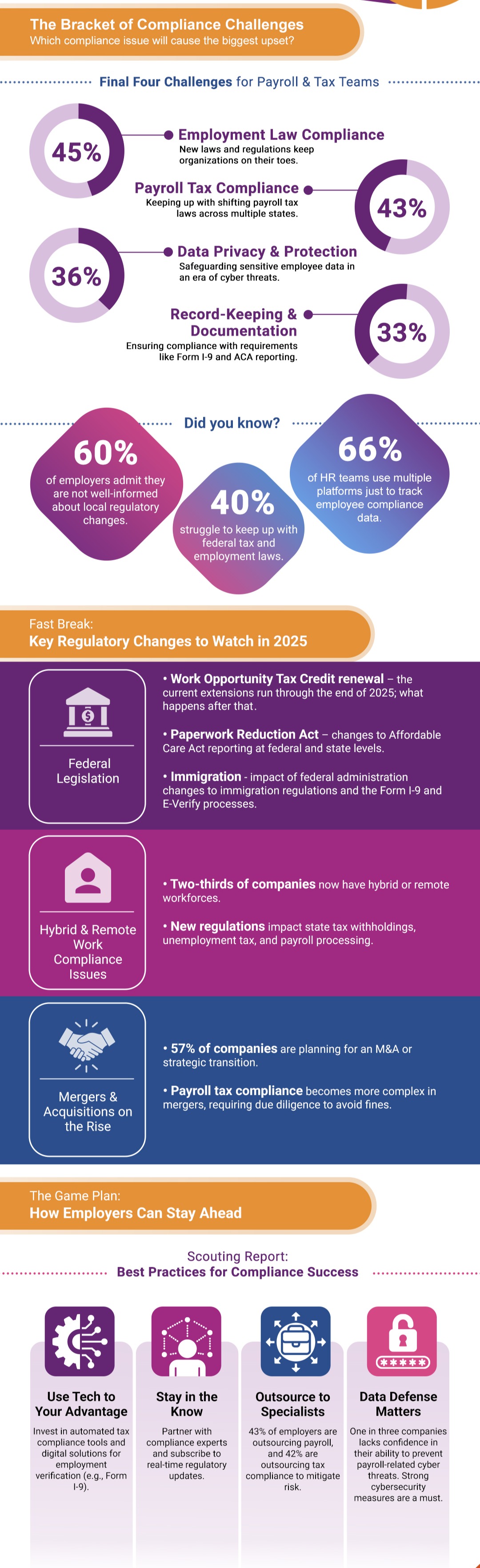

The HR function faces a broad set of legislative and regulatory requirements that must be met, in addition to their ongoing responsibilities within their organization to best serve employees. When asked about the three most challenging areas related to legislative/regulatory affairs affecting HR processes and payroll management, most respondents cited employment law compliance, changes in employment laws and regulators, and data privacy and protection.

Examples of employment law includes regulations concerning Form I-9 compliance and employee form delivery. Confirming the work authorization of a new employee is nothing new, but recent changes to Form I-9 made a complicated process even more challenging. Add in the propensity for hybrid and remote work, and the risk of compliance errors increases.

Employee forms like labor law posters and separation notice forms are another challenge because the types of forms, the methods for delivery, and more often vary in each state where your employees live and work. Tracking changes and complying with new laws is a moving target that can be difficult for HR teams to get right.

Payroll Tax Compliance

Finance and tax teams are similarly challenged by legislative and regulatory changes. Respondents in these roles frequently cited payroll tax compliance, tax audits/disputes, and employment law compliance as their top challenges.

Receiving a penalty with interest for inaccurate payroll tax is one problem, but another common issue is overpayment. Employers may often be unaware of changes that could potentially lower their payroll tax obligation. These include tax refunds and cost-saving opportunities often discovered with a payroll tax lookback services, which internal teams are too busy to engage in.

Organizations struggling with the complex environment of federal, state and local payroll taxes should leverage the expertise of consulting services with payroll tax professionals who are knowledgeable about the latest regulatory changes. These services can offer strategic advice on tax compliance.

Another challenge with a largely hybrid or remote workforce is accommodating the tax differences in jurisdictions for individuals. Accurate tax withholding is expected from employees, and getting this wrong creates significant dissatisfaction. Incorporating a process for automating local tax withholding correctly is essential in today’s world.

Competing Priorities and Organizational Objectives

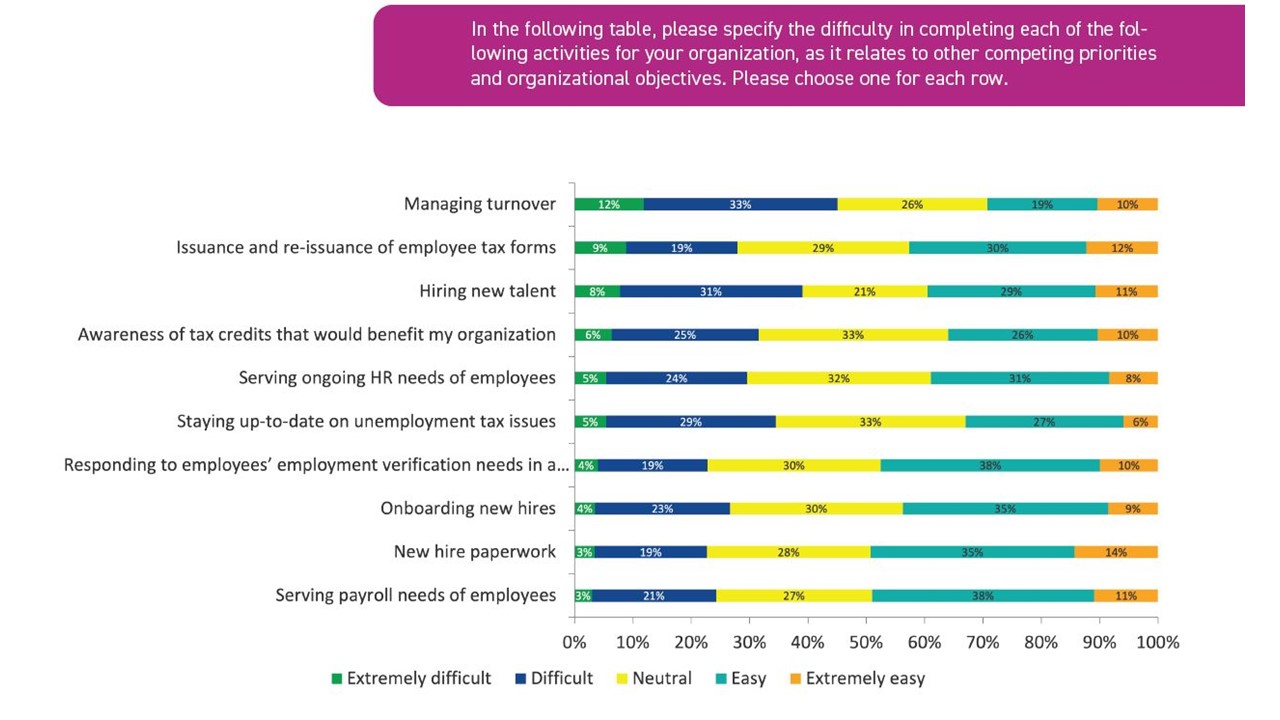

A main reason HR, payroll and tax teams are unable to adequately stay informed on legislative and regulatory changes affecting compliance obligation is because of the numerous competing objectives that demand their attention.

Internal teams are often pulled in numerous directions. This makes it a tall order to ask them to also track the constantly evolving laws at the federal, state and local levels. For this reason, many organizations will find that they are not prepared to address employer compliance challenges, as the respondents of this survey reported.

Finding the Right Partner

A solution for many employers looking to improve their compliance processes is by working with a trusted partner to outsource these responsibilities. Employer tasks like Form I-9 management, employee form delivery, unemployment management, tax withholding, year-end tax management and more can be offloaded to a vendor who utilizes specialists to manage these jobs on behalf of organizations.

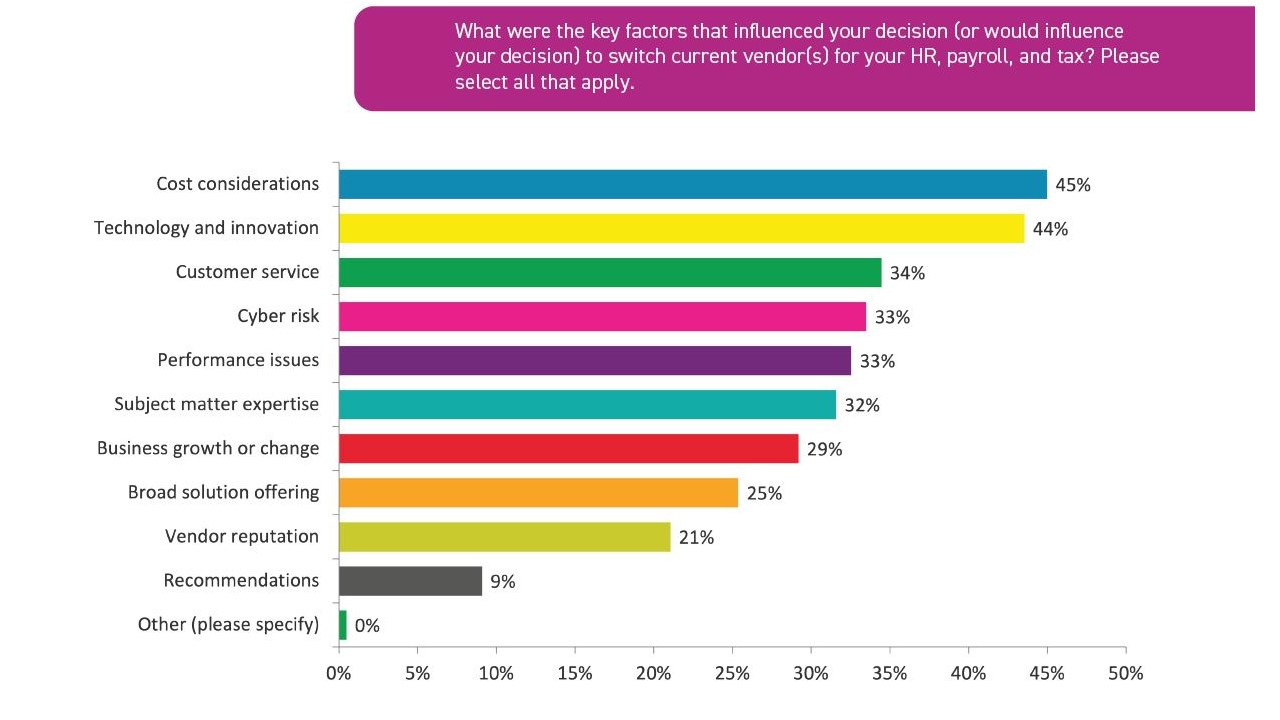

When asked about the criteria for switching vendors handling their HR, payroll and tax responsibilities, respondents cited technology and innovation, customer service and security as their chief considerations after cost.

In order to overcome the gap in their readiness to address legislative and regulatory changes to compliance requirements, employers should consider a partner who can address numerous HR, tax and payroll tasks while also delivering on these top qualities as determined by respondents. To read the full report with additional insight and survey results, download by visiting this link.