The Form I-9 Employment Eligibility verification process is crucial for onboarding new employees and consists of two main sections: Section 1 is completed by the employee, and Section 2 is completed by the employer after examining the employee’s original documents. These documents, from the list of Form I-9 acceptable documents, are one document from either List A or List B and one document from List C. In an era marked by rapid technological advancements, mDLs (mobile driver’s licenses) are emerging as a novel solution to enhance privacy and security.

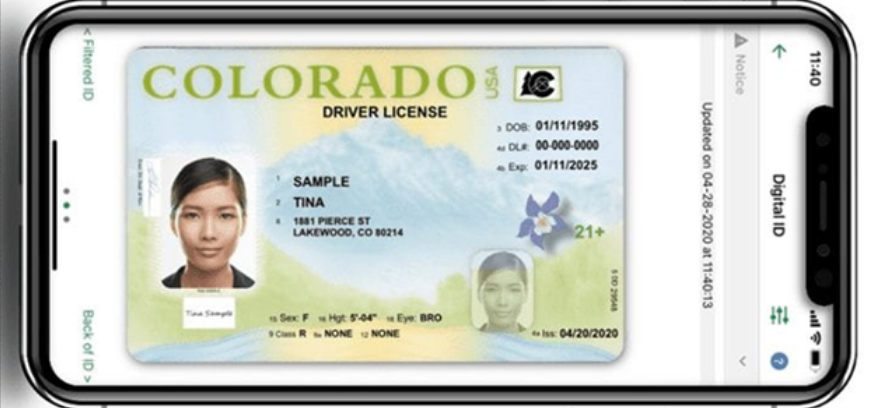

Physical cards are not only susceptible to fraud and theft but often reveal more information than necessary when presenting a driver’s license for non-driving-related purposes (e.g., opening a bank account, check-in at the hotel or clubs, etc.), inadvertently exposing details beyond what’s relevant. Digital credentials aim to address these challenges and can be used for age verification, government benefits, voting and poll check-in and travel and transportation. The federal government has approved legislation allowing the use of digital documents including Real ID and driver’s licenses stored or accessed via electronic means, such as mobile or digital driver’s licenses wallet.

States Accepting MDLs

Several states, including California (pilot testing), Arizona, Colorado, District of Columbia, Louisiana and Maryland, have already implemented digital ID programs. As states increasingly issue digital or mobile equivalents of hard copy driver’s licenses and identification cards, employers face the question of whether they can accept mDLs as a List B document for Form I-9 purposes. However, the U.S. Department of Homeland Security (DHS) has not explicitly confirmed that mDLs are accepted at the federal level for identity verification during the Form I-9 process. Upon inquiring with E-Verify about the acceptability of mDLs for I-9/E-Verify purposes, an E-Verify agent confirmed that currently, mDLs are not considered valid documents for Form I-9 verification. Therefore, it is not recommended for employers to accept mDLs until clear guidance is provided by DHS. Although federal legislation suggests that compliant mDLs may be accepted in the future, employers should currently ask employees presenting mDLs to provide an alternative document from the List of Acceptable Documents on Form I-9.

Completing Form I-9 requires attention to detail and adherence to specific guidelines set forth by USCIS and E-Verify. To navigate these intricacies, employers must consult with legal counsel well-versed in Form I-9 compliance. This step can assist in ensuring that I-9 practices adhere to present laws and regulations, thus mitigating the potential for costly errors.

Adopt an automated solution to avoid the common Form I-9 errors. Ensuring electronic management, storage and handling of information will minimize the compliance risk, and save time and resources.