Acknowledging that workplaces are essentially a smaller representation of society, it stands to reason that the same way society contains individuals who engage in misconduct, workplaces will undeniably encounter their own share of such individuals, often observed through instances of occupational fraud or misbehavior.

Occupational fraud and misconduct range from minor acts, like taking paperclips from the supply closet, to major crimes such as embezzlement. The issue is that among various types of workplace misconduct, occupational theft and fraud are the most persistent, expensive, and challenging for employers to detect and stop.

As stated in the 2024 Report to the Nations by the Association of Certified Fraud Examiners (ACFE), a leading anti-fraud organization, occupational fraud is identified as “the most expensive and prevalent type of financial crime globally.”

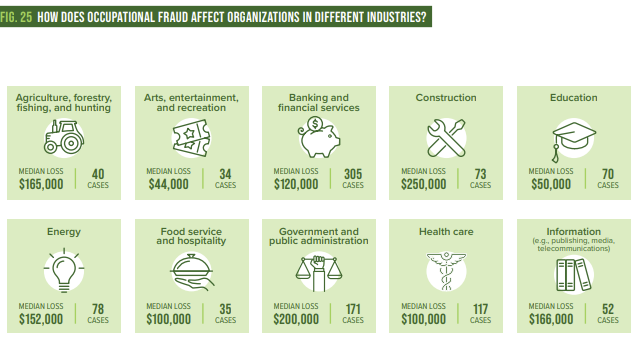

Occupational fraud, sometimes referred to as workplace fraud, poses a serious risk to companies across various sectors and sizes.

Why do staff commit fraud?

In 2022, Frontiers in Psychology published a study examining unethical behavior and white-collar crime. The study concluded that both employee fraud and unethical conduct infringe on social ethics; however, their underlying motivations differ. Employees engaging in unethical behavior typically do not act out of self-interest, whereas employee fraud is mostly committed for personal gain, often harming the organization in the process.

The likelihood of fraud increases when employees believe it to be uncommon within their organization.

Moreover, the stronger the incentive for committing fraud, the more prolonged the activity tends to be.

Strategies for Avoiding Workplace Fraud

This kind of fraud occurs when employees exploit their role to commit theft or fraud against their own company for personal benefit. The financial and reputational damage inflicted on businesses can be substantial. However, there are numerous preventative actions that organizations can implement to guard against occupational fraud.

1. Establish a Strong Ethical Culture

The corporate culture of an organization is a vital element in deterring fraud. Employees who are aware that integrity and ethical practices are paramount are less inclined to commit fraud.

- Set the Tone at the Top: Leaders should model ethical behavior and make it clear that fraud will not be tolerated.

- Code of Conduct: Develop and enforce a comprehensive code of conduct that outlines acceptable behavior and the consequences of unethical actions.

- Regular Training: Conduct regular training sessions on ethics and fraud prevention to keep employees informed and vigilant.

2. Implement Robust Internal Controls

Internal controls consist of the measures and practices established to protect assets, guarantee precise financial reporting, and encourage adherence to legal and regulatory standards.

- Segregation of Duties: Divide responsibilities among different employees to reduce the risk of fraud. For example, the person who authorizes payments should not be the same person who processes them.

- Authorization and Approval: Require management approval for significant transactions to ensure they are legitimate.

- Regular Audits: Conduct regular internal and external audits to detect and deter fraudulent activities.

3. Utilize Technology

Advancements in technology provide powerful tools to prevent and detect occupational fraud.

- Data Analytics: Use data analytics to monitor transactions and identify unusual patterns that may indicate fraud.

- Access Controls: Implement strong access controls to restrict employees’ ability to access sensitive information and systems.

- Fraud Detection Software: Invest in software specifically designed to detect and prevent fraud.

4. Encourage Whistleblowing

It’s crucial to foster a workplace atmosphere that encourages employees to report any questionable actions to effectively detect instances of fraud.

- Anonymous Reporting: Establish a confidential whistleblower hotline or online reporting system to allow employees to report fraud anonymously.

- Non-Retaliation Policy: Implement a clear non-retaliation policy to protect whistleblowers from any form of retaliation.

- Prompt Investigation: Ensure that all reports of suspected fraud are promptly and thoroughly investigated.

5. Conduct Thorough Background Checks

Conducting background checks on job applicants can deter the employment of persons with a track record of fraud.

- Pre-Employment Checks: Conduct comprehensive background checks on all potential hires, including criminal history, credit checks, and reference verification.

- Ongoing Screening: Periodically re-screen employees in sensitive positions to identify any changes in behavior or circumstances that could increase the risk of fraud.

6. Promote Open Communication

Encouraging open communication within the organization can help prevent fraud by fostering a transparent and accountable environment.

- Regular Meetings: Hold regular meetings to discuss the company’s financial health, ethical standards, and any concerns employees may have.

- Clear Reporting Lines: Ensure employees know how and to whom they can report suspicious activities or ethical concerns.

7. Lead by Example

Leadership commitment to ethical behavior is critical in preventing occupational fraud.

- Transparency: Be transparent about the company’s financial matters and decision-making processes.

- Accountability: Hold everyone, including top management, accountable for their actions.

- Consistent Enforcement: Apply policies and consequences consistently across all levels of the organization.

Reduce Occupational Fraud Risk

To reduce occupational fraud risk, a comprehensive and proactive approach is necessary. Building a robust ethical environment, firm internal controls, utilizing technological innovations, reinforcing whistleblower policies, thorough background screenings, promoting clear communication, and leading by example are vital measures organizations should implement to prevent fraud. Such steps protect company assets and promote a culture of integrity and trustworthiness.

To learn more about Experian’s employer services, visit our website.