Managing employee tax withholding has always been challenging for many employers, and the increase in remote work due to previous COVID-19 emergency declarations and emerging trends has introduced new tax nexus considerations and compounded the process. In fact, according to Dean Baker, 17 million more people work remotely today, making it important to better understand tax withholding for remote employees.

Each state has its own rules on whether and how telecommuters create a tax nexus for their employers, leading to differing and evolving local tax regulations. For example, some states treat telecommuters as creating a tax nexus, while others have issued guidance stating that a nexus can’t be established solely by employees telecommuting from within the state due to emergencies. The complexity and variance from state to state means that employers need the right combination of people, processes and technologies to overcome the challenges of payroll tax withholding for remote employees across all locations.

The acceleration of remote work has also changed tax withholding for employees and employers. Generally, taxes should be withheld for the state where services are performed, but this becomes more complicated when an employee works in multiple states or telecommutes. Instead of a uniform federal standard, employers must follow a patchwork of local tax regulations set by states and cities, which can be modified regularly or in response to emergencies like COVID-19.

Understanding state income tax for remote workers is important for employers, as it helps avoid non-compliance with state tax laws that can result in penalties, fines and reputational damage. It’s also a key component of leveraging state-specific tax incentives, credits and deductions. In this guide, we explore employees working in multiple states and withholding taxes, along with important considerations like tax nexus and reciprocity agreements.

Understanding the Concept of Tax Nexus and Its Impact on Remote Work

The intersection of tax withholding, remote work and local tax rules can be seen in the dispute between Massachusetts and New Hampshire in 2020 over nonresident taxation. Massachusetts issued guidance stating that income earned by nonresidents who had worked in Massachusetts before the COVID-19 emergency declaration, but were now telecommuting from another state, would be treated as Massachusetts-source income subject to state taxes. This meant New Hampshire residents who performed their work entirely in New Hampshire instead of commuting to Massachusetts would still have Massachusetts taxes withheld. New Hampshire, which has no state income tax, sued Massachusetts, disputing the constitutionality of this type of withholding of income taxes from nonresidents. The U.S. Supreme Court ultimately denied a review of New Hampshire’s lawsuit, meaning it passed on the opportunity to review the broader issue of whether a state can impose its income tax on a nonresident telecommuting employee.

When it comes to state tax withholding for remote employees, tax nexus is also important to understand, as each state has its threshold for establishing tax nexus. For example, let’s say a company is physically located in Oregon but makes sales in the states of California and Colorado. Tax nexus will be established in California if over $500,000 of sales are made, but for Colorado, that threshold is $100,000. As one of the key elements of multistate payroll tax withholding compliance, it’s crucial for employers to understand each state’s tax nexus requirements to ensure the correct amount of taxes are withheld in each state they operate in.

The Importance of Reciprocity Agreements in State Tax Withholding for Remote Employees

New York, which has a significant influence on nonresident taxation, considers days telecommuted to be days worked in New York unless the employer has a “bona fide” location set up in the remote worker’s locality. New York also has a “convenience rule,” under which New York state tax withholding for remote employees must be withheld if an employee works outside New York for convenience rather than due to employer necessity. In other words, their job could be done in the employer’s state and thus creates a tax nexus.

Five other states have similar convenience rules: Arkansas, Connecticut, Delaware, Nebraska and Pennsylvania. These rules create tax withholding complexity for employers and employees in these states, partly due to the lack of reciprocity agreements between states. Without reciprocity, more complex work is required to determine the correct withholding and file the appropriate tax returns.

Determining Residency Status: Key to Understanding California State Tax Withholding for Remote Employees

In California, a permanent resident will be subject to the state’s income tax. Part-time residents or nonresidents will also be taxed on California-based income. If you can prove that you are no longer a resident of California, you will be taxed as a part-time resident for only the months you were still living in the state. However, if your move was temporary, you will still be taxed as a full-time resident. Employers face the challenge of determining where a tax nexus exists and what emergency-related exemptions and reciprocity agreements apply.

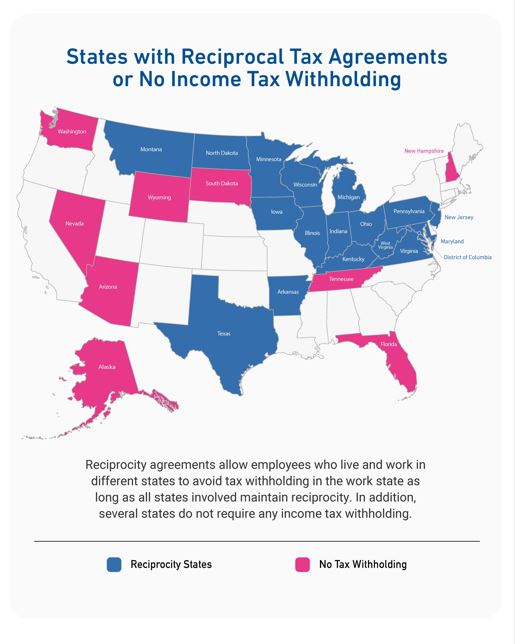

A tax nexus is a state’s determination that an organization has a presence in the jurisdiction. Pre-COVID-19, many states regarded remote workers as a nexus for employers based in different states. COVID-19 work-from-home orders generally stated that temporary telecommuters would not create a tax nexus where one would not otherwise exist. California has taken this approach, but other states have gone in different directions. Reciprocity agreements allow employees who live and work in different states to avoid tax withholding in the work state as long as all states involved maintain reciprocity.

Currently, there are 17 states plus the District of Columbia with reciprocal tax agreements in place:

- Arkansas

- Arizona

- Illinois

- Indiana

- Iowa

- Kentucky

- Maryland

- Michigan

- Minnesota

- Montana

- New Jersey

- North Dakota

- Ohio

- Pennsylvania

- Virginia

- West Virginia

- Wisconsin

- District of Columbia

Simplifying the Process: Tips for Managing Payroll and Taxes for Remote Employees

A sales tax nexus refers to a connection a business has to a state. It often occurs when a company has a physical presence or an economic relationship in a state. Employers might be required to report taxable employee benefits, such as bonuses and stipends, for remote workers and withhold income taxes for the respective states. Several states do not require income tax withholding, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

States with no income tax, such as Texas and Washington, are popular for remote workers but might be responsible for other taxes or mandatory employee benefits. Remote workers are employees who work outside of the office setting and are on a company’s payroll, while independent contractors are self-employed and responsible for managing their taxes. Employers are responsible for withholding federal income taxes, FICA taxes (Social Security and Medicare) and federal unemployment taxes (FUTA) for remote employees. Confusion may arise when it comes to withholding state income taxes, as each state has different rules and regulations. Employers need to stay up-to-date on all tax laws and requirements for remote employees.

When setting up your payroll to handle multi-state employees, there are several best practices to follow to ensure compliance. Determining employee residency is a crucial first step, as it helps ensure proper tax withholding. When collecting this information, determine employee working location, especially for those who telecommute or work across state lines. As you set up your payroll, you must also register with the applicable tax and labor agencies in each state to ensure compliance with state-specific regulations.

Utilizing payroll software for tax withholding is another best practice for ensuring compliance and accurate tax withholding and tax filing. Offloading the administrative tasks that come with employment tax compliance frees up time for busy HR and payroll teams to focus on other areas of your business.

Experian Employer Services offers a solution for automating the tax withholding process for remote employees, providing all necessary tax forms based on their work and home addresses. This solution also integrates with Workday, ServiceNow and Cornerstone to streamline the onboarding and payroll process for remote employees. It helps employees and employers avoid tax-time surprises and manage the growth of telecommuting. Experian Employer Services’ Tax Withholding Services can assist companies in determining the proper state tax withholding for remote and on-site employees.

Legal Implications of Incorrect Withholding

State tax withholding for remote employees requires careful attention to detail to ensure you’re accurately withholding the correct amount of taxes from each paycheck based on each employee’s withholding elections. Failing to accurately withhold state taxes for remote workers can result in various legal implications depending on the severity of the error.

Withholding employment taxes is a primary responsibility of any business, and employers must comply with IRS guidelines when withholding payroll taxes for remote employees. Incorrectly withholding taxes may result in penalties and interest, which can hurt your bottom line and reputation and affect employee morale and trust. Other legal implications include liens against property and assets, criminal sanctions and, in severe cases, jail sentences.

FAQs

How do I withhold taxes for remote employees?

Remote employee tax withholding can be complex. When it comes to withholding taxes from remote employees, it’s important to remain compliant with tax regulations in both the location of your company and the location where your employees reside. The steps to withhold taxes for remote employees varies depending on the jurisdiction, which is why working with a remote employee tax withholding service who is well-versed in relevant laws and regulations is recommended.

However, there are general steps organizations can follow when it comes to remote employee tax withholding:

- Determine the location(s) in which your remote employees are located and determine the tax obligations of those jurisdictions, such as income tax rates, thresholds and any applicable exemptions or deductions.

- Ensure employees complete all relevant tax documentation, such as Form W-4 or their local equivalent if they reside outside the U.S.

- Calculate the amount of taxes that need to be withheld for remote employees, and note that some countries have specific thresholds that trigger tax withholding obligations.

- If required, register your organization with relevant tax authorities by obtaining any necessary tax identification or employer identification numbers.

- Report and remit withheld taxes from each remote employee’s paycheck and send them to the appropriate tax authorities.

Do remote workers have to withhold taxes?

In most cases no, remote workers do not have to withhold taxes. Instead, the employer is responsible for withholding taxes for remote employees and remitting them to the appropriate tax authorities. However, remote workers who are independent contractors are responsible for withholding their income taxes.

Are remote workers taxed differently?

No, remote workers are not taxed differently than in-house workers. Employers will tax all employees based on their location and withhold the necessary taxes from each paycheck, no matter where the employee resides.

What are some of the major challenges in managing remote workers?

There are several challenges employers might face when it comes to remote employee tax withholding. Some of the top challenges in managing remote workers include:

- Communicating and establishing effective communication channels that foster collaboration and teamwork.

- Establishing trust when concerns centered around productivity, accountability or monitoring work effectively arise.

- Maintaining a strong company culture where employees feel valued and a sense of belonging.

- Ensuring compliance with legal requirements, such as various state and local employment laws, tax regulations, data privacy requirements and other jurisdiction-specific regulations.

What state do you pay taxes to if you work remotely?

The state where an employee’s taxes are withheld depends on the state. In some cases, employees may have tax obligations in both the state in which they live and the state of their employer’s location. In some cases, states have reciprocity agreements to prevent double taxation. However, others don’t, which means employers may need to withhold taxes from an employee’s paycheck for multiple states. There are various factors that can determine the tax obligations of a remote worker, such as their residency, a nexus tax and state-specific rules and thresholds, so working with a remote employee tax withholding service like Experian Employer Services can help you navigate complicated tax withholding rules.

What happens if an employee works from home in another state?

In many cases, employees working from home in another state are subject to the tax laws of the state where they live, meaning they will follow their state’s tax laws, not those of the state in which their employer is located. However, remote employees can face more complications than in-office workers, as some states may require individuals to also pay taxes in the state where their employer is located, such as income taxes, unemployment insurance and worker’s compensation.

What are the employer tax implications of working remotely from another state?

If you’re an employer with telecommuting employees, remaining compliant with remote employee tax withholding laws is crucial. In most cases, employers must withhold income taxes for the state where a remote employee lives and works, not the state where your organization is located. You will be responsible for reporting income to the respective state where they live and paying unemployment taxes to local tax authorities.

There are various employer tax implications of having remote employees. For example, having a remote employee in another state can trigger a nexus and establish a business presence in that state, requiring the employer to abide by corporate income tax obligations for that state. Additionally, employers with remote employees need to consider state tax registration and compliance requirements, requirements for withholding and remitting taxes, state unemployment insurance and more.

What should employers provide for remote workers?

Managing a remote workforce can be challenging. However, equipping your remote staff with the right information and resources can improve compliance, productivity and employee satisfaction. Here’s what employers should provide for remote workers:

- Equipment and technology to efficiently complete their job responsibilities.

- Communication tools to facilitate teamwork and collaboration.

- Cybersecurity measures to protect sensitive employer, employee and client data.

- Support and training with the right software to help remote employees adapt to a remote work environment.

- Policies and guidelines that remote employees are required to follow, such as expectations, work hours and data security measures.

- Information on documentation that needs to be completed to remain compliant, such as employment verification documents, tax documents and more.

- Feedback and recognition to maintain engagement and employee satisfaction.

State Tax Withholding Compliance

State tax withholding for remote employees is a crucial responsibility for employers to remain compliant for each state in which they operate. However, there are various challenges in managing a remote workforce, particularly determining residency status, adhering to relevant tax nexus guidelines and taking reciprocity agreements into account. Working with a trusted tax withholding services provider like Experian Employer Services can help ensure you’re up to date on the latest updates to state tax laws to ensure you’re in compliance.

Did you know our Tax Withholding solution is also integrated into Workday’s business process framework? Our Workday Certified integration automates the process for capturing tax withholding elections — down to the local level.