The Current ERC Backlog

The IRS announcement on September 14th of a moratorium on processing Employee Retention Credit (ERC) claims has generated renewed interest in the processing backlog of the credit. As of September 27, 2023, the IRS reports that their inventory of unprocessed Forms 941-X is 779,000. That is up from 637,000 on September 6th, the last update prior to the moratorium.

On October 3rd, in response to the processing moratorium, Ways and Means Chairman Jason Smith (R-MO) and Oversight Subcommittee Chairman David Schweikert (R-AZ) sent a letter to Commissioner Werfel. The representatives criticized the Commissioner’s characterization of the ERC backlog:

“On July 26, 2023, one day before the Oversight Subcommittee’s ERTC hearing, the IRS issued a press release claiming that the ERTC backlog of valid claims had been cleared. Yet, the IRS’ own website noted that as of late July, there were still nearly 500,000 Forms 941-X that needed to be processed, and as of August 16, 2023, the figure increased to approximately 521,000. The September 5, 2023 statement also began by claiming the previous ERTC backlog had been cleared. It is concerning that the agency claimed a false victory over a backlog that has not been resolved.”

But that July 26th press release explained, “The IRS has made substantial progress on these claims this year, with 99 percent of claims approximately three months old as of mid-July.” In other words, returns filed within the previous 90 days are not considered part of the ERC “backlog.”

Similarly, On September 14th, Bloomberg Tax reported, “The agency has received over 3.6 million claims since the program started, Werfel said. About 600,000 claims—‘virtually all of which were received in the last 90 days,’ Werfel said—still need to be processed.” Again, the IRS is asserting that substantially all the pending returns at the start of their moratorium are not backlogged since they were received within the last 90 days.

Overall Claims Volume

As noted above, on September 14th, the IRS said they had “received approximately 3.6 million of these [ERC] claims over the course of the program,” with about 600,000 of those in the 90 days before September 14th.

A July 26, 2023 IRS press release stated that there had been “more than 2.5 million claims coming in since the program was enacted.”

We have previously discussed other sources of data showing the total volume of ERC claims (primarily made using Form 941-X). At that time, we wrote:

“The IRS Statistics of Income Publication 6292 reported in its Spring 2022 edition (the first time statistics for Form 941-X were reported) that for the fiscal year 2021 (October 1, 2020 – September 30, 2021), they received 564,701 Forms 941-X, and they projected receiving 1,087,800 for the fiscal year 2022. In the Fall edition of the same report (updatedin September), they revised the fiscal year 2022 projection to 2.2 million forms. The report also revises the fiscal year 2023 projection from 677,400 in the Spring report to 1.6 million in the Fall report. Based on the indications discussed above, these projections appear to be low.”

The Spring 2023 of Publication 6292 was recently published and reports the final number of Forms 941-X filed in fiscal year 2022 of 2,228,753. The projection of returns in fiscal year 2023 was increased from 1.6 million to over 1.9 million. The next update to the report will be in December.

Therefore, the official SOI number of Forms 941-X received by IRS for the 2-year period from October 1, 2020 through September 30, 2022 is 2,793,454. Not all Forms 941-X were for ERC claims, so we can subtract the average number of such forms the IRS received before the ERC and be left with about 2.1 million. This doesn’t include ERC claims made on original Form 941 filings or using Form 7200. Nevertheless, it appears that the 2.5 million figure stated in the July 26, 2023 press release was understated since approximately that number had already been received by September 30, 2022.

Publication 6292 estimates over 1.9 million Forms 941-X will be received between October 1, 2022 and September 30, 2023 (which would represent approximately 1.6 million ERC claims if we subtract the average pre-pandemic number of those forms expected), for a total of approximately 3.6 million ERC claims using Form 941-X, which just may be the source for the 3.6 million figure used in the September 14th announcement.

Of course, when discussing these volume counts, each form represents the credit for just one calendar quarter. An employer claiming the credit for all possible quarters would file six Forms 941-X, so the total number of businesses claiming the ERC is much lower than the total number of claims.

As for the rate of new claims, the Wall Street Journal reported that “The IRS says it is still receiving 50,000 claims each week, more than twice the average volume since March 2020”; and the New York Times reported that “[IRS Commissioner Danny] Werfel said 15 percent of the 3.6 million claims for the credit that the IRS had received since the program began were submitted in the past 90 days.”

False Alarm?

The assertion that 15% of all ERC claims have been submitted in just the past 90 days was mentioned the IRS’ own press release and reiterated across news outlets and is apparently meant to indicate a concerning upswell in the volume of claims.

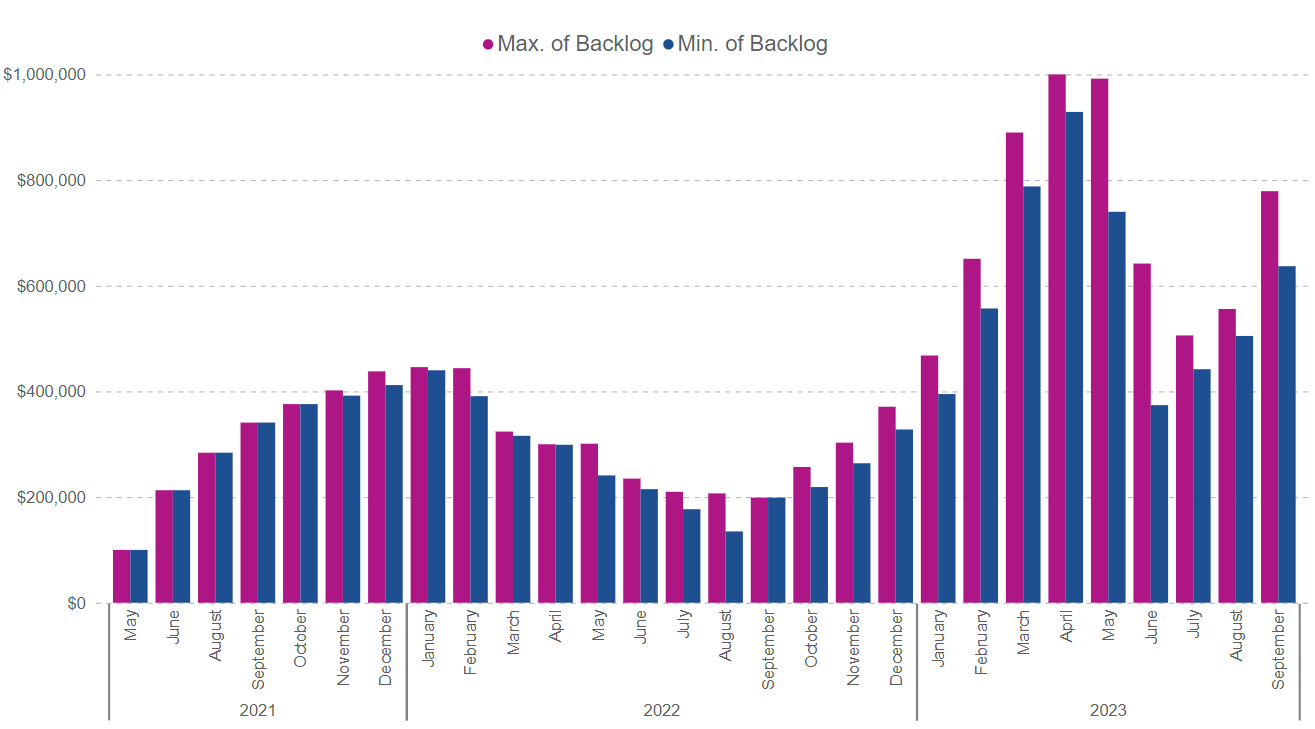

But if we take a step back and look at the history of the program, should the fact that 15% of claims have been made over the last three months necessarily be cause for alarm?

Recall that it wasn’t until the passage of the Consolidated Appropriations Act of 2021 on December 27, 2020 that businesses that had participated in the PPP were retroactively authorized to participate in the ERC. This included virtually all small businesses that could have theoretically been eligible for the ERC. Instructions for the tax forms required to claim the credit retroactively were not published until April 2021. Even if we look at the entire timeline of opportunity to file ERC claims, the overwhelming majority of activity would have to have taken place within the past 30 months. The past 90 days, then, represent about 10% of that time.

It is also interesting to note that the latest update of Publication 6292 discussed above says that the IRS expects to receive almost 300,000 fewer Forms 941-X in fiscal year 2023 than it received in 2022.