By leveraging insights from leading industry analysts, Experian’s expertise, extensive market studies, and market sentiment, we identified four key themes shaping the financial services sector this year.

Four themes impacting financial services this year:

1. Fraud evolution driven by AI

- Tracking synthetic identities is a big challenge for FIs in 2025, exacerbated by fraudsters’ use of Gen AI tools to scale activities.

- Investment in AI is a growing priority as banks seek to strengthen identity verification.

- Account takeover (ATO) and Authorised Push Payment Fraud (APP) are also growing problems very much linked to advanced AI methods employed by criminals.

- Collaboration across institutions and the adoption of advanced analytics will be critical in staying ahead of fraudsters.

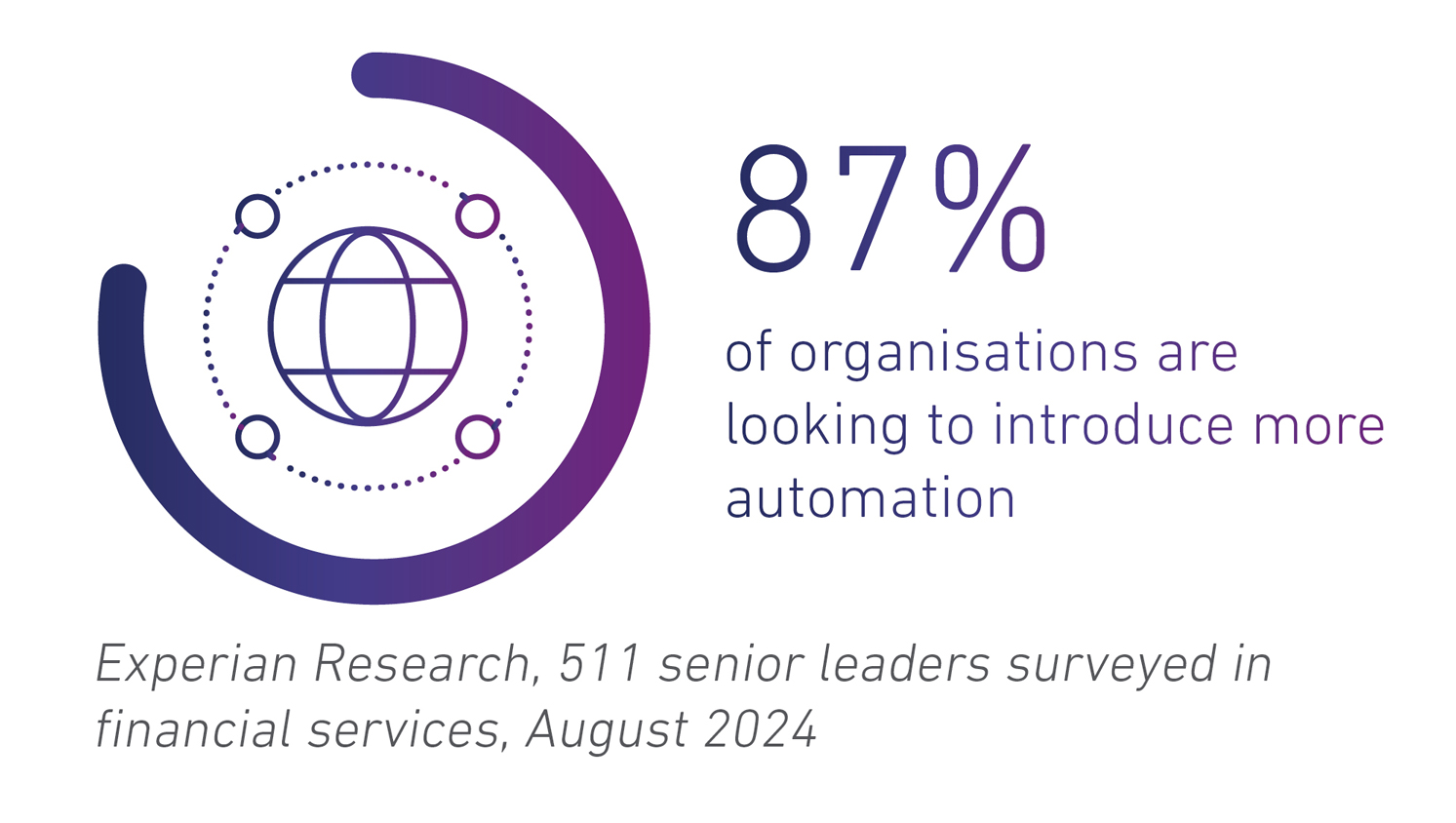

2. Advanced AI will improve operational efficiencies in new ways

- GenAI and Agentic AI (an orchestration tool connecting multiple AI models) are unlocking new levels of efficiency and personalisation.

- The emphasis on adoption is twofold: first, automating steps to accelerate development and delivery, and second, ensuring transparency, compliance, and governance.

- Businesses need to take an incremental approach to GenAI adoption, with centralised governance and a focus on explainability.

- AI will improve mid-office processes where internal manual inefficiencies impact downstream customer interactions.

3. Emergence of RegTech to meet complexities of compliance

- Heightened regulatory scrutiny is driving the adoption of innovative compliance technologies.

- Adopting cloud-native, modular systems supports more agile compliance strategies and reduces the cost and complexity of updating solutions.

- Explainable AI is increasingly essential for demonstrating compliance and fostering regulator confidence in automated decision-making.

4. Convergence of risk management

- The integration of fraud prevention, credit risk assessment, and compliance is a growing trend among financial institutions.

- Digital identity frameworks and unified data analytics are becoming essential for holistic risk management.

- Banks need to embrace collaborative approaches and consortium-level partnerships to address interconnected challenges.