In a new report, the Treasury Inspector General for Tax Administration (TIGTA) found that a variety of employee retention credit (ERC) processing delays at the IRS have caused an ongoing backlog of unprocessed refund payments.

The report generally focuses on two primary issues regarding ERC:

- Tax return processing delays preventing businesses from receiving relief benefits that were intended to provide immediate emergency assistance.

- Deficiencies in controls to prevent payments for fraudulent credit claims.

IRS ERC Refund Processing Delays and Backlog

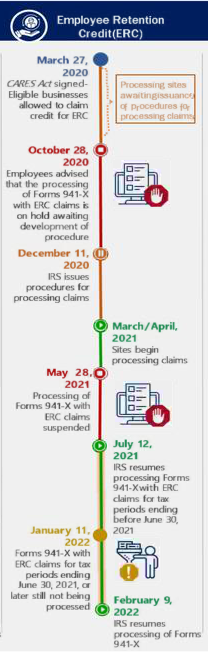

To understand the processing delays, it is important to recall the key dates of the ERC legislation, each of which introduced program changes that the IRS was required to accommodate:

- March 27, 2020, the CARES Act was signed into law authorizing the ERC for wages paid between March 13, 2020, and December 31, 2020. Initially, employers who chose to take a PPP loan were barred from participating in the ERC.

- December 27, 2020, the Consolidated Appropriations Act of 2021 extended the ERC through June 30, 2021, and retroactively allowed employers who used the PPP program to participate.

- March 11, 2021, the American Rescue Plan extended the ERC through 12/31/2021. The Act also introduced the “recovery startup business” eligibility.

- November 15, 2021, the Infrastructure Investment and Jobs Act retroactively terminated the ERC on September 30, 2021, except for recovery startup businesses.

Related: Who Qualifies for the ERC Tax Credit?

The report reveals that IRS did not even begin processing amended returns reporting ERC for 12 months after the CARES Act was enacted. Most ERC claims were and will be made via amended tax returns using Form 941-X. In June 2021, TIGTA found that IRS had suspended the processing of all Forms 941-X with COVID-19 related credits, “after processing claims for only two months after a 12-month delay.” TIGTA further states:

“The IRS did not take immediate steps to prioritize Form 941-X claims that were suspended. As noted previously, the IRS resumed processing Forms 941-X with claims for COVID-19 related employer credits in July 2021 after several delays. However, IRS management did not begin its weekly calls to engage Headquarters and processing sites to make COVID-19 business credit cases priority work until August 2021. The IRS did not begin tracking the processing of amended employment tax returns with COVID-19 related employer credits until September 2021. As such, the IRS did not begin prioritizing amended employment tax returns with COVID-19 related employer credits or tracking the processing of the backlog of suspended Forms 941-X for eight months after procedures to process the amended employment tax returns were available.”

The report includes the following timeline illustrating that the IRS did not materially begin processing Forms 941-X until July 12, 2021.

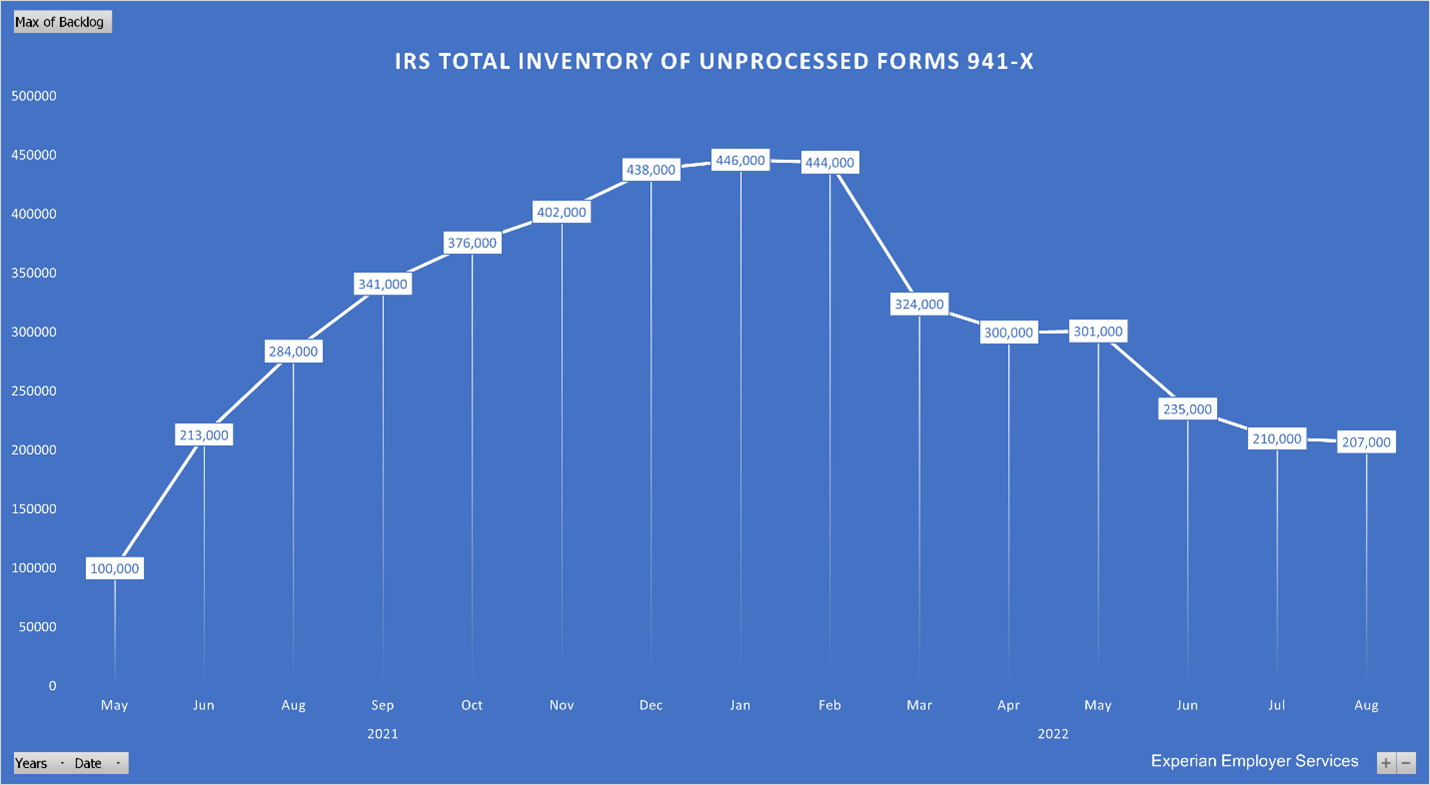

The delays in actively processing claims led to a backlog of unprocessed returns:

“We found that ongoing and considerable delays in the processing of amended Forms 941 filed by businesses resulted in businesses not timely receiving the immediate financial relief for which this legislation was enacted. As of February 1, 2022, there were 447,435 Forms 941-X waiting to be processed. Over 90 percent (402,814) of these Forms 941-X were over-aged, i.e., have not been processed within 45 calendar days.”

The IRS has been reporting the number of unprocessed forms 941-X on a webpage, “IRS Operations During COVID-19: Mission-critical functions continue,” since May 2021. Based on these data, the TIGTA figure from February 2022 represents the high-water mark for unprocessed forms. The following graph shows the number of unprocessed Forms 941-X reported by the IRS between May 2021 and August 31, 2022:

Suspicious Credit Claims

TIGTA appears to be tracking two primary causes of fraudulent or incorrect ERC claims: 1. Claims made by ineligible government entities; and 2. claims made by businesses with “questionable characteristics” which are identified using an “identity theft fraud filter.” The IRS has already reversed 7,400 claims of the first type which were apparently claimed based on a misunderstanding of the program’s rules. For the second type, the IRS said in a letter incorporated into the report that, “The IRS identified 11,096 suspicious returns during processing with more than $2 trillion in credits claimed.”

A “$2 trillion” figure is incredibly large, as the entire CARES Act legislation was estimated to cost $2 trillion. That would represent an average of over $180 million for each of those 11,096 returns. However, a Public Affairs Liaison at TIGTA confirmed to Experian Employer Services, “The $2 trillion figure is accurate.”

The report goes on to discuss “CAT-A,” a program within IRS to review ERC claims prior to paying those claims. On the one hand, referring claims to CAT-A would increase the backlog by increasing the scrutiny placed on those claims. On the other hand, TIGTA criticizes IRS for not referring enough returns to the CAT-A process:

“Specifically, our review identified 209 Forms 941-X processed as of July 28, 2021, that met the CAT-A referral criteria. We reviewed a statistically valid sample of 56 of these Forms 941-X and found that 41 (73 percent) were not referred to Examination as required. Based on the results of our statistically valid sample analysis, we project that 153 amended returns were not referred as required resulting in $45,310,431 in potentially erroneous nonrefundable employer tax credits being allowed”

Recovery Startup Business

The American Rescue Plan introduced a new pathway to ERC eligibility for employers that began carrying on a trade or business after February 15, 2020, the recovery startup business. The IRS acknowledges that they have no mechanism to confirm whether employers meet the requirements to be considered an RSB.

Conclusions

TIGTA is simultaneously critical of the IRS for ERC refund delays and concerned about the detection of fraudulent claims. This may be a case of not being able to have your cake and eat it too. Given the enormous opportunity for fraud indicated in the report, IRS appears to have no choice but to slow down claims processing to minimize that damage.

Learn about the tax credit solution from Experian Employer Services.