Recently, I was fortunate to attend the annual National Foundation for Unemployment Compensation and Workers’ Compensation (UWC) Conference in Spokane, Washington. The UWC serves the business community by promoting unemployment insurance and workers’ compensation programs which provide fair benefits to eligible workers at an affordable rate for employers. Some of the areas of focus for UWC, according to its website, are advocating for employers, research on and dissemination of proposed or enacted laws and regulations and providing a forum for best practice information exchange.

It is always exciting to attend their annual conference to find out what state workforce agencies and the U.S. Department of Labor (USDOL) consider their most pressing issues and how they plan to address them. Over the course of the three-day conference, state workforce agency representatives, third-party administrators and employers were given the option to participate in any number of sessions that were educational and informative.

U.S. Department of Labor Updates on the Unemployment Insurance System

During the first day, Jim Garner, Administrator, Office of Unemployment Insurance (UI), Employment and Training Administration, U.S. Department of Labor, shared what the hot topics were from a USDOL standpoint.

The US Department of Labor (USDOL) published a notice on its website in April 2024, regarding a transformation plan. Due to an audit by the US Government Accountability Office (GAO), on which we published a previous blog, the UI systems were placed on a “high risk” list with a recommendation by the GAO that the US DOL develop and implement a plan to transform the system.

Since the pandemic brought to light the antiquated systems state workforce agencies were using, it is now a priority to rebuild and improve program performance, improve the timely delivery of benefit payments, ensure equitable access, support reemployment of claimants and ensure program integrity. Unemployment Insurance Public Letter (UIPL) 09-23 outlines this with an emphasis on projects that were awarded grants from the American Rescue Plan Act (ARPA). Through grants issued by ARPA, the resources were made available for the first time, to implement system improvements, including but not limited to IT-related upgrades.

Further plans are in process to transform the UI program. Mr. Garner presented seven areas of action to this end.

- Adequately fund UI administration

- Delivering high-quality customer service

- Building resilient and responsive state IT systems

- Bolstering state UI programs against fraud

- Ensuring equitable access to robust benefits and services

- Rebuilding and stabilizing the long-term funding of state UI benefits

- Strengthening reemployment and connections to suitable work

There is also a study being conducted by the Department’s Chief Evaluation Officer in collaboration with ETA to study UI Administrative Funding. Evidence found from this study may be used to inform potential future developments of the UI administrative cost funding model.

Mr. Garner went on to report on statistical information gathered by the USDOL. First payment timeliness for claimants is recovering towards the standard which hadn’t occurred since the start of the pandemic. Improper payments and fraud, though still elevated, are also declining after the pandemic spike. This is good news for employers because, as you know, increased unemployment benefit payouts can cause individual employer tax rates to increase.

Fraud in Unemployment Insurance

Fraud prevention has been a hot topic in the UI industry for several years, mainly due to the pandemic. States have been collaborating to help combat this spike in activity. A new National ID Verification Offering (NIDVO) was introduced to all state workforce agency leadership. Each state has an option to enter into a data sharing agreement for NIDVO and any development, be funded by funds from ARPA. There are currently 12 states participating in NIDVO with another 16 states in implementation and outreach and discussions occurring with another eight.

Additional integrity activities taking place are around cross-matching and data analytics through the UI Integrity Data Hub, reporting UI identify fraud and work with the Office of Inspector General (OIG) and working with the GAO Fraud Risk Framework “Fraud Risk Profile”. Also, state workforce agencies are once again being encouraged to participate in all of the exchanges of the State Information Data Exchange System (SIDES). SIDES helps prevent and reduce the number of improper payments by providing quick and more accurate data regarding a claimant’s separation from employment. There are currently six exchanges developed with another one currently in development.

Kevin Stapleton, Director, from the Division of Fiscal & Actuarial Services Office of Unemployment Insurance from the USDOL presented information about the UI trust fund solvency. For context, each state has a trust fund from which it pays unemployment benefits to eligible claimants. It is managed by the US Department of Treasury and funded by the payment of taxes by employers. How a state remains solvent is up to each individual state but there are recommendations for targets provided by the USDOL. If a state’s trust fund balance is at risk to become insolvent, the state has the option to borrow federal funds using Title XII advances.

As of January 1, 2024, 19 states met the recommended minimum solvency standard which represents an increase from 16 states in 2023. However, for comparison, it is down from the start of 2020 when 31 states met the standard. Four states had an outstanding Title XII advance balance totaling $27 billion. This is a reduction f $1.1 billion from the start of 2023 and encompassed five states. One additional state currently has outstanding private borrowing instruments totaling an estimated $2.35 billion. For 2024, there are 20 states which meet eligibility criteria for interest-free borrowing, an increase from 17 states in 2023.

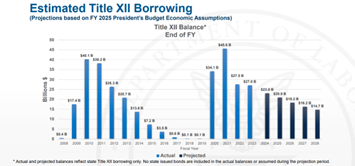

Mr. Stapleton also presented estimates on Title XII borrowing through 2028. His data spanned from 2008 through 2028 and can be seen in the graphic below.

As you can see, it is estimated that there will still be over $14 billion in outstanding advances in 2028. Since the amount of outstanding balances is in the billions, it is not far-fetched to anticipate the total payoff will take many years to complete.

The outstanding balances must be repaid by employers via a Federal Unemployment Tax Act (FUTA) Credit Reduction on the Federal Form 940 which is collected annually. FUTA Credit Reductions force repayment of the loans by reducing the 5.4% credit against the 6% FUTA rate. It goes into effect when a state passes two consecutive January 1’s with an outstanding Title XII balance and does not repay the balance by November 10th of the second year. For each additional consecutive January 1st on which a state has an outstanding balance, the FUTA tax credit is reduced according to a schedule. Any funds collected via the FUTA credit reduction are credited against the state’s outstanding loan balance.

Overview of Legislative Changes from UWC President

Doug Holmes, President of the UWC – Strategic Services on Unemployment Compensation and Workers’ Compensation, presented information regarding legislative changes. One key component of his presentation had to do with the Unemployment Insurance Modernization and Recession Readiness Act proposed by Senator Ron Wyden and Senator Michael Bennet. This proposed legislation has the potential to result in the largest UI-related tax increase in history and mandate coverage to include workers using the ABC test rather than the Common Law test or FUTA definition under current law.

Some of the parameters in this legislation are outlined below:

- Automatically add weeks of benefits when unemployment rises

- Establish new requirements to cover more workers via the ABC test

- Require that all states offer 26 weeks of benefits, replace 75% of workers’ wages, cover part-time workers and pay workers for their first week of unemployment, called the waiting week

- Create a permanent $250 per week Jobseeker Allowance for any unemployed workers not covered by traditional unemployment insurance system, such as self-employed workers and new entrants to the workforce

- Include additional $25 weekly federal allowance for each dependent an unemployment worker has and provide federal funding to increase unemployed workers’ wage replacement rates to 100% during major disasters or public health emergencies

Considering employers are responsible for funding the state UI programs, with a few exceptions, this would represent an unprecedented tax increase for them across the country. This legislation continues to be monitored and updates will be sent out as soon as available.

Additional information presented by Mr. Holmes was around fraudulent overpayments. Look for legislation extending the period for criminal prosecution, extending the period for overpayment collection on fraudulent overpayments and possibly non-fraud. We may also see requirements for cross-matching and measures to address identity theft. Something to keep in mind is the upcoming presidential election may impact negotiations for the end of 2024 agreement and scope of reform legislation in 2025.

The conference took place over a three-day timeframe and had numerous other topics relative to UI. These mentioned are some we deemed as critical about which we need to inform our customers and prospects. If you have questions about these or any topics related to UI, contact us for more information.