On March 23, 2023, fifteen Republican members of the House Ways and Means Committee sent a letter to the new IRS Commissioner, Daniel Werfel, expressing concern about chronic delays in the processing of employee retention tax credit (ERTC/ERC) claims. The letter asked for responses to six specific questions related to the ERC backlog:

“1. What are the reasons contributing to the delay of ERTC claims being processed, and what if anything has the IRS done to address these challenges?

“2. What is the average wait time between when employers filed their ERTC claim and when they receive a refund from the IRS? How has the average wait time changed over the last six months?

“3. Are there any restrictions that the IRS is placing on who is eligible for ERTC credits aside from the eligibility requirements detailed above? If so, please detail those restrictions and why the IRS has implemented those restrictions.

“4. Are employers able to track their ERTC refund status with the IRS? If so, explain the process by which employers can track their ERTC refund status.

“5. When does the IRS anticipate completing the processing of all ERTC claims and issuing all necessary refunds?

“6. What is the IRS doing to address potentially fraudulent ERTC claims from ERTC ‘mills’?”

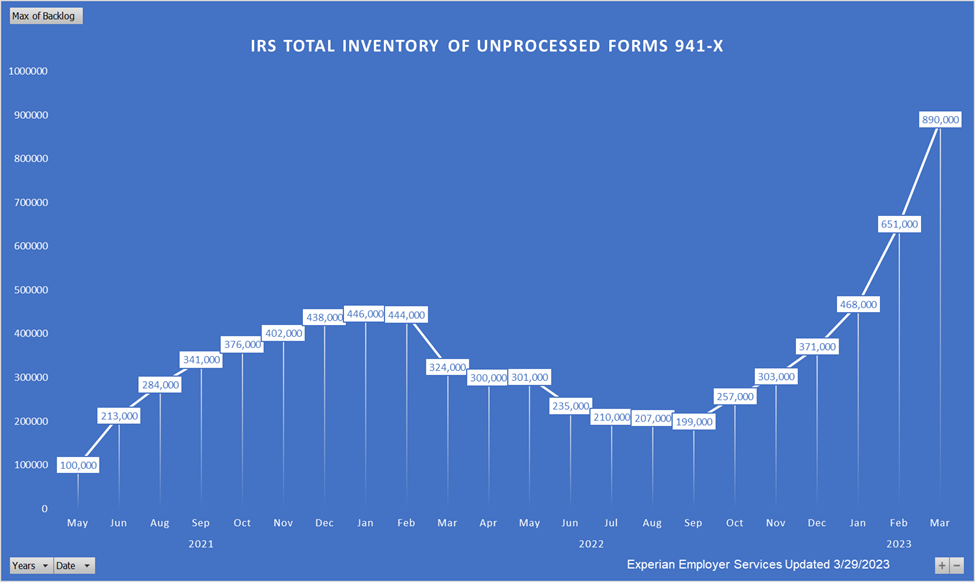

As we have reported in the past, the ERC backlog of unprocessed claims has been steadily growing since the fall of 2022. The most recent figure, as of March 29, 2023, is that the IRS has a backlog of 890,000 unprocessed Forms 941-X.

It is unclear whether this rapid increase in unprocessed forms indicates that the IRS has paused its processing of forms, or that the volume of new forms has accelerated and outpaced their processing capacity.

While the letter from the members of Congress requested responses from and a meeting with IRS by April 3, a source informed us that a meeting has yet to occur.