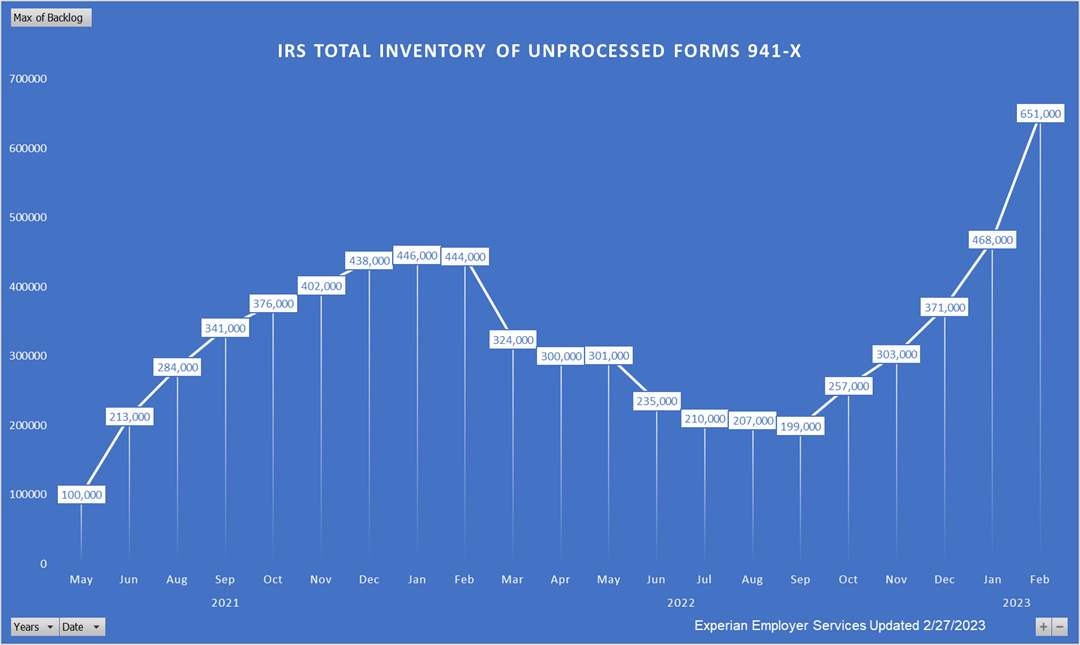

We have written previously (September and November 2022) about the Employee Retention Credit (ERC) processing backlog at IRS. New data on Form 941-X filings provides an update on the current backlog of ERC claims.

Since late 2021, the only available method for filing an ERC claim with the IRS has been via Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. There is no option for filing this form electronically. The IRS must manually review mailed or faxed paper returns, but only after the original Forms 941 have been processed. While not all Forms 941-X represent claims for ERC, the large increase in the number of these amended returns being filed indicates that most are due to the ERC. While the IRS reduced its backlog of unprocessed Forms 941-X to a low of 199,000 in September 2022, that number has recently climbed to its highest point since IRS began publishing the statistic. The IRS states, “As of February 22, 2023, our total inventory of unprocessed Forms 941-X was approximately 651,000.” This includes a jump of 94,000 over the two weeks from Feb. 8 to Feb. 22.

Does this increase in the backlog of unprocessed Forms 941-X represent a slow-down in the processing of these forms, or a significant increase in the number of forms submitted?

IRS has only recently started to report the number of Forms 941-X received. The2021 Annual Reportof the National Taxpayer Advocate said that the average number of Forms 941-X received between calendar years 2018-2020 was 331,492, but in the calendar year 2021 that number more than doubled to 738,422. In their 2022 Annual Report, the number nearly doubled again to 1,369,000 received in calendar year 2022. (This number is preliminary, as a footnote indicates that the figure was provided by IRS on November 3, 2022.)

IRS began January 2022 with a backlog of 446,000 unprocessed Forms 941-X. They received 1,369,000 new forms over the course of 2022, and they ended December 2022 with 371,000 unprocessed forms. We can therefore estimate that IRS was able to process approximately 1.4 million forms during the year, or an average of 120,333 each month. If that rate of processing remained about the same, the data would indicate that IRS received approximately 250,000 new Forms 941-X per month during the first two months of 2023.

The IRS Statistics of Income Publication 6292 reported in its Spring 2022 edition (the first time statistics for Form 941-X were reported) that for the fiscal year 2021 (October 1, 2020 – September 30, 2021), they received 564,701 Forms 941-X, and they projected receiving 1,087,800 for the fiscal year 2022. In the Fall edition of the same report (updated in September), they revised the fiscal year 2022 projection to 2.2 million forms. The report also revises the fiscal year 2023 projection from 677,400 in the Spring report to 1.6 million in the Fall report. Based on the indications discussed above, these projections appear to be low.

A Government Accountability Office (GAO) report, published May 17, 2022, discussed the number of ERC claims and the amount of credit claimed in 2020. A representative from the GAO replied to our inquiry, “At this time we’re not planning to conduct additional reviews of the employee retention credit, although we continue to follow up with IRS on its implementation of the recommendations from our May 2022 report.”