In September, we wrote about a Treasury Inspector General for Tax Administration (TIGTA) report highlighting processing delays at the IRS directly affecting ERC claims. At that time, TIGTA reported they, “found that ongoing and considerable delays in the processing of amended Forms 941 filed by businesses resulted in businesses not timely receiving the immediate financial relief for which this legislation was enacted. As of February 1, 2022, there were 447,435 Forms 941-X waiting to be processed. Over 90 percent (402,814) of these Forms 941-X were over-aged, i.e., have not been processed within 45 calendar days.”

Since late 2021, the only available method for filing an ERC claim with the IRS has been via Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. There is no option for filing this form electronically. Mailed or faxed paper returns must be reviewed manually by the IRS, but only after the original Forms 941 have been processed.

IRS ERC Claims Update

A new report by the Internal Revenue Service Advisory Council (IRSAC) indicates that the backlog problems related to ERC are ongoing:

“The Coronavirus Aid, Relief, and Economic Security (CARES) Act introduced the Employee Retention Credit that businesses could claim through the Form 941-X process. Millions of businesses have submitted these forms, but they have not been processed due to significant IRS backlogs in processing paper returns. According to the Taxpayer Advocate, the IRS was backlogged almost three million Forms 941 Employer’s Federal Tax Return, and Forms 941-X.”

Similarly, a recent (11/10/2022) blog post by the National Taxpayer Advocate, Erin Collins, said:

“Likewise, business taxpayers are continuing to feel the strain of delays in IRS processing. Some business taxpayers are still waiting for pandemic relief benefits, as the IRS has over 250,000 unprocessed Forms 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, in its inventory. Unfortunately, some cannot be processed until the related Form 941, Employer’s Quarterly Federal Tax Return, is processed first, and as of November 2, the IRS still had about 2.5 million Forms 941 in its inventory awaiting processing. I suspect a large portion of the Form 941-X amended returns relate to the Employee Retention Tax Credit authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act (2020) and extended by the Consolidated Appropriations Act (2021).”

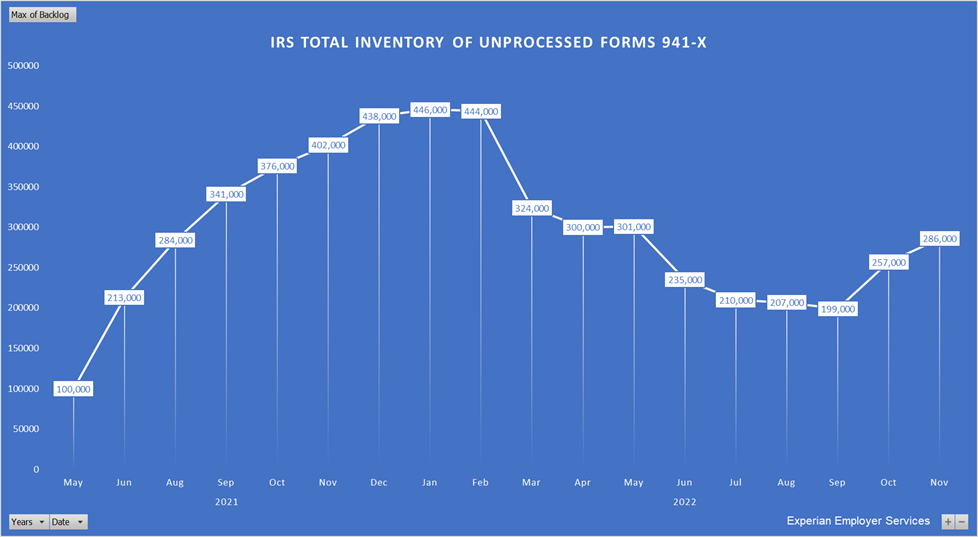

The IRS regularly updates the number of unprocessed Forms 941-X, which have ranged from a high of 446,000 in January 2022 to a low of 199,000 in September 2022. As of November 16, 2022, there are 286,000 unprocessed returns.

But what these number don’t tell us are the actual number of ERC claims being made, or at least the number of Forms 941-X being filed. Does the fact that the backlog grew from 199,000 to 286,000 from September to November mean that IRS received 96,000 new forms while processing none, or that they received a much larger number but also processed a large number? According to the IRSAC report, “Millions of businesses have submitted these forms.” What is the basis for this claim?

Tracking Forms 941-X and 941

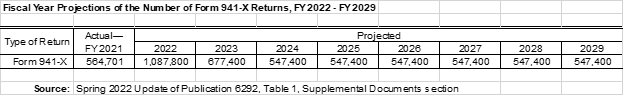

Until very recently, the IRS has not reported the number of Forms 941-X they receive each year. However, in the 2021 Annual Report of the National Taxpayer Advocate, they tell us the average number of Forms 941-X received between calendar years 2018-2020 was 331,492. In calendar year 2021, that number more than doubled to 738,422. Newly reported numbers from the IRS tell us that for fiscal year 2021 (October 1, 2020 – September 30, 2021), they received 564,701 Forms 941-X, and they project receiving 1,087,800 in fiscal year 2022. While that fiscal year has ended, final counts are apparently not yet available.

Apparently, IRSAC’s assertion that, “Millions of businesses have submitted these forms,” must include both amended 941-X returns and Forms 941 original returns.

Projecting Future Claims

Using the available information, at the beginning of fiscal year 2022, IRS started with a backlog of about 376,000 unprocessed Forms 941-X. Using their recent estimate, they received approximately 1.1 million new forms through September 2022. They ended September 2022 with a backlog of 199,000, meaning they processed between 1.2 and 1.3 million returns during the fiscal year.

IRS projects the number of Forms 941-X for fiscal year 2023 will fall to about 677,000. But if the IRS was able to process over 1.2 million forms last fiscal year, the increase in the backlog of unprocessed returns from September through November indicates a rate of new forms well beyond that projection. Learn more about claiming the ERC by speaking with an Experian Employer Services tax expert.