A compliance program is essential for ensuring that both employees and organizations adhere to internal codes of conduct as well as external laws, rules, and regulations. This is a critical strategy for organizations to safeguard against substantial fines and lawsuits, which can significantly disrupt business operations and impact the bottom line. The landscape of compliance and risk is constantly evolving. As the complex regulations governing businesses change, organizations find it increasingly challenging to maintain compliance. In this blog, we will delve into the key metrics for compliance employers need to monitor and advanced solutions to streamline the process and effectively reduce the risk of non-compliance.

Measuring Form I-9 key metrics is crucial for several reasons:

- Compliance: Accurate I-9 metrics help in identifying and rectifying compliance issues promptly, thereby avoiding hefty fines and legal complications.

- Efficiency: By tracking I-9 metrics, organizations can streamline their hiring processes. This leads to quicker onboarding and reduces the administrative burden on HR departments.

- Risk Management: Regularly monitoring I-9 metrics allows companies to identify potential risks early. This proactive approach helps in mitigating issues before they escalate into significant problems.

- Data-Driven Decisions: Having access to detailed I-9 metrics enables organizations to make informed decisions. This data can be used to improve hiring practices, enhance employee retention, optimize overall workforce management, or measure vendor performance.

- Audit Preparedness: Having well-maintained I-9 metrics ensures that your organization is prepared in the event of an audit. This readiness can significantly reduce the stress and disruption audits can cause.

Companies can measure the effectiveness of their I-9 compliance programs through a combination of quantitative metrics and qualitative assessments. Here are some ways to evaluate and improve I-9 compliance:

1. Error Rates and Corrections

Monitor the number of errors found in I-9 forms and the frequency of corrections needed. A decrease in these numbers over time indicates improvement in compliance. Specifically, track:

a. Percentage of I-9 forms with errors

b. Types of errors most commonly occurring (Section 1, Section 2, Section 3, Substantive, Technical)

2. Timeliness

Measure how quickly and consistently I-9 forms are completed within the required timeframes:

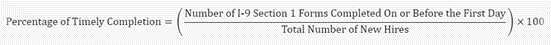

a. Percentage of I-9 Section 1 completed on or before the first day of employment

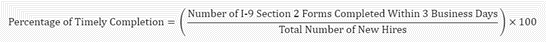

b. Percentage of I-9 Section 2 completed within 3 business days of hire (adhering to the “Thursday Rule”)

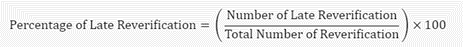

c. Percentage of I-9 Section 3 reverification (Supplement B) not timely completed

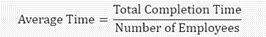

d. Average time to complete I-9 forms

3. Audit Performance

Track performance in internal and external audits:

a. Number of violations found during internal and external audits

b. Severity of violations (substantive vs technical) by assigning the dollar value based on the penalty chart and penalty enhancement matrix.

c. Improvement in audit results over time

4. Employee Understanding

Evaluate how well employees comprehend I-9 requirements:

a. Use gamification to engage employees and assess their understanding of I-9 processes and measure results from quizzes and assessments gauging employee knowledge of I-9 requirements.

5. Process Efficiency

Assess the overall efficiency of your I-9 process:

a. Time spent on I-9 related tasks ranging from initial notifications for Section 1, Section 2, escalations and queries, E-Verify Tentative Non-confirmations and interim statues, etc.

b. Employee feedback on the ease of the I-9 process

c. HR team feedback on managing I-9 compliance

d. Vendor feedback on servicing the candidates and section 2 completers

6. Compliance Monitoring Program

a. Frequency of internal audits conducted (semi-annually, annually)

b. Number of issues identified and resolved through self-audits

c. Periodic review of I-9 policies and procedures (semi-annually, annually)

d. Measure the frequency of continuous training and education for HR staff and hiring managers

7. Training Effectiveness

a. Participation rates in I-9 compliance training sessions

b. Improvement in employee understanding pre- and post-training

8. E-Verify Integration

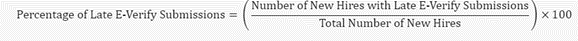

a. Percentage of new hires verified through E-Verify compared to those who failed to timely submit with E-Verify due to technical issues or processing delays

b. Number of E-Verify mismatches and their resolution time

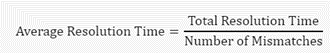

- Track Mismatches: Record each instance where an E-Verify case results in a Tentative Nonconfirmation (TNC) or mismatch. This occurs when the information provided by the employee does not match the records available to the Department of Homeland Security (DHS) or the Social Security Administration (SSA).

- Log Resolution Times: For each mismatch, note the time it takes from the initial notification of the mismatch to its resolution. This includes the time taken for the employee to respond and for the relevant authorities to verify the information.

- Calculate Average Resolution Time: Sum the total resolution times for all mismatches and divide by the number of mismatches to find the average resolution time. Use the formula:

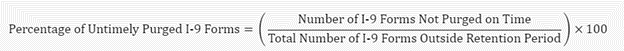

9. Document Management

a. Percentage of I-9 forms properly stored and efficiently and timely retrievable

b. Percentage of I-9 forms outside the retention period not timely purged

10. Technology Utilization

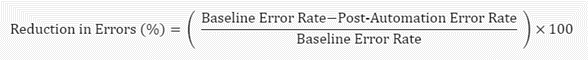

Measure the effectiveness of technology in improving I-9 compliance:

a. Adoption rate of electronic I-9 systems

b. Reduction in manual errors after implementing automated systems

- Identify Baseline Error Rate: Determine the error rate for the manual process before automation. This can be calculated by dividing the number of errors by the total number of tasks performed manually.

- Track Errors Post-Automation: After implementing the automated system, track the number of errors that occur during the same tasks.

- Calculate Post-Automation Error Rate: Divide the number of errors by the total number of tasks performed using the automated system.

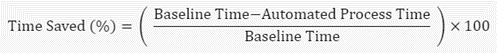

c. Time saved through automation of I-9 processes

By combining these key metrics, companies can comprehensively view the effectiveness of their I-9 compliance program. Regular monitoring and analysis of these indicators will help identify areas for improvement and demonstrate the program’s impact on overall compliance.

Remember that the goal is not just to check boxes but to create a compliance culture that permeates the organization. Companies can significantly enhance their I-9 compliance programs and reduce associated risks by focusing on these key metrics and continuously refining processes.