Both the Senate and House Appropriations Committees recently passed bills with report language directing the Internal Revenue Service (IRS) to deal with the backlog of unprocessed Employee Retention Credit (ERC) claims. The Congressional Research Service explains the role of appropriations report language:

“Congress uses report language to communicate with the federal agencies receiving the appropriations by providing supplementary information and an explanation of the measure’s legislative intent, which often includes a range of directives to the agency … agencies are generally expected to comply with a report’s directives. One congressional scholar observed, ‘The criticisms and suggestions carried in the reports accompanying each bill are expected to influence the subsequent behavior of the agency. Committee reports are not the law, but it is expected that they be regarded almost as seriously.’”

Legislation Addressing the ERC Claims Backlog

The committees advanced bills on July 13. The House Committee on Appropriations included the following report language:

“The Committee is concerned that the backlog of 941–X filings continues to grow at an exponential rate. The Committee notes that the delayed processing of payroll tax credits, particularly the employee retention tax credit (ERTC), is creating significant hardship for thousands of small businesses and their employees across the country. The Committee further notes that businesses are having to pay ERTC tax liabilities prior to receiving ERTC funds, which exacerbates liquidity hardships. The Committee strongly urges the IRS to modernize their processing systems and move away from paper-based 941–X forms toward an electronic filing system. The IRS is directed to brief the Committee on its approach to ERTC processing and strategies to reduce the backlog within 90 days after enactment of this Act.”

Whereas the Senate Appropriations Committee included the just the following in its report language:

“Employee Retention Credits.—The Committee is concerned about continuing IRS inventory backlogs and the delay in processing Employee Retention Tax Credits [ERTC] owed to businesses. The Service is directed to take appropriate action to address the ERTC backlogs.”

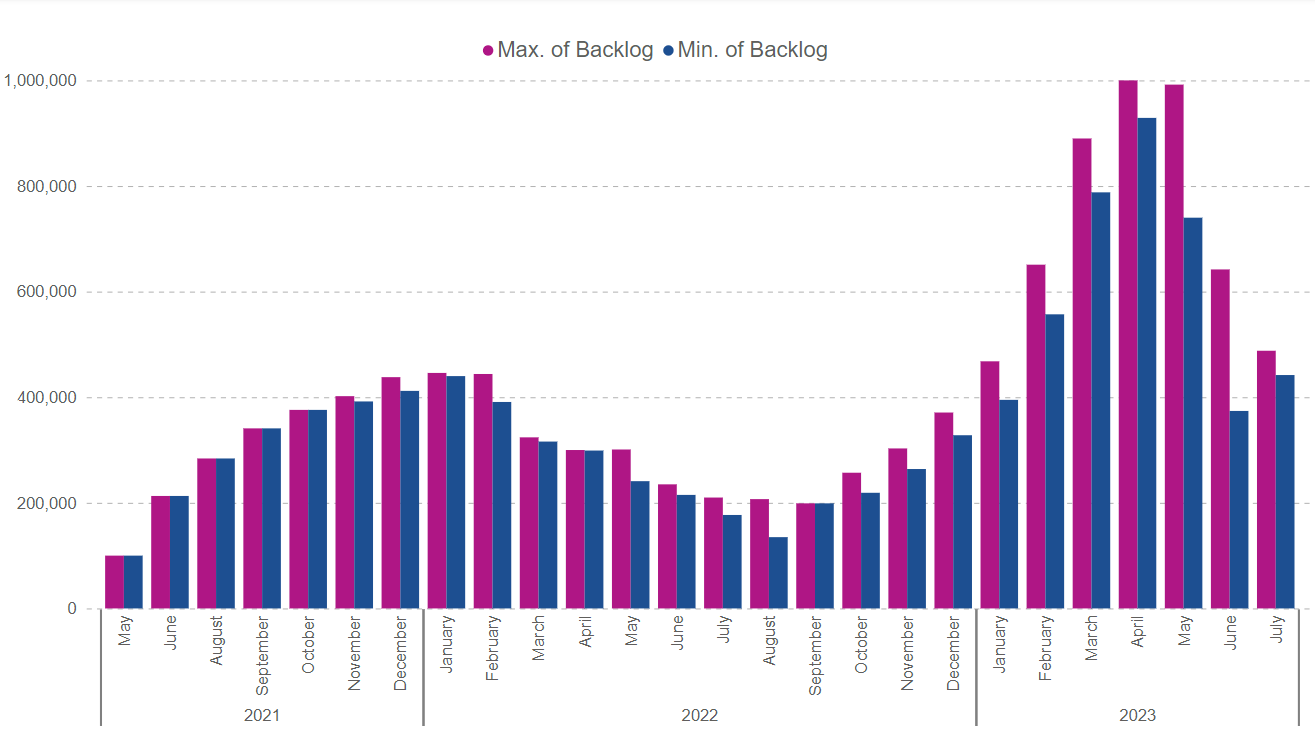

In our previous update regarding the unprocessed Forms 941-X backlog, the IRS had just begun to reduce the backlog below 1 million. At the end of June, they managed to wipe out almost two-thirds of that backlog ending the month with 347,000. While the IRS does not provide regular data about the number of new Forms 941-X received, we have to assume that they managed to reduce the backlog while still receiving significant numbers of newly amended returns. Indeed, the most recent update on July 19, 2023, shows an increase in the unprocessed backlog up to 488,000.